Sallie Mae 2013 Annual Report Download - page 150

Download and view the complete annual report

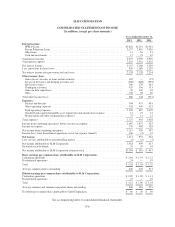

Please find page 150 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Business

SLM Corporation (“we,” “us,” “our,” or the “Company”) is a holding company that operates through a

number of subsidiaries. We were formed in 1972 as the Student Loan Marketing Association, a federally

chartered government-sponsored enterprise (the “GSE”), with the goal of furthering access to higher education

by acting as a secondary market for federal student loans. In 2004, we completed our transformation to a private

company through our wind-down of the GSE. The GSE’s outstanding obligations were placed into a Master

Defeasance Trust Agreement as of December 29, 2004, which was fully collateralized by direct, noncallable

obligations of the United States.

Currently, our primary business is to originate, service and collect loans we make to students and their

families to finance the cost of their education. Since July 2010, we have originated only Private Education Loans.

We use “Private Education Loans” to mean education loans to students or their families that are non-federal

loans and loans not insured or guaranteed under the previously existing Federal Family Education Loan Program

(“FFELP”). The core of our marketing strategy is to generate student loan originations by promoting our products

on campus through the financial aid office and through direct marketing to students and their families. Since the

beginning of 2006, virtually all of our Private Education Loans have been originated and funded by Sallie Mae

Bank, a Utah industrial bank subsidiary, which is regulated by the Utah Department of Financial Institutions

(“UDFI”) and the Federal Deposit Insurance Corporation (“FDIC”). We also provide servicing, loan default

aversion and defaulted loan collection services for loans owned by other institutions, including the U.S.

Department of Education (“ED”). We also operate Upromise, Inc. (“Upromise”), a consumer savings network

that provides financial rewards on everyday purchases to help families save for college, and provide insurance

products through Sallie Mae Insurance Services to protect their college investment through tuition, rental and life

insurance services.

In addition, we are currently the largest holder, servicer and collector of loans made under the previously

existing FFELP, and the majority of our income has been derived, directly or indirectly, from our portfolio of

FFELP Loans and servicing we have provided for FFELP Loans. In 2010, Congress passed legislation ending the

origination of education loans under FFELP. The terms and conditions of existing FFELP Loans were not

affected by this legislation. Our FFELP Loan portfolio will amortize over approximately 20 years. The fee

income we have earned from providing servicing and contingent collection services on such loans will similarly

decline over time.

On May 29, 2013, we announced our intent to separate into two distinct publicly-traded entities — an

education loan management business (“NewCo”) and a consumer banking business (“SLM BankCo”). It is our

intent to effect the separation through the distribution of the common stock of NewCo, which was formed to hold

the assets and liabilities associated with our education loan management business. In order to effect the

separation, we will first undergo an internal corporate reorganization, which is necessary for the contemplated

separation of NewCo from our consumer banking business. This internal corporate reorganization will be then

followed by a pro rata share distribution of all of the shares of NewCo common stock to our stockholders that

will implement the actual separation of NewCo. Throughout this Annual Report on Form 10-K, we sometimes

collectively refer to the proposed internal corporate reorganization and separation as the “Spin-Off.”

2. Significant Accounting Policies

Use of Estimates

Our financial reporting and accounting policies conform to generally accepted accounting principles in the

United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

F-12