Capital One 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

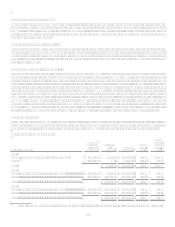

76

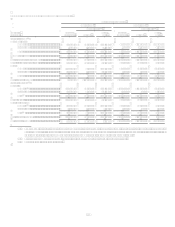

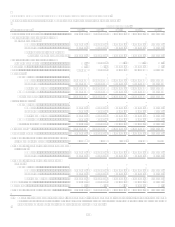

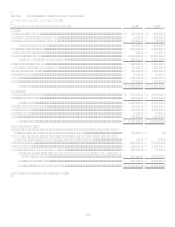

Year Ended December 31

(Dollars in thousands)

2008

2007

2006

2005

2004

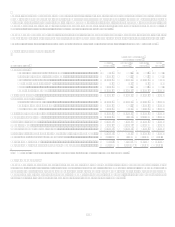

Average Balances:

Reported loans held for investment:

Consumer loans...................................

.

Credit cards................................

.

Domestic ..........................

.

$ 12,656,686

$ 12,601,155 $ 15,114,625 $ 12,073,407 $ 12,243,466

International .....................

.

3,202,928

2,980,539 3,226,858 3,530,174 3,192,501

Total credit card ...............

.

15,859,614

15,581,694 18,341,483 15,603,581 15,435,967

Installment loans........................

.

Domestic ..........................

.

10,255,818

8,622,863 6,582,942 6,087,114 5,828,325

International .....................

.

239,117

490,914 615,255 553,357 347,259

Total installment loans .....

.

10,494,935

9,113,777 7,198,197 6,640,471 6,175,584

Auto loans ...........................................

.

23,439,520

23,928,080 19,902,920 13,056,708 9,305,008

Mortgage loans....................................

.

11,426,279

11,412,960 5,826,632 674,047

Total consumer loans ....................................

.

61,220,348

60,036,511 51,269,232 35,974,807 30,916,559

Commercial loans .........................................

.

37,750,555

33,505,314 12,308,047 4,759,430 3,349,109

Total reported loans held for investment ......

.

98,970,903

93,541,825 63,577,279 40,734,237 34,265,668

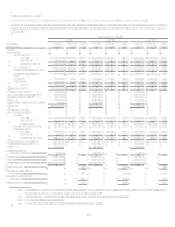

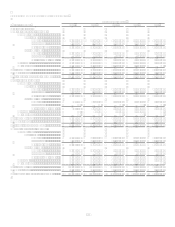

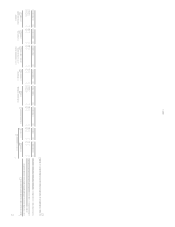

Securitization adjustments:

Consumer loans...................................

.

Credit cards................................

.

Domestic ..........................

.

38,148,268

37,747,827 34,367,401 34,612,169 33,529,885

International .....................

.

7,124,805

7,835,913 7,285,459 6,452,707 5,159,458

Total credit card ...............

.

45,273,073

45,583,740 41,652,860 41,064,876 38,689,343

Installment loans........................

.

Domestic ..........................

.

1,389,164

2,542,837 2,828,332 1,133,036 438,364

International .....................

.

Total installment loans .....

.

1,389,164

2,542,837 2,828,332 1,133,036 438,364

Auto loans ...........................................

.

28,367

256,388 748,751 1,608,989

Mortgage loans....................................

.

Total consumer loans ....................................

.

46,690,604

48,382,965 45,229,943 43,806,901 39,127,707

Commercial loans .........................................

.

2,150,759

2,802,217 2,521,373 723,885 318,298

Total securitization adjustments....................

.

48,841,363

51,185,182 47,751,316 44,530,786 39,446,005

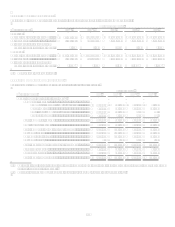

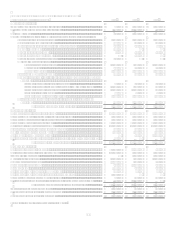

Managed loans held for investment:

Consumer loans...................................

.

Credit cards................................

.

Domestic ..........................

.

50,804,954

50,348,982 49,482,026 46,685,576 45,773,351

International .....................

.

10,327,733

10,816,452 10,512,317 9,982,881 8,351,959

Total credit card ...............

.

61,132,687

61,165,434 59,994,343 56,668,457 54,125,310

Installment loans........................

.

Domestic ..........................

.

11,644,982

11,165,700 9,411,274 7,220,150 6,266,689

International .....................

.

239,117

490,914 615,255 553,357 347,259

Total installment loans .....

.

11,884,099

11,656,614 10,026,529 7,773,507 6,613,948

Auto loans ...........................................

.

23,467,887

24,184,468 20,651,671 14,665,697 9,305,008

Mortgage loans....................................

.

11,426,279

11,412,960 5,826,632 674,047

Total consumer loans ....................................

.

107,910,952

108,419,476 96,499,175 79,781,708 70,044,266

Commercial loans .........................................

.

39,901,314

36,307,531 14,829,420 5,483,315 3,667,407

Total managed loans held for investment .....

.

$ 147,812,266 $ 144,727,007 $ 111,328,595 $ 85,265,023 $ 73,711,673