Sallie Mae 2013 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

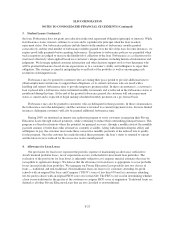

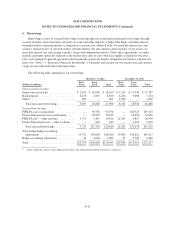

4. Allowance for Loan Losses (Continued)

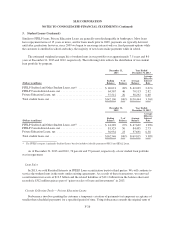

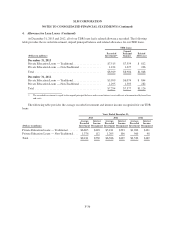

Key Credit Quality Indicators

FFELP Loans are substantially insured and guaranteed as to their principal and accrued interest in the event

of default; therefore, the key credit quality indicator for this portfolio is loan status. The impact of changes in

loan status is incorporated quarterly into the allowance for loan losses calculation.

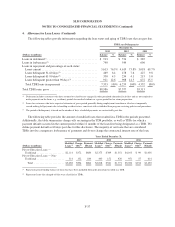

For Private Education Loans, the key credit quality indicators are school type, FICO scores, the existence of

a cosigner, the loan status and loan seasoning. The school type/FICO score are assessed at origination and

maintained through the traditional/non-traditional loan designation. The other Private Education Loan key quality

indicators can change and are incorporated quarterly into the allowance for loan losses calculation. The following

table highlights the principal balance (excluding the receivable for partially charged-off loans) of our Private

Education Loan portfolio stratified by the key credit quality indicators.

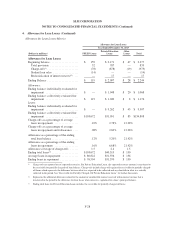

Private Education Loans

Credit Quality Indicators

December 31, 2013 December 31, 2012

(Dollars in millions) Balance(3) % of Balance Balance(3) % of Balance

Credit Quality Indicators

School Type/FICO Scores:

Traditional ........................................ $36,140 93% $35,347 92%

Non-Traditional(1) ................................... 2,860 7 3,207 8

Total ............................................... $39,000 100% $38,554 100%

Cosigners:

With cosigner ...................................... $26,321 67% $24,907 65%

Without cosigner ................................... 12,679 33 13,647 35

Total ............................................... $39,000 100% $38,554 100%

Seasoning(2):

1-12 payments ..................................... $ 5,171 14% $ 7,371 19%

13-24 payments .................................... 5,511 14 6,137 16

25-36 payments .................................... 5,506 14 6,037 16

37-48 payments .................................... 5,103 13 4,780 12

More than 48 payments .............................. 11,181 29 8,325 22

Not yet in repayment ................................ 6,528 16 5,904 15

Total ............................................... $39,000 100% $38,554 100%

(1) Defined as loans to customers attending for-profit schools (with a FICO score of less than 670 at origination) and customers attending not-

for-profit schools (with a FICO score of less than 640 at origination).

(2) Number of months in active repayment for which a scheduled payment was due.

(3) Balance represents gross Private Education Loans.

F-31