Sallie Mae 2013 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

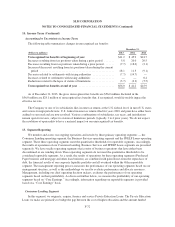

13. Commitments, Contingencies and Guarantees

At the time of this filing, Sallie Mae Bank remains subject to a cease and desist order originally issued in

August 2008 by the FDIC and the UDFI. In July 2013, the FDIC notified us that it plans to replace the existing

cease and desist order on Sallie Mae Bank with a new formal enforcement action against Sallie Mae Bank that

would more specifically address certain cited violations of Section 5 of the Federal Trade Commission Act (the

“FTC Act”), including practices relating to payment allocation practices and the disclosures and assessments of

certain late fees, as well as alleged violations under the Servicemembers Civil Relief Act (the “SCRA”). In

November 2013, the FDIC notified us that the new formal enforcement action would be against Sallie Mae Bank

and an additional enforcement action would be against Sallie Mae, Inc. (“SMI”), in its capacity as a servicer of

education loans for other financial institutions, and would include civil money penalties and restitution. Sallie

Mae Bank has been notified by the UDFI that it does not intend to join the FDIC in issuing any new enforcement

action. With respect to alleged civil violations of the SCRA, Sallie Mae Bank and SMI are also separately

negotiating a comprehensive settlement, remediation and restitution plan with the Department of Justice (the

“DOJ”), in its capacity as the agency having primary authority for enforcement of such matters. As of December

31, 2013, we reserved $70 million for estimated amounts and costs that are probable of being incurred for

expected compliance remediation efforts with respect to the FDIC and DOJ matters described above.

We have made and continue to make changes to Sallie Mae Bank’s oversight of significant activities

performed outside Sallie Mae Bank by affiliates and to our business practices in order to comply with all

applicable laws and regulations and the terms of any cease and desist orders, including in connection with our

pursuit of a strategic plan to separate our existing organization into two publicly-traded companies. We are

cooperating fully with the FDIC, DOJ and Consumer Financial Protection Bureau (the “CFPB”) in response to

their investigations and requests for information and are in active discussions with each with respect to any

potential actions to be taken against us. We could be required to, or otherwise determine to, make further changes

to the business practices and products of Sallie Mae Bank and our other affiliates to respond to regulatory

concerns.

Contingencies

In the ordinary course of business, we and our subsidiaries are defendants in or parties to pending and

threatened legal actions and proceedings including actions brought on behalf of various classes of claimants.

These actions and proceedings may be based on alleged violations of consumer protection, securities,

employment and other laws. In certain of these actions and proceedings, claims for substantial monetary damage

are asserted against us and our subsidiaries.

In the ordinary course of business, we and our subsidiaries are subject to regulatory examinations,

information gathering requests, inquiries and investigations. In connection with formal and informal inquiries in

these cases, we and our subsidiaries receive numerous requests, subpoenas and orders for documents, testimony

and information in connection with various aspects of our regulated activities.

In view of the inherent difficulty of predicting the outcome of such litigation and regulatory matters, we

cannot predict what the eventual outcome of the pending matters will be, what the timing or the ultimate

resolution of these matters will be, or what the eventual loss, fines or penalties related to each pending matter

may be.

We are required to establish reserves for litigation and regulatory matters where those matters present loss

contingencies that are both probable and estimable. When loss contingencies are not both probable and

estimable, we do not establish reserves.

F-68