Capital One 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

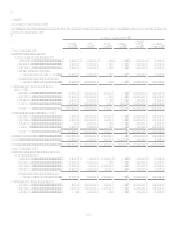

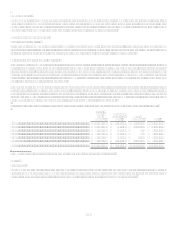

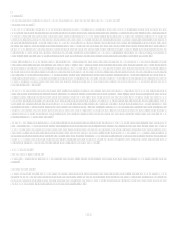

Premises and equipment were as follows:

December 31

2008

2007

Land ....................................................................................................................................................... $ 424,409

$ 402,422

Buildings and improvements ................................................................................................................. 1,529,827

1,392,666

Furniture and equipment........................................................................................................................ 1,144,606

1,067,299

Computer software................................................................................................................................. 836,465

745,061

In process............................................................................................................................................... 257,333

335,755

4,192,640

3,943,203

Less: Accumulated depreciation and amortization ................................................................................ (1,879,534) (1,643,600)

Total premises and equipment, net ........................................................................................................ $ 2,313,106

$ 2,299,603

Depreciation and amortization expense from continuing operations was $331.2 million, $308.8 million, and $269.6 million, for the

years ended December 31, 2008, 2007 and 2006, respectively.

In 2007, the Company discontinued operations for the majority of the GreenPoint Mortgage business. As a result, the loss on

discontinued operations for 2007 includes the write-off of premises and equipment of $34.6 million (includes $63.3 million of write-

off in premises and equipment net of $28.7 million of accumulated depreciation and amortization write-off).

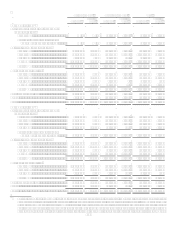

Lease Commitments

Certain premises and equipment are leased under agreements that expire at various dates through 2035, without taking into

consideration available renewal options. Many of these leases provide for payment by the lessee of property taxes, insurance

premiums, cost of maintenance and other costs. In some cases, rentals are subject to increases in relation to a cost of living index.

Total rent expense from continuing operations amounted to $163.8 million, $136.1 million and $58.7 million for the years ended

December 31, 2008, 2007 and 2006, respectively.

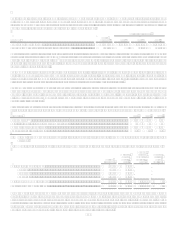

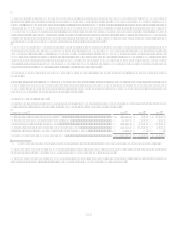

Future minimum rental commitments as of December 31, 2008, for all non-cancelable operating leases with initial or remaining terms

of one year or more are as follows:

2009.................................................................................................................................................................

.

$ 132,780

2010.................................................................................................................................................................

.

124,581

2011.................................................................................................................................................................

.

117,092

2012.................................................................................................................................................................

.

113,816

2013.................................................................................................................................................................

.

109,119

Thereafter ........................................................................................................................................................

.

634,441

Total ................................................................................................................................................................

.

$ 1,231,829

Minimum sublease rental income of $23.5 million, due in future years under noncancelable leases, has not been included in the table

above as a reduction to minimum lease payments.

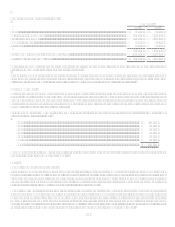

Note 7

Goodwill and Other Intangible Assets

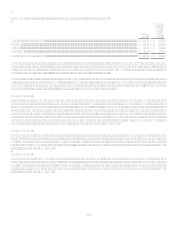

In 2006, the Company acquired North Fork Bancorporation, Inc., (North Fork) a commercial and retail bank in New York, which

created $9.7 billion of goodwill. The goodwill associated with the acquisition of North Fork was held in the Other category at the end

of 2006. The North Fork acquisition goodwill was allocated across the reportable segments during 2007. Goodwill associated with the

2005 acquisition of Hibernia Corporation of $3.2 billion was allocated across the reportable segments during 2006. Goodwill was

reallocated as part of our segment reorganization in the first quarter of 2008.

Goodwill impairment is tested at the reporting unit level, which is an operating segment or one level below on an annual basis in

accordance with SFAS No. 142, Goodwill and Other Intangible Assets. The Companys reporting units are Local Banking, U.S. Card,

Auto Finance, and International. The goodwill impairment analysis is a two-step test. The first step, used to identify potential

impairment, involves comparing each reporting units fair value to its carrying value including goodwill. If the fair value of a

reporting unit exceeds its carrying value, applicable goodwill is considered not to be impaired. If the carrying value exceeds fair value,

there is an indication of impairment and the second step is performed to measure the amount of impairment.