Capital One 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

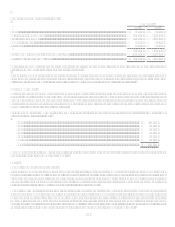

For the 2008 annual impairment test, the fair value of reporting units was calculated using a discounted cash flow analysis, a form of

the income approach, using each reporting units internal five year forecast and a terminal growth rate reflecting the nominal growth

rate of the economy as a whole. Cash flows were adjusted as necessary in order to maintain each reporting units equity capital

requirements. Our discounted cash flow analysis required management to make judgments about future loan and deposit growth,

revenue growth, credit losses, and capital rates. The cash flows were discounted to present value using reporting unit specific discount

rates that are largely based on the Companys external cost of equity with adjustments for risk inherent in each reporting unit.

Discount rates used for the reporting units ranged from 10.1% to 14.0%. The key inputs into the discounted cash flow analysis were

corroborated with market data, where available, indicating that assumptions used were within a reasonable range of observable market

data.

Based on the comparison of fair value to carrying amount, as calculated using the methodology summarized above, fair value

exceeded carrying amount in the U.S. Card, International, and Local Banking reporting units as of the Companys annual testing date;

therefore, the goodwill of those reporting units was considered not impaired, and the second step of impairment testing was

unnecessary. However, all others factors held constant, a 7% decline in the fair value of the Local Banking reporting unit, a 19%

decline in the fair value the U.S. Card reporting unit and a 5% decline in the fair value of the International reporting unit would have

caused the carrying amount for those reporting units to be in excess of fair value which would require the second step to be performed.

The Auto Finance reporting unit, with a $1.4 billion carrying amount of goodwill as of the testing date, failed the first step as fair

value was less than carrying amount by $909.7 million, requiring it to move to the second step of the goodwill impairment test. Based

on the results of the second step, a loss of $810.9 million ($804.4 million after tax) was recognized for the year-ended December 31,

2008. The impairment was primarily a result of a reduced estimate of the fair value of the Auto Finance reporting unit due to fourth

quarter business decisions to scale back that business.

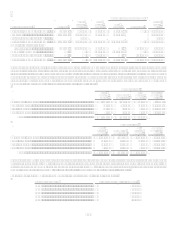

During the fourth quarter of 2008 and continuing into 2009, our stock price, along with the stock prices of others in the financial

services industry, declined significantly, resulting in a decline in our market capitalization subsequent to our annual goodwill

impairment testing date. While this decline did not result in further goodwill impairment in 2008, the Company will continue to

regularly monitor its market capitalization, overall economic conditions and other events or circumstances that might result in an

impairment of goodwill in the future.

In the third quarter of 2007, the Company shutdown mortgage origination operations at its wholesale mortgage banking unit,

GreenPoint. As a result of the closure of the mortgage originations business, a goodwill impairment loss of $650.0 million ($646.0

million after tax) was recognized as part of discontinued operations.

For the years ended December 31, 2008 and 2007, no additional impairment of goodwill was required to be recognized.

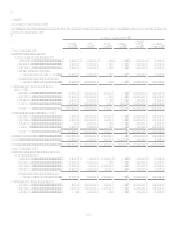

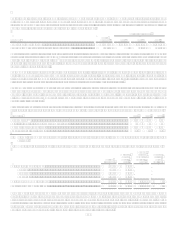

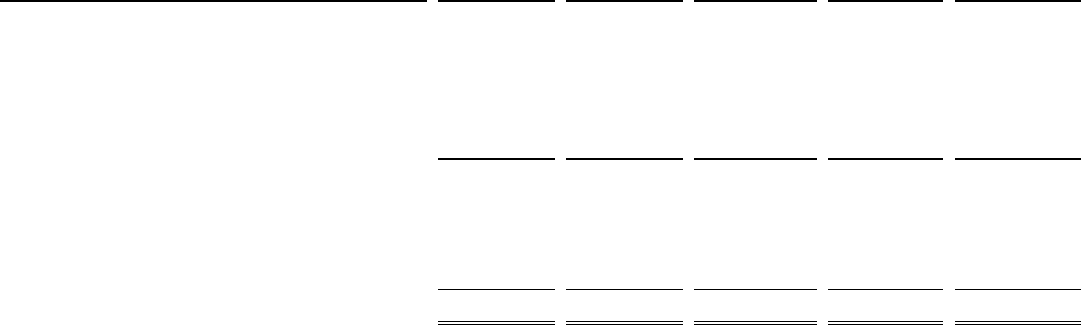

The following table provides a summary of goodwill.

Total Company

National

Lending

Local

Banking

Other

Discontinued

Operations

Total

Balance at December 31, 2006 ...................................

$ 2,278,880

$ 1,623,928 $ 9,732,627

$

$ 13,635,435

Transfers ..................................................................... 3,954,025 5,128,602 (9,732,627 ) 650,000

Adjustments ................................................................ (148,339 ) (148,339 )

Disposals..................................................................... (9,151 ) (650,000) (659,151 )

Foreign currency translation ....................................... 2,795 2,795

Balance at December 31, 2007 ...................................$ 6,235,700 $ 6,595,040 $ $ $ 12,830 ,740

Impact of reporting structure reorganization............... (87,848 ) 87,848

Goodwill impairment.................................................. (810,876 ) (810,876 )

Other adjustments ....................................................... (21,700 ) (21,700 )

Foreign currency translation ....................................... (33,677 ) (33,677 )

Balance at December 31, 2008 ...................................$ 5,303,299 $ 6,661,188 $ $ $ 11,964 ,487