Capital One 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.93

periodic provisioning for estimated losses is undertaken on a quarterly basis, but may increase in frequency should conditions arise

that would require the Companys prompt attention. Conditions giving rise to such action are business combinations or other

acquisitions or dispositions of large quantities of loans, dispositions of non-performing and marginally performing loans by bulk sale

or any development which may indicate a significant trend.

Commercial and small business loans are considered to be impaired in accordance with the provisions of SFAS 114 when it is

probable that all amounts due in accordance with the contractual terms will not be collected. Specific allowances are determined in

accordance with SFAS 114. Impairment is measured based on the present value of the loans expected cash flows, the loans

observable market price or the fair value of the loans collateral.

For purposes of determining impairment, consumer loans are collectively evaluated as they are considered to be comprised of large

groups of smaller-balance homogeneous loans and therefore are not individually evaluated for impairment under the provisions of

SFAS 114.

Troubled debt restructurings (TDR) occur when the Company agrees to significantly modify the original terms of a loan due to the

deterioration in the financial condition of the borrower. The Company modified an immaterial amount of loans under TDRs in 2008.

The Company had no TDRs in 2007.

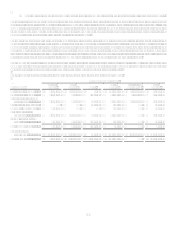

As of December 31, 2008 and 2007, the balance in the allowance for loan and lease losses was $4.5 billion and $3.0 billion,

respectively. See Note 5 for additional detail.

Goodwill and Other Intangible Assets

The Company performs annual impairment tests on goodwill and between annual tests if events occur or circumstances change in

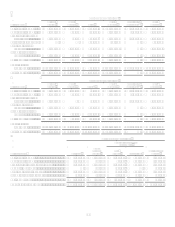

accordance with SFAS 142. As of December 31, 2008 and 2007, goodwill of $12.0 billion and $12.8 billion, respectively, was

included in the Consolidated Balance Sheet. See Note 7 for additional detail.

Other intangible assets that have finite useful lives are amortized either on a straight-line or on an accelerated basis over their

respective estimated useful lives and evaluated for impairment whenever events or changes in circumstances indicate the carrying

amount of the assets may not be recoverable. At December 31, 2008 and 2007, net intangible assets included in other assets of $0.9

billion and $1.1 billion, respectively, consist of core deposit intangibles, trust intangibles, lease intangibles and other intangibles.

Other Assets

Included in other assets are investments in Federal Home Loan Bank (FHLB) stock of $267.5 million and $424.6 million and

Federal Reserve stock of $676.1 million and $645.1 million as of December 31. 2008 and 2007, respectively. We carry FHLB stock

and Federal Reserve stock at cost which approximates fair value and assess for impairment under SFAS 115. No impairment was

recognized for 2008 and 2007.

Mortgage Servicing Rights

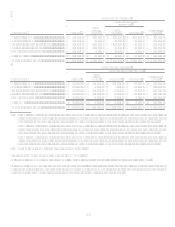

MSRs, are recognized when mortgage loans are sold in the secondary market and the right to service these loans for a fee is retained.

MSRs are carried at fair value with changes in fair value recognized in mortgage servicing and other income. The Company continues

to operate the mortgage servicing business and to report the changes in the fair value of MSRs in continuing operations. To evaluate

and measure fair value, the underlying loans are stratified based on certain risk characteristics, including loan type, note rate and

investor servicing requirements. Fair value of the MSRs is determined using the present value of the estimated future cash flows of net

servicing income. The Company uses assumptions in the valuation model that market participants use when estimating future net

servicing income, including prepayment speeds, discount rates, default rates, cost to service, escrow account earnings, contractual

servicing fee income, ancillary income and late fees. This model is highly sensitive to changes in certain assumptions. Different

anticipated prepayment speeds, in particular, can result in substantial changes in the estimated fair value of MSRs. If actual

prepayment experience differs from the anticipated rates used in the Companys model, this difference could result in a material

change in MSR value.

The MSR balance was $150.5 million and $247.6 million at December 31, 2008 and 2007, respectively. See Notes 12 and 13 for

additional detail.