Capital One 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 5

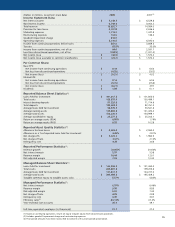

Finally, we recognize that maintaining appropriate capital levels is a particular concern in todays environment. In September, we

raised $760.8 million of new common equity to provide insurance that would be able to seize new opportunities as they arose and to

protect our capital position from the potential for unanticipated credit deterioration. In October, we agreed to issue $3.5 billion of

preferred stock and warrants to the U.S. Treasury under the Capital Purchase Program to protect against any potential risks to our

regulatory capital ratios. We plan and manage our balance sheet, lending and investment activities to conform to our views regarding

capital sufficiency. Ensuring that we have sufficient capital is one of the core functions of our Finance Department, Executive

Committee, ALCO Committee, Finance Committee of the Board and our full Board of Directors. See Section X. Capital for further

discussion regarding capital.

Risk Management Roles and Responsibilities

The Board of Directors is responsible for:

establishing Capital Ones overall risk framework;

authorizing, approving, and overseeing execution of the Enterprise Risk Management Policy; and

reviewing Capital Ones risk profile and establishing the overall risk appetite.

The Chief Executive Officer is responsible for:

managing the companys overall risk position;

appointing the Chief Risk Officer, subject to the Boards approval;

appointing executives to the Risk Management Committee, in coordination with the Chief Risk Officer; and

selecting Risk Stewards for each risk category based on subject matter expertise and organizational authority.

The Division Presidents are responsible for:

identifying risks and implementing appropriate risk controls when pursuing their business strategies and objectives;

ensuring their businesses operate within the corporate risk appetite and comply with policies and procedures established

by the Risk Stewards;

considering risk when developing strategic plans, budgets, and new products, including mitigating risk when necessary;

producing risk reporting that is relevant, sufficient, accurate and timely; and

designating Business Chief Risk Officers for their respective divisions.

The Chief Risk Officer is responsible for:

assessing the quality of Capital Ones risk management program and driving appropriate action to resolve gaps in the risk

management program or in risk mitigation;

establishing and implementing Capital Ones overall Enterprise Risk Management Policy;

overseeing the overall Enterprise Risk Management Program;

chairing the Risk Management Committee;

appointing the Enterprise Risk Management Executive; and

aggregating risks and reporting Capital Ones risk profile to the Board of Directors.

The Enterprise Risk Management Executive is responsible for:

providing frameworks, tools and methods to identify and manage risk;

monitoring adherence with the Enterprise Risk Management Policy;

analyzing, aggregating, and recommending risks for top risk designation;

managing processes and providing tools for identification, aggregation and mitigation of risks across all risk categories;

and

managing risk related to horizontal functions on behalf of the entire company.