Sallie Mae 2013 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of the examination are confidential. The cost of examinations may be assessed against the examined institution as

the agency deems necessary or appropriate.

Source of Strength

Under the Dodd-Frank Act, we are required to serve as a source of financial strength to Sallie Mae Bank and

to commit resources to support Sallie Mae Bank in circumstances when we might not do so absent the statutory

requirement. Any loans by us to Sallie Mae Bank would be subordinate in right of payment to depositors and to

certain other indebtedness of Sallie Mae Bank.

Community Reinvestment Act

The Community Reinvestment Act requires the FDIC to evaluate the record of Sallie Mae Bank in meeting

the credit needs of its local community, including low- and moderate-income neighborhoods. These evaluations

are considered in evaluating mergers, acquisitions and applications to open a branch or facility. Failure to

adequately meet these criteria could result in additional requirements and limitations on Sallie Mae Bank.

Privacy Laws

Financial institutions are required to disclose their policies for collecting and protecting confidential

customer information. Customers generally may prevent financial institutions from sharing nonpublic personal

financial information with nonaffiliated third parties, with some exceptions, such as the processing of

transactions requested by the consumer. Financial institutions generally may not disclose certain consumer or

account information to any nonaffiliated third party for use in telemarketing, direct mail marketing or other

marketing. Federal and state banking agencies have prescribed standards for maintaining the security and

confidentiality of consumer information, and Sallie Mae Bank is subject to such standards, as well as certain

federal and state laws or standards for notifying consumers in the event of a security breach.

Regulation of Systemically Important Non-Bank Financial Companies

As directed by the Dodd-Frank Act, on April 3, 2012, the Financial Stability Oversight Council (“FSOC”)

approved the final rule and interpretive guidance it will use for designating non-bank financial companies as

systemically important to the financial stability of the United States and subject to supervision by the Board of

Governors of the Federal Reserve System (the “FRB”) under enhanced prudential supervision and regulatory

standards. To be subject to FRB enhanced supervision, a non-bank financial company’s material financial

distress, its nature, scope, size, scale, concentration, interconnectedness, or mix of activities, must pose a threat to

the financial stability of the United States. For a further discussion of the risks and implications of being

designated a Systematically Important Financial Institution (“SIFI”), see Item 1A. “Risk Factors — Legal,

Regulatory and Compliance.”

While we have no way of knowing the qualitative judgments the FSOC will use in the future to determine if

a non-bank financial company merits SIFI designation, and no assurances can be given, we continue to believe it

is unlikely the FSOC will determine that we qualify for SIFI designation, especially in light of the proposed

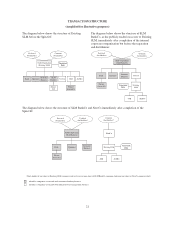

Spin-Off of NewCo from Sallie Mae Bank, which will reduce the complexity of both organizations.

Oversight of Derivatives

The Dodd-Frank Act created a comprehensive new regulatory framework for derivatives transactions, to be

implemented by the Commodity Futures Trading Commission and the SEC. This new framework, among other

things, subjects certain swap participants to new capital and margin requirements, recordkeeping and business

conduct standards and imposes registration and regulation of swap dealers and major swap participants. The

scope of potential exemptions remains to be further defined through agency rulemakings. Moreover, while we

may or may not qualify for exemptions, many of our derivatives counterparties are likely to be subject to the new

capital, margin and business conduct requirements.

16