Sallie Mae 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

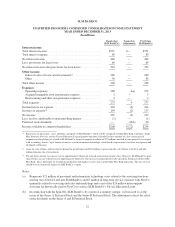

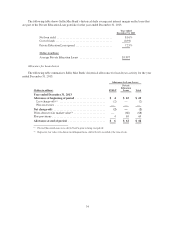

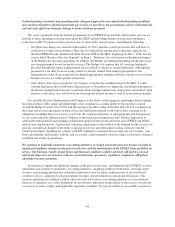

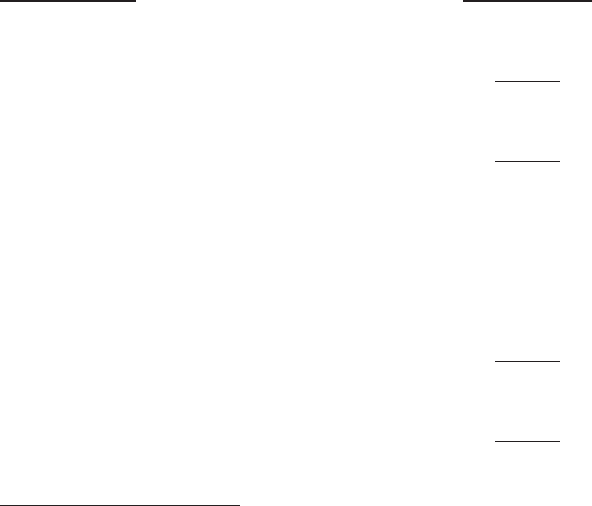

GAAP to Regulatory Capital Reconciliation

(Dollars in millions) December 31, 2013

Shareholder equity(1) .......................... $ 1,218

Less intangible assets ....................... —

Less preferred stock(1) ....................... —

Tangible common equity ...................... 1,218

Total assets ................................. 10,742

Less intangible assets ....................... —

Tangible assets .............................. 10,742

Tangible common equity to tangible assets ratio .... 11.3%

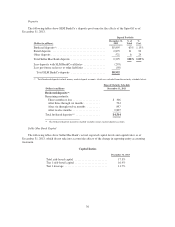

Tier 1 common equity:

Shareholder equity(1) ......................... 1,218

Qualifying capital securities:

Less goodwill ............................. —

Less accumulated other comprehensive loss ...... (3)

Less other assets ........................... —

Total Tier 1 capital .......................... 1,221

Less qualifying capital securities .............. —

Less preferred stock(1) ....................... —

Total Tier 1 common equity ................... 1,221

Net risk-weighted assets ...................... $ 7,472

(1) Does not include the Series A Preferred Stock and Series B Preferred Stock outstanding at the time of the closing

of the separation and distribution.

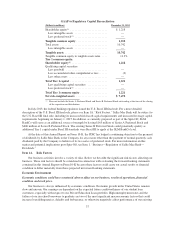

In July 2013, the federal banking regulators issued the U.S. Basel III final rule. For a more detailed

description of the U.S. Basel III final rule, please see Item 1A. “Risk Factors.” Sallie Mae Bank will be subject to

the U.S. Basel III final rule, including its increased risk-based capital requirements and increased leverage capital

requirements beginning on January 1, 2015. In addition, as currently proposed as part of the Spin-Off, SLM

BankCo will serve as an additional source of strength by having $165 million of Series A Preferred Stock and

$400 million of Series B Preferred Stock. The existing Series B Preferred Stock could potentially qualify as

additional Tier 1 capital under Basel III standards were Basel III to apply at the SLM BankCo level.

At the date of this Annual Report on Form 10-K, the FDIC has lodged a continuing objection to the payment

of dividends by Sallie Mae Bank to the Company for any reason other than the payment of normal quarterly cash

dividends paid by the Company to holders of its two series of preferred stock. For more information on this

matter and potential implications post-Spin-Off, see Item 1. “Business—Regulation of Sallie Mae Bank—

Dividends.”

Item 1A. Risk Factors

Our business activities involve a variety of risks. Below we describe the significant risk factors affecting our

business. These risk factors should be considered in connection with evaluating the forward-looking statements

contained in this Annual Report on Form 10-K because these factors could cause our actual results or financial

condition to differ materially from those projected in forward-looking statements.

Economic Environment

Economic conditions could have a material adverse effect on our business, results of operations, financial

condition and stock price.

Our business is always influenced by economic conditions. Economic growth in the United States remains

slow and uneven. Our earnings are dependent on the expected future creditworthiness of our student loan

customers, especially with respect to our Private Education Loan portfolio. High unemployment rates and the

failure of our in-school borrowers to graduate are two of the most significant macroeconomic factors that could

increase loan delinquencies, defaults and forbearance, or otherwise negatively affect performance of our existing

37