Sallie Mae 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Reduce Operating Expenses While Improving Efficiency and Customer Experience

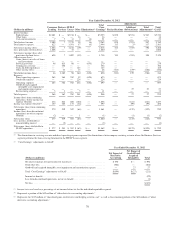

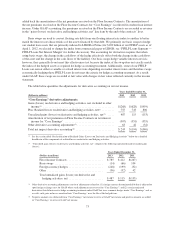

For 2013, we set out to reduce unit costs, and balance our Private Education Loan growth and the challenge

of increased regulatory oversight. We also planned and accomplished improving efficiency and customer

experience by replacing certain of our legacy systems and making enhancements to our self-service platform and

call centers (including improved call segmentation that routes an in-bound customer call directly to the

appropriate agent who can answer the customer’s inquiry). In the fourth quarter of 2013, we reserved $70 million

for expected compliance remediation efforts relating to pending regulatory inquiries. Excluding this compliance

remediation expense, full-year 2013 operating expenses were $972 million compared with $897 million for 2012.

The $75 million increase was primarily the result of increases in third-party servicing and collection activities

(which resulted in $108 million of additional revenue), continued investments in technology and increased

Private Education Loan marketing activities (which resulted in a 14 percent increase in originations volume).

Although total operating expenses, excluding the $70 million compliance remediation expense, were $75

million higher from the prior year, the majority of the increase related to generating higher fee income and loan

originations as discussed above. An example of becoming more efficient can be seen in our Consumer Lending

segment; direct operating expenses as a percentage of revenues (revenues calculated as net interest income after

provision plus total other income) were 31 percent and 38 percent in the years ended December 31, 2013 and

2012, respectively.

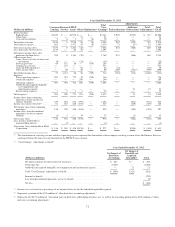

Maintain Our Financial Strength

It was management’s objective for 2013 to continue paying dividends and repurchasing common shares

through our share repurchase program while ending 2013 with capital and reserve positions as strong as those

with which we ended 2012. In February 2013, we announced an increase in our quarterly common stock dividend

to $0.15 per share, resulting in full-year common stock dividends paid of $264 million or $0.60 per share. In

2013, we authorized a total of $800 million for common stock repurchases. We repurchased an aggregate of

27 million shares for $600 million in 2013. At December 31, 2013, there was $200 million remaining

authorization for additional common stock repurchases under our current stock repurchase program. We did this

while achieving diluted “Core Earnings” per share of $2.83 and maintaining our strong balance sheet and capital

positions.

In addition, on June 10, 2013, we closed on a new $6.8 billion credit facility that matures in June 2014, to

facilitate the term securitization of FFELP Loans. The facility was used in June 2013 to refinance all of the

FFELP Loans previously financed through the ED Conduit Program.

On July 17, 2013, we closed on a $1.1 billion asset-backed borrowing facility that matures on August 15,

2015. The facility was used to fund the call and redemption of our SLM 2009-D Private Education Loan Trust

ABS, which occurred on August 15, 2013.

Expand Sallie Mae Bank Capabilities

Sallie Mae Bank continued to fund our Private Education Loan originations in 2013. We continued to

evolve the operational and enterprise risk oversight program at Sallie Mae Bank in preparation for expected

growth and designation as a “large bank,” which will entail enhanced regulatory scrutiny. In addition, we

voluntarily made similar changes at the holding company level. See Item 1. “Business” for additional

information about Sallie Mae Bank’s regulatory environment once it becomes a “large bank.”

2014 Outlook and Management Objectives

In May 2013, we announced plans to separate our consumer banking and education loan management

operations into two separate businesses and complete the Spin-Off in the first half of 2014. Our primary objective

for 2014 is successfully completing this transaction. We continue to believe a first half 2014 separation to be

achievable. See Item 1. “Business” for a further discussion of the Spin-Off. Upon a successful separation,

NewCo and SLM BankCo will each put in place their 2014 Management Objectives. We expect those objectives

to be similar, as appropriate, to the 2013 Management Objectives that were established.

63