Sallie Mae 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

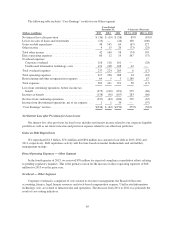

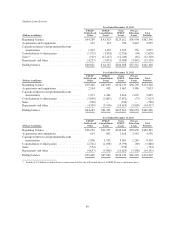

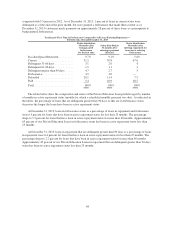

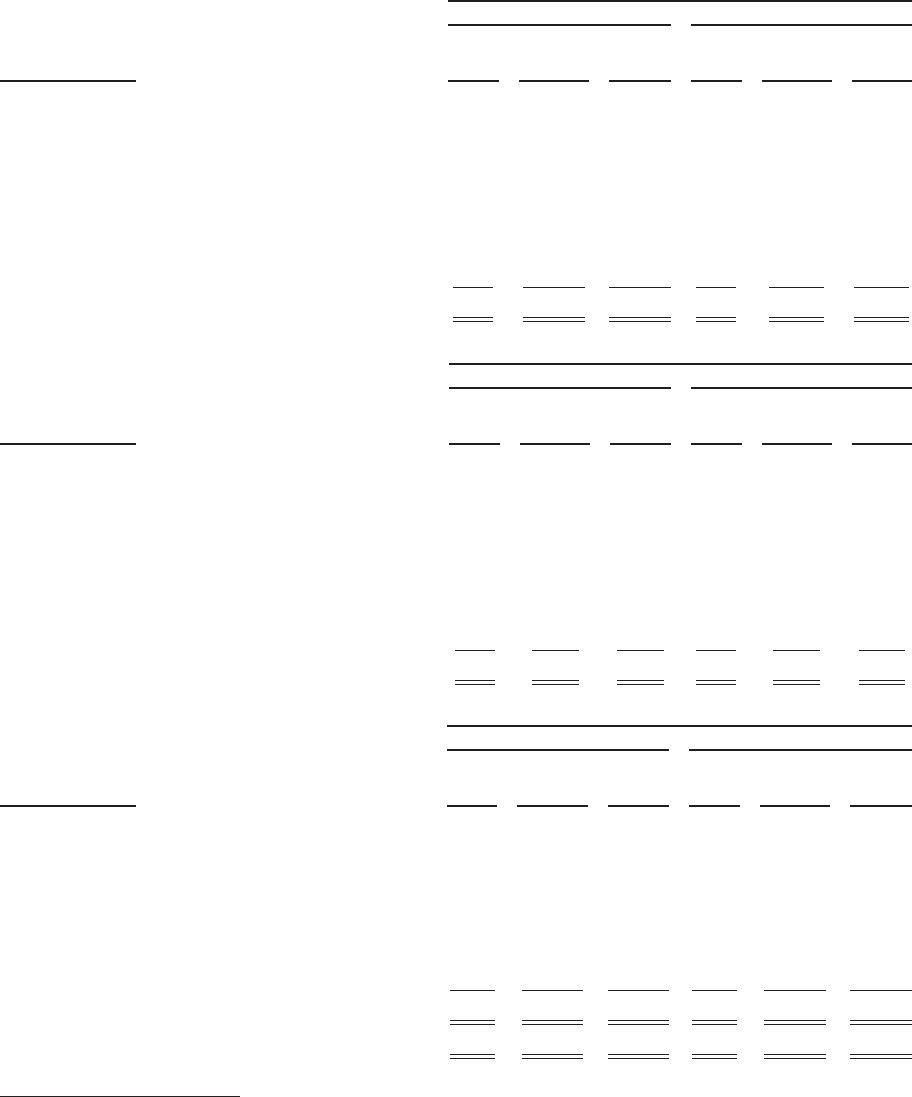

GAAP Basis

December 31, 2010 December 31, 2009

(Dollars in millions)

FFELP

Loans

Private

Education

Loans

Total

Portfolio

FFELP

Loans

Private

Education

Loans

Total

Portfolio

GAAP Basis:

Beginning balance ........................... $161 $ 1,443 $ 1,604 $138 $1,308 $1,446

Less:

Charge-offs(1) ............................. (87) (1,291) (1,378) (79) (876) (955)

Student loan sales .......................... (8) — (8) (4) — (4)

Plus:

Provision for loan losses ..................... 98 1,298 1,396 106 967 1,073

Reclassification of interest reserve(2) ........... — 48 48 — 44 44

Consolidation of securitization trusts(3) ......... 25 524 549 — — —

Ending balance .............................. $189 $ 2,022 $ 2,211 $161 $1,443 $1,604

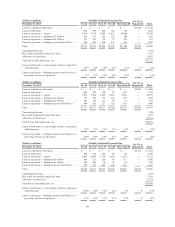

Off-Balance Sheet

December 31, 2010 December 31, 2009

(Dollars in millions)

FFELP

Loans

Private

Education

Loans

Total

Portfolio

FFELP

Loans

Private

Education

Loans

Total

Portfolio

Off-Balance Sheet:

Beginning balance ........................... $ 25 $524 $549 $ 27 $505 $532

Less:

Charge-offs(1) ............................. — — — (15) (423) (438)

Student loan sales .......................... — — — — — —

Plus:

Provision for loan losses ..................... — — — 13 432 445

Reclassification of interest reserve(2) ........... — — — — 10 10

Consolidation of securitization trusts(3) ......... (25) (524) (549) — — —

Ending balance .............................. $— $— $— $ 25 $524 $549

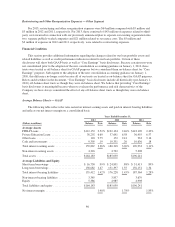

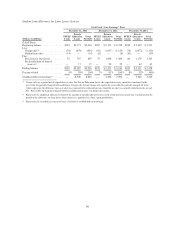

“Core Earnings” Basis

December 31, 2010 December 31, 2009

(Dollars in millions)

FFELP

Loans

Private

Education

Loans

Total

Portfolio

FFELP

Loans

Private

Education

Loans

Total

Portfolio

“Core Earnings” Basis:

Balance at beginning of period ................. $186 $1,967 $ 2,153 $ 165 $ 1,813 $ 1,978

Less:

Charge-offs(1) ............................. (87) (1,291) (1,378) (94) (1,299) (1,393)

Student loan sales .......................... (8) — (8) (4) — (4)

Plus:

Provision for loan losses .................... 98 1,298 1,396 119 1,399 1,518

Reclassification of interest reserve(2) ........... — 48 48 — 54 54

Total “Core Earnings” basis ................ $189 $2,022 $ 2,211 $ 186 $ 1,967 $ 2,153

Percent of total .............................. 9% 91% 100% 9% 91% 100%

Troubled debt restructuring(3) ................... $— $ 439 $ 439 $— $ 223 $ 223

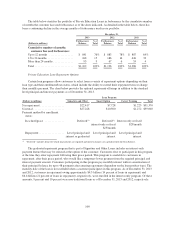

(1) Charge-offs are reported net of expected recoveries. For Private Education Loans, the expected recovery amount is transferred to the

receivable for partially charged-off loan balance. Charge-offs include charge-offs against the receivable for partially charged-off loans

which represents the difference between what was expected to be collected and any shortfalls in what was actually collected in the period.

See the section titled “Receivable for Partially Charged-Off Private Education Loans” for further discussion.

(2) Represents the additional allowance related to the amount of uncollectible interest reserved within interest income that is transferred in the

period to the allowance for loan losses when interest is capitalized to a loan’s principal balance.

(3) Represents the recorded investment of loans identified as troubled debt restructuring.

91