Sallie Mae 2013 Annual Report Download - page 109

Download and view the complete annual report

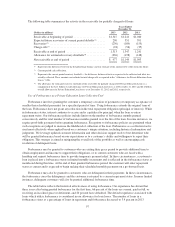

Please find page 109 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2013 Financing Transactions

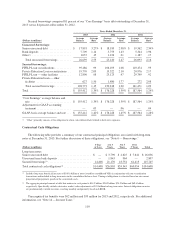

During 2013, we issued $6.5 billion in FFELP ABS, $3.1 billion in Private Education Loan ABS and

$3.75 billion in unsecured bonds.

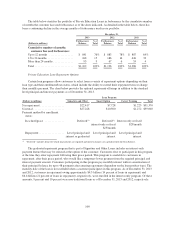

On June 10, 2013, we closed on a new $6.8 billion credit facility that matures in June 2014 to facilitate the

term securitization of FFELP Loans. The facility was used in June 2013 to refinance all of the FFELP Loans

previously financed through the ED Conduit Program. As a result, we ended our participation in the ED Conduit

Program.

On July 17, 2013, we closed on a $1.1 billion asset-backed borrowing facility that matures on August 15,

2015. The facility was used to fund the call and redemption of our SLM 2009-D Private Education Loan Trust

ABS, which occurred on August 15, 2013.

Shareholder Distributions

On February 5, 2013, we increased our quarterly dividend on our common stock from $0.125 per common

share to $0.15 per common share. We paid our quarterly dividend on March 15, 2013, June 21, 2013,

September 20, 2013 and December 20, 2013. In 2013, the Board of Directors authorized a share repurchase

program in total of $800 million for our outstanding common stock. The program does not have an expiration

date. During 2013, we repurchased 27 million shares of common stock for an aggregate purchase price of

$600 million. In 2012, we repurchased 58 million shares at an aggregate price of $900 million.

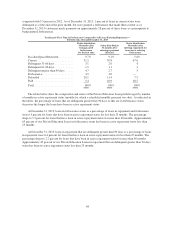

2013 Sales of FFELP Loan Securitization Trust Residual Interests

On February 13, 2013, we sold the Residual Interest in a FFELP Loan securitization trust to a third party.

We will continue to service the student loans in the trust under existing agreements. The sale removed

securitization trust assets of $3.82 billion and related liabilities of $3.68 billion from our balance sheet.

On April 11, 2013, we sold the Residual Interest in a FFELP Loan securitization trust to a third party. We

will continue to service the student loans in the trust under existing agreements. The sale removed securitization

trust assets of $2.03 billion and related liabilities of $1.99 billion from our balance sheet.

On June 13, 2013, we sold the three Residual Interests in FFELP Loan securitization trusts to a third party.

We will continue to service the student loans in the trusts under existing agreements. The sale removed

securitization trust assets of $6.60 billion and related liabilities of $6.42 billion from our balance sheet.

Recent First-Quarter 2014 Transactions

On January 10, 2014, we closed on a new $8 billion asset-backed commercial paper (“ABCP”) facility that

matures in January 2016. This facility replaces an existing $5.5 billion FFELP ABCP facility which was retired

in January 2014. The additional $2.5 billion will be available for FFELP acquisition or refinancing. The

maximum amount that can be financed steps down to $7 billion in March 2015. The new facility’s maturity date

is January 8, 2016.

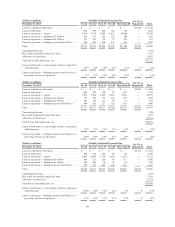

Counterparty Exposure

Counterparty exposure related to financial instruments arises from the risk that a lending, investment or

derivative counterparty will not be able to meet its obligations to us. Risks associated with our lending portfolio

are discussed in the section titled “Financial Condition — Consumer Lending Portfolio Performance” and

“— FFELP Loan Portfolio Performance.”

107