Sallie Mae 2013 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

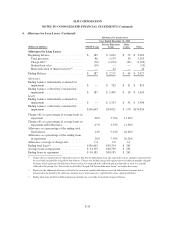

3. Student Loans (Continued)

Similar to FFELP loans, Private Education Loans are generally non-dischargeable in bankruptcy. Most loans

have repayment terms of 15 years or more, and for loans made prior to 2009, payments are typically deferred

until after graduation; however, since 2009 we began to encourage interest-only or fixed payment options while

the customer is enrolled in school and today, the majority of new loans make payments while in school.

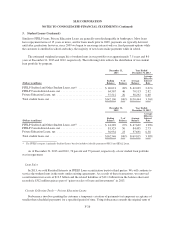

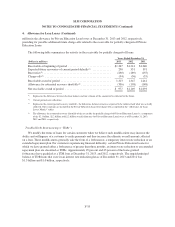

The estimated weighted average life of student loans in our portfolio was approximately 7.5 years and 8.0

years at December 31, 2013 and 2012, respectively. The following table reflects the distribution of our student

loan portfolio by program.

December 31,

2013

Year Ended

December 31, 2013

(Dollars in millions)

Ending

Balance

%of

Balance

Average

Balance

Average

Effective

Interest

Rate

FFELP Stafford and Other Student Loans, net(1) ................. $ 40,021 28% $ 42,039 2.01%

FFELP Consolidation Loans, net ............................. 64,567 46 70,113 2.82

Private Education Loans, net ................................ 37,512 26 38,292 6.60

Total student loans, net ..................................... $142,100 100% $150,444 3.56%

December 31,

2012

Year Ended

December 31, 2012

(Dollars in millions)

Ending

Balance

%of

Balance

Average

Balance

Average

Effective

Interest

Rate

FFELP Stafford and Other Student Loans, net(1) ................. $ 44,289 27% $ 47,629 1.98%

FFELP Consolidation Loans, net ............................. 81,323 50 84,495 2.73

Private Education Loans, net ................................ 36,934 23 37,691 6.58

Total student loans, net ..................................... $162,546 100% $169,815 3.38%

(1) The FFELP category is primarily Stafford Loans, but also includes federally guaranteed PLUS and HEAL Loans.

As of December 31, 2013 and 2012, 76 percent and 75 percent, respectively, of our student loan portfolio

was in repayment.

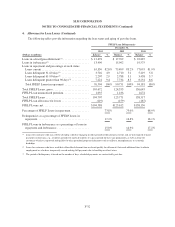

Loan Sales

In 2013, we sold Residual Interests in FFELP Loan securitization trusts to third parties. We will continue to

service the student loans in the trusts under existing agreements. As a result of these transactions, we removed

securitization trust assets of $12.5 billion and the related liabilities of $12.1 billion from the balance sheet and

recorded a $312 million gain as part of “gains on sales of loans and investments” in 2013.

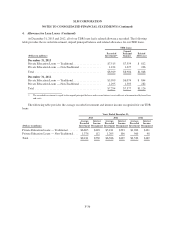

Certain Collection Tools — Private Education Loans

Forbearance involves granting the customer a temporary cessation of payments (or temporary acceptance of

smaller than scheduled payments) for a specified period of time. Using forbearance extends the original term of

F-26