Capital One 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

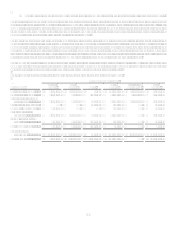

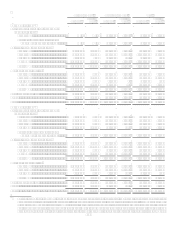

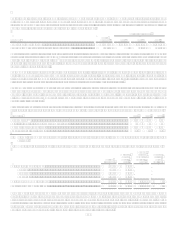

Weighted Average Yields

1 Year

or Less

15

Years

510

Years

Over 10

Years

Collateralized mortgage obligations

Fannie Mae.................................................................................................................

.

5.15 5.32 5.28

Freddie Mac................................................................................................................

.

4.28 5.16 5.42

Other GSE ..................................................................................................................

.

4.92

Non GSE ....................................................................................................................

.

5.76 5.57 5.30 6.58

Total CMO .................................................................................................................

.

4.98 5.32 5.38 6.58

Mortgage backed securities

Fannie Mae.................................................................................................................

.

5.39 5.87 5.15

Freddie Mac................................................................................................................

.

7.45 5.60 5.00

Other GSE ..................................................................................................................

.

6.30 6.09 5.56

Non GSE ....................................................................................................................

.

5.89

Total MBS..................................................................................................................

.

5.52 5.81 5.17

Asset backed securities ........................................................................................................

.

4.77 4.88 5.01

Other ....................................................................................................................................

.

4.57 4.20 4.54 4.98

Total.....................................................................................................................................

.

4.75 % 5.42% 5.08% 5.06 %

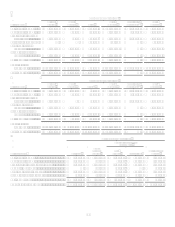

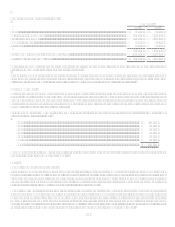

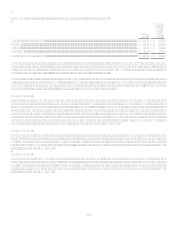

December 31, 2006(1)

U.S. Treasury and other U.S. government agency obligations

U.S. Treasury..............................................................................................................

.

% 4.06% 4.27% %

Fannie Mae.................................................................................................................

.

3.67 4.86 4.43

Freddie Mac................................................................................................................

.

3.41 4.72 4.59

Other GSE ..................................................................................................................

.

3.67 4.78 5.44

Total U.S. Treasury and other U.S. government agency obligations .........................

.

3.58 4.75 4.42 5.44

Collateralized mortgage obligations

Fannie Mae.................................................................................................................

.

5.22 5.20 5.35

Freddie Mac................................................................................................................

.

5.28 5.11 5.43

Other GSE ..................................................................................................................

.

5.13 5.39

Non GSE ....................................................................................................................

.

4.44 5.14 4.81 4.82

Total CMO .................................................................................................................

.

5.08 5.14 5.34 4.82

Mortgage backed securities

Fannie Mae.................................................................................................................

.

6.48 5.76 5.66 6.28

Freddie Mac................................................................................................................

.

7.62 5.33 5.03

Other GSE ..................................................................................................................

.

4.83 5.34 5.85 3.41

Total MBS..................................................................................................................

.

4.92 5.69 5.45 5.87

Asset backed securities ........................................................................................................

.

4.47 4.87 5.60

Other ....................................................................................................................................

.

4.12 3.82 3.83 5.17

Total.....................................................................................................................................

.

4.03 % 5.21% 5.10% 5.24 %

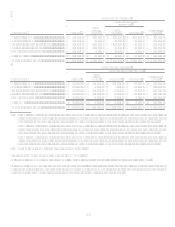

(1) Certain information disclosed for the years ended December 31, 2007, and 2006 has been revised in these tables from the

versions that appeared in prior 10-Ks to reflect a change in methodology to certain weighted average yield information and to

reclassify securities among investment categories and to make certain other immaterial changes. Weighted Average Yields have

been recalculated using different prepayment assumptions, resulting in a more precise weighted average remaining life for our

investments. For the year ended December 31, 2006, the Company used median prepayment speed projections obtained from a

number of dealers which resulted in longer weighted average remaining life. For the year ended December 31, 2007, the

Company used expected yield to maturity instead of average book yield.