Sallie Mae 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

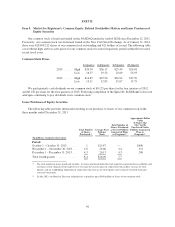

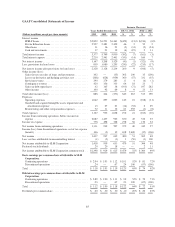

PART II.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

Our common stock is listed and traded on the NASDAQ under the symbol SLM since December 12, 2011.

Previously, our common stock was listed and traded on the New York Stock Exchange. As of January 31, 2014,

there were 428,698,212 shares of our common stock outstanding and 421 holders of record. The following table

sets forth the high and low sales prices for our common stock for each full quarterly period within the two most

recent fiscal years.

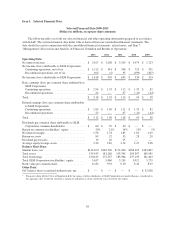

Common Stock Prices

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

2013 ...... High $20.50 $26.17 $25.49 $26.81

Low 16.57 19.32 22.69 23.93

2012 ...... High $16.89 $15.96 $16.94 $17.99

Low 13.11 12.85 15.07 15.75

We paid quarterly cash dividends on our common stock of $0.125 per share for the four quarters of 2012

and $0.150 per share for the four quarters of 2013. Following completion of the Spin-Off, SLM BankCo does not

anticipate continuing to pay dividends on its common stock.

Issuer Purchases of Equity Securities

The following table provides information relating to our purchase of shares of our common stock in the

three months ended December 31, 2013.

Total Number

of Shares

Purchased(1)

Average Price

Paid per

Share

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs(2)

Approximate Dollar

Value

of Shares that

May Yet Be

Purchased Under

Publicly Announced

Plans or

Programs(2)

(In millions, except per share data)

Period:

October 1 – October 31, 2013 ....... .1 $25.47 — $400

November 1 – November 30, 2013 . . . 4.0 26.06 3.4 311

December 1 – December 31, 2013 . . . 4.3 26.13 4.3 200

Total fourth quarter ............... 8.4 $26.09 7.7

(1) The total number of shares purchased includes: (i) shares purchased under the stock repurchase program discussed below and

(ii) shares of our common stock tendered to us to satisfy the exercise price in connection with cashless exercise of stock

options, and tax withholding obligations in connection with exercise of stock options and vesting of restricted stock and

restricted stock units.

(2) In July 2013, our Board of Directors authorized us to purchase up to $400 million of shares of our common stock.

56