Sallie Mae 2013 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

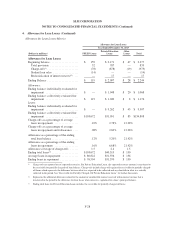

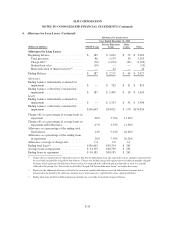

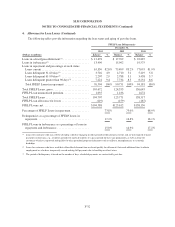

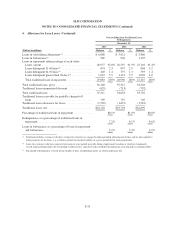

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. Significant Accounting Policies (Continued)

As discussed in “Restricted Cash and Investments” of this Note 2, our restricted cash balances primarily

relate to on-balance sheet securitizations. This balance is primarily the result of timing differences between when

principal and interest is collected on the trust assets and when principal and interest is paid on the trust liabilities.

As such, changes in this balance are reflected in investing activities.

Reclassifications

Certain reclassifications have been made to the balances as of and for the years ended December 31, 2012

and 2011, to be consistent with classifications adopted for 2013, which had no effect on net income, total assets

or total liabilities.

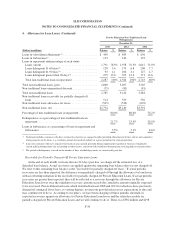

3. Student Loans

Student loans consist of FFELP and Private Education Loans.

There are three principal categories of FFELP Loans: Stafford, PLUS, and FFELP Consolidation Loans.

Generally, Stafford and PLUS Loans have repayment periods of between five and ten years. FFELP

Consolidation Loans have repayment periods of twelve to thirty years. FFELP Loans do not require repayment,

or have modified repayment plans, while the customer is in-school and during the grace period immediately upon

leaving school. The customer may also be granted a deferment or forbearance for a period of time based on need,

during which time the customer is not considered to be in repayment. Interest continues to accrue on loans in the

in-school, deferment and forbearance period. FFELP Loans obligate the customer to pay interest at a stated fixed

rate or a variable rate reset annually (subject to a cap) on July 1 of each year depending on when the loan was

originated and the loan type. FFELP Loans disbursed before April 1, 2006 earn interest at the greater of the

borrower’s rate or a floating rate based on the SAP formula, with the interest earned on the floating rate that

exceeds the interest earned from the customer being paid directly by ED. In low or certain declining interest rate

environments when student loans are earning at the fixed borrower rate, and the interest on the funding for the

loans is variable and declining, we can earn additional spread income that we refer to as Floor Income. For loans

disbursed after April 1, 2006, FFELP Loans effectively only earn at the SAP rate, as the excess interest earned

when the borrower rate exceeds the SAP rate (Floor Income) is required to be rebated to ED.

FFELP Loans are insured as to their principal and accrued interest in the event of default subject to a Risk

Sharing level based on the date of loan disbursement. These insurance obligations are supported by contractual

rights against the United States. For loans disbursed after October 1, 1993 and before July 1, 2006, we receive 98

percent reimbursement on all qualifying default claims. For loans disbursed on or after July 1, 2006, we receive

97 percent reimbursement.

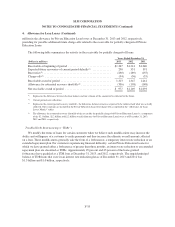

On December 23, 2011, the President signed the Consolidated Appropriations Act of 2012 into law. This

law includes changes that permit FFELP lenders or beneficial holders to change the index on which the Special

Allowance Payments (“SAP”) are calculated for FFELP Loans first disbursed on or after January 1, 2000. The

law allows holders to elect to move the index from the Commercial Paper (“CP”) Rate to the one-month LIBOR

rate. We elected to use the one-month LIBOR rate rather than the CP rate commencing on April 1, 2012 in

connection with our entire $128 billion of CP indexed loans. This change will help us to better match loan yields

with our financing costs. This election did not materially affect our results for 2012.

Our Private Education Loans are made largely to bridge the gap between the cost of higher education and

the amount funded through financial aid, federal loans or customers’ resources. Private Education Loans bear the

full credit risk of the customer. We manage this additional risk through historical risk-performance underwriting

strategies and the addition of qualified cosigners. Private Education Loans generally carry a variable rate indexed

to LIBOR or Prime indices. We encourage customers to include a cosigner on the loan, and the majority of loans

in our portfolio are cosigned. We also encourage customers to make payments while in school.

F-25