Capital One 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Company closed approximately 2 million inactive accounts during the second quarter of 2008. See below for a detailed discussion of

the results of the U.S. Card, Auto Finance and International sub-segments.

Year Ended December 31, 2007 Compared to Year Ended December 31, 2006

The National Lending segment contributed $2.4 billion of net income during 2007, compared to $2.3 billion during 2006. At

December 31 2007, loans outstanding in the National Lending segment totaled $106.5 billion while deposits outstanding totaled $2.1

billion. Profits are primarily generated from net interest income, which includes past-due fees earned and deemed collectible from our

loans, and non-interest income, which includes fee-based services to customers. Total revenue increased 12% during 2007 primarily

due to growth in the average managed loans held for investment portfolio of 7% and selective pricing and fee changes following

conversion of our cardholder system. Provision for loan and lease losses increased $1.5 billion, or 46%, during 2007, compared to

2006 due to normalization of credit following the unusually favorable credit environment in 2006, selective pricing and fee policy

moves in the U.S. Card sub-segment, the significant pull back from prime revolver marketing in the U.S. Card sub-segment, continued

elevated losses in the Auto Finance sub-segment, and from economic weakening consistent with recently released economic

indicators.

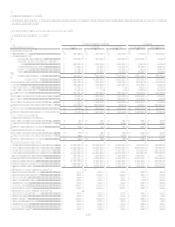

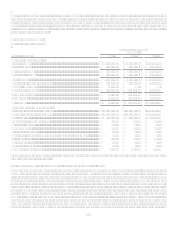

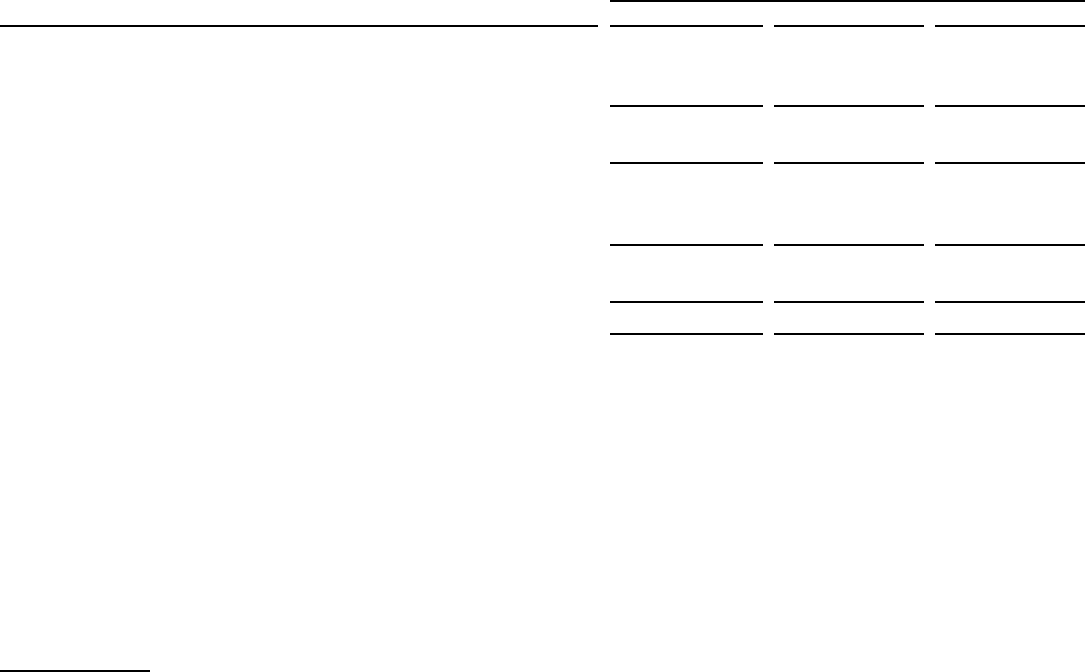

U.S. Card Sub-Segment

Table 4: U.S. Card

As of and for the Year Ended

December 31,

(Dollars in thousands)

2008

2007

2006

Earnings (Managed Basis)

Interest income.............................................................................................

.

$ 8,986,301 $ 9,407,355 $ 8,313,110

Interest expense............................................................................................

.

2,494,215 3,135,436 2,773,610

Net interest income.......................................................................................

.

6,492,086 6,271,919 5,539,500

Non-interest income .....................................................................................

.

4,127,615 4,136,158 3,700,765

Total revenue................................................................................................

.

10,619,701 10,408,077 9,240,265

Provision for loan and lease losses...............................................................

.

5,460,986 3,033,217 2,016,476

Non-interest expense....................................................................................

.

3,618,639 3,934,574 4,100,966

Income before taxes .....................................................................................

.

1,540,076 3,440,286 3,122,823

Income taxes.................................................................................................

.

539,026 1,183,458 1,093,289

Net income ...................................................................................................

.

$ 1,001,050 $ 2,256,828 $ 2,029,534

Selected Metrics (Managed Basis)

Period end loans held for investment ...........................................................

.

$ 70,944,581 $ 69,723,169 $ 68,856,534

Average loans held for investment...............................................................

.

$ 68,634,756 $ 66,774,914 $ 63,774,470

Loans held for investment yield ...................................................................

.

13.09% 14.09% 13.04%

Net interest margin .......................................................................................

.

9.46% 9.39% 8.69%

Revenue margin............................................................................................

.

15.47% 15.59% 14.49%

Risk adjusted margin....................................................................................

.

9.14% 11.59% 11.37%

Non-interest expense as a % of average loans held for investment..............

.

5.27% 5.89% 6.43%

Efficiency ratio.............................................................................................

.

34.07% 37.80% 44.38%

Net charge-off rate .......................................................................................

.

6.33% 4.00% 3.12%

30+ day delinquency rate .............................................................................

.

4.78% 4.28% 3.30%

Purchase Volume(1) .......................................................................................

.

$ 103,035,146 $ 105,875,472 $ 102,079,717

Number of total accounts (000s) ..................................................................

.

37,436 41,044 42,174

(1) Includes purchase transactions net of returns and excludes cash advance transactions.

The U.S. Card sub-segment consists of domestic consumer credit card lending, national small business lending, installment loans and

other unsecured consumer financial service activities.