Sallie Mae 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

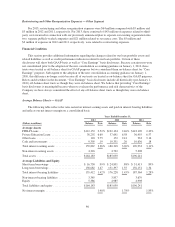

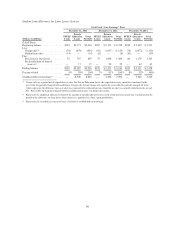

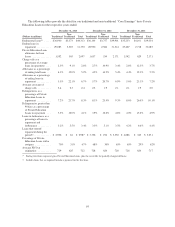

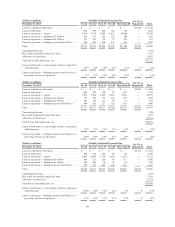

December 31, 2010 December 31, 2009

(Dollars in millions) Traditional

Non-

Traditional Total Traditional

Non-

Traditional Total

Ending total loans(1) .................. $34,177 $4,395 $38,572 $33,223 $4,747 $37,970

Ending loans in repayment ............. 25,043 2,809 27,852 21,453 2,913 24,366

Private Education Loan allowance for loan

losses ............................ 1,231 791 2,022 1,056 911 1,967

Charge-offs as a percentage of average

loans in repayment ................. 3.6% 16.8% 5.0% 3.6% 21.4% 6.0%

Allowance as a percentage of ending total

loans ............................ 3.6% 18.0% 5.2% 3.2% 19.2% 5.2%

Allowance as a percentage of ending loans

in repayment ...................... 4.9% 28.2% 7.3% 4.9% 31.3% 8.1%

Allowance coverage of charge-offs ...... 1.5 1.7 1.6 1.6 1.5 1.5

Delinquencies as a percentage of Private

Education Loans in repayment ........ 8.8% 27.4% 10.6% 9.5% 31.4% 12.1%

Delinquencies greater than 90 days as a

percentage of Private Education Loans

in repayment ...................... 4.2% 15.0% 5.3% 4.6% 17.5% 6.1%

Loans in forbearance as a percentage of

loans in repayment and forbearance .... 4.4% 6.1% 4.6% 5.3% 7.1% 5.5%

Loans that entered repayment during the

period(2) .......................... $ 6,451 $ 553 $ 7,004 $ 6,430 $ 851 $ 7,281

Percentage of Private Education Loans

with a cosigner .................... 63% 28% 59% 61% 28% 57%

Average FICO at origination ........... 725 623 715 725 623 713

(1) Ending total loans represent gross Private Education Loans, plus the receivable for partially charged-off loans.

(2) Includes loans that are required to make a payment for the first time.

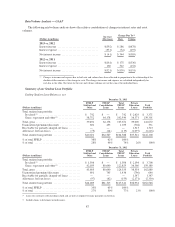

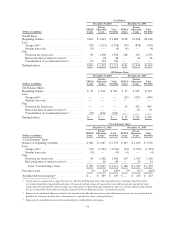

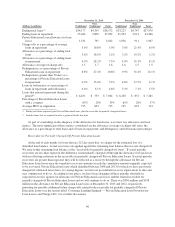

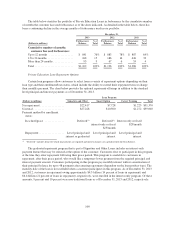

As part of concluding on the adequacy of the allowance for loan losses, we review key allowance and loan

metrics. The most significant of these metrics considered are the allowance coverage of charge-offs ratio; the

allowance as a percentage of total loans and of loans in repayment; and delinquency and forbearance percentages.

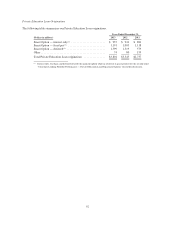

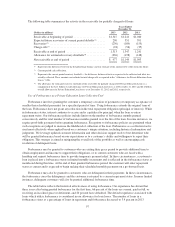

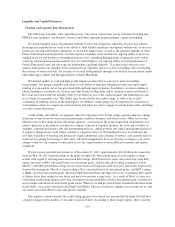

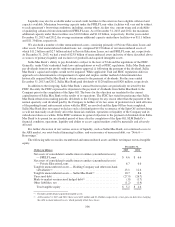

Receivable for Partially Charged-Off Private Education Loans

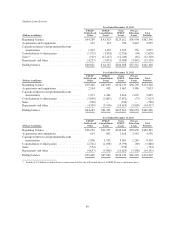

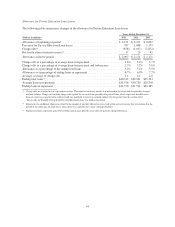

At the end of each month, for loans that are 212 days past due, we charge off the estimated loss of a

defaulted loan balance. Actual recoveries are applied against the remaining loan balance that was not charged off.

We refer to this remaining loan balance as the “receivable for partially charged-off loans.” If actual periodic

recoveries are less than expected, the difference is immediately charged off through the allowance for loan losses

with an offsetting reduction in the receivable for partially charged-off Private Education Loans. If actual periodic

recoveries are greater than expected, they will be reflected as a recovery through the allowance for Private

Education Loan losses once the cumulative recovery amount exceeds the cumulative amount originally expected

to be recovered. Private Education Loans which defaulted between 2008 and 2013 for which we have previously

charged off estimated losses have, to varying degrees, not met our post-default recovery expectations to date and

may continue not to do so. According to our policy, we have been charging off these periodic shortfalls in

expected recoveries against our allowance for Private Education Loan losses and the related receivable for

partially charged-off Private Education Loans and we will continue to do so. There was $336 million and $198

million in the allowance for Private Education Loan losses at December 31, 2013 and 2012, respectively,

providing for possible additional future charge-offs related to the receivable for partially charged-off Private

Education Loans (see the section titled “Consumer Lending Segment — Private Education Loan Provision for

Loan Losses and Charge-Offs” for a further discussion).

96