Capital One 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

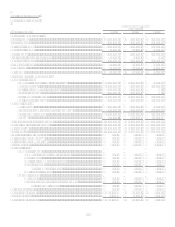

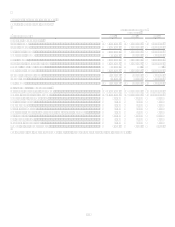

Other National Lending Sub-Segment

Table 5: Other National Lending

As of and for the Year Ended

December 31,

(Dollars in thousands)

2008

2007

2006

Earnings (Managed Basis)

Interest income...................................................................................................

.

$ 4,081,704 $ 4,268,331 $ 3,757,418

Interest expense..................................................................................................

.

1,582,916 1,699,014 1,400,784

Net interest income.............................................................................................

.

2,498,788 2,569,317 2,356,634

Non-interest income ...........................................................................................

.

609,997 734,569 674,361

Total revenue......................................................................................................

.

3,108,785 3,303,886 3,030,995

Provision for loan and lease losses.....................................................................

.

1,967,490 1,658,470 1,191,170

Goodwill impairment charge..............................................................................

.

810,876

Non-interest expense..........................................................................................

.

1,275,259 1,485,630 1,428,138

Income (loss) before taxes..................................................................................

.

(944,840) 159,786 411,687

Income taxes.......................................................................................................

.

(53,761) 53,705 147,319

Net income .........................................................................................................

.

$ (891,079) $ 106,081 $ 264,368

Selected Metrics (Managed Basis)

Period end loans held for investment .................................................................

.

$ 30,202,553 $ 36,785,274 $ 33,502,646

Average loans held for investment.....................................................................

.

$ 34,054,497 $ 35,460,470 $ 31,695,965

Loans held for investment yield .........................................................................

.

11.99% 12.04% 11.85%

Net interest margin .............................................................................................

.

7.34% 7.25% 7.44%

Revenue margin..................................................................................................

.

9.13% 9.32% 9.56%

Risk adjusted margin..........................................................................................

.

4.17% 5.44% 6.08%

Non-interest expense as a % of average loans held for investment....................

.

3.74% 4.19% 4.51%

Efficiency ratio...................................................................................................

.

41.02% 44.97% 47.12%

Net charge-off rate .............................................................................................

.

4.96% 3.88% 3.49%

30+ day delinquency rate ...................................................................................

.

8.64% 8.03% 5.72%

Number of total accounts (000s) ........................................................................

.

7,381 7,493 7,199

The Other National Lending sub-segment consists of the Auto Finance and International sub-segments.