Capital One 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 71

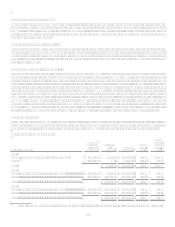

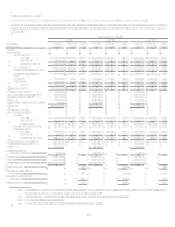

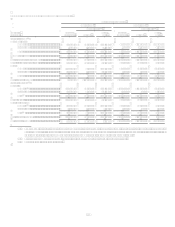

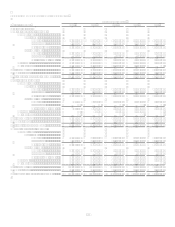

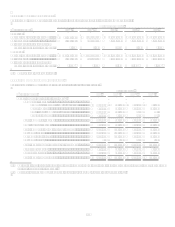

As of December 31, 2008, the Banks each exceeded the minimum regulatory requirements to which it was subject. Each of the Banks

was considered well-capitalized under applicable capital adequacy guidelines. Also as of December 31, 2008, the Company was

considered well-capitalized under Federal Reserve capital standards for bank holding companies and, therefore, exceeded all

minimum capital requirements. There have been no conditions or events since that we believe would have changed the capital

category of the Company or either of the Banks.

Failure to meet applicable capital guidelines could subject the Company or the Banks to a variety of enforcement remedies available to

the regulators, including a limitation on the ability to pay dividends and the issuance of a capital directive to increase capital, and in

the case of the Banks, the termination of deposit insurance by the FDIC (in severe cases) and the appointment of a conservator or

receiver. Failure to meet these capital guidelines could also prevent the Company or the Banks from engaging in the expanded

activities permitted for bank holding companies and banks under the Gramm-Leach-Bliley Act.

Prompt Corrective Action

In general, the Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA) subjects banks to significantly increased

regulation and supervision. Among other things, FDICIA requires federal banking agencies to take prompt corrective action in

respect of banks that do not meet minimum capital requirements. FDICIA establishes five capital ratio levels: well-capitalized,

adequately capitalized, undercapitalized, significantly undercapitalized, and critically undercapitalized. Under applicable regulations, a

bank is considered to be well-capitalized if it maintains a total risk-based capital ratio of at least 10%, a Tier 1 risk-based capital ratio

of at least 6%, a Tier 1 leverage capital ratio of at least 5% and is not subject to any supervisory agreement, order, or directive to meet

and maintain a specific capital level for any capital reserve. A bank is considered to be adequately capitalized if it maintains a total

risk-based capital ratio of at least 8%, a Tier 1 risk-based capital ratio of at least 4%, a Tier 1 leverage capital ratio of at least 4% (3%

for certain highly rated institutions), and does not otherwise meet the well-capitalized definition. The three undercapitalized categories

are based upon the amount by which a bank falls below the ratios applicable to adequately capitalized institutions. The capital

categories are determined solely for purposes of applying FDICIAs prompt corrective action provisions, as discussed below, and such

capital categories may not constitute an accurate representation of each of the Banks overall financial condition or prospects. As of

December 31, 2008, COBNA and CONA each met the requirements for a well capitalized institution.

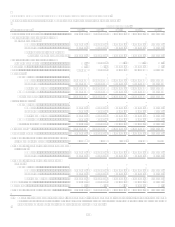

Under FDICIAs prompt corrective action system, a bank in the undercapitalized category must submit a capital restoration plan

guaranteed by its parent company. The liability of the parent company under any such guarantee is limited to the lesser of 5% of the

banks assets at the time it became undercapitalized, or the amount which is necessary (or would have been necessary) to bring the

institution into compliance with all capital standards applicable with respect to such institution as of the time the institution fails to

comply with the plan. A bank in the undercapitalized category also is subject to limitations in numerous areas including, but not

limited to, asset growth, acquisitions, branching, new business lines, acceptance of brokered deposits and borrowings from the Federal

Reserve. Progressively more burdensome restrictions are applied to banks in the undercapitalized category that fail to submit or

implement a capital plan and to banks that are in the significantly undercapitalized or critically undercapitalized categories. In

addition, a banks primary federal banking agency is authorized to downgrade the banks capital category to the next lower category

upon a determination that the bank is in an unsafe or unsound condition or is engaged in an unsafe or unsound practice. An unsafe or

unsound practice can include receipt by the institution of a less than satisfactory rating on its most recent examination with respect to

its asset quality, management, earnings or liquidity. Critically undercapitalized institutions are subject to the appointment of a

receiver or conservator. Under FDICIA, absent an FDIC exemption, from the date 60 days after an institution becomes or is deemed to

become critically undercapitalized it may not make any payments of principal or interest on its subordinated debt.

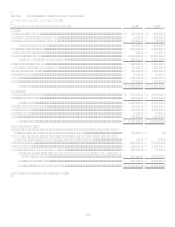

As an additional means to identify problems in the financial management of depository institutions, FDICIA requires regulators to

establish certain non-capital safety and soundness standards. The standards relate generally to operations and management, asset

quality, interest rate exposure and executive compensation. The agencies are authorized to take action against institutions that fail to

meet such standards.

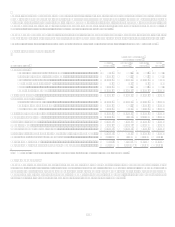

Subprime Lending Guidelines

As discussed in the Supervision and Regulation section on page 11, COBNA treats a portion of its loans as subprime under the

Guidelines issued by the four federal banking agencies that comprise the Federal Financial Institutions Examination Council

(FFIEC), and have assessed its capital and allowance for loan and lease losses accordingly.

Under the Guidelines, COBNA exceeded the minimum capital adequacy guidelines as of December 31, 2008. Also, as of

December 31, 2008, none of CONAs on-balance sheet assets were treated as subprime for purposes of the Subprime Guidelines.