Sallie Mae 2013 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

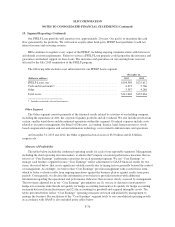

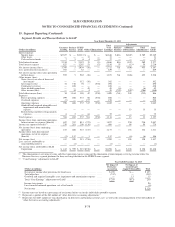

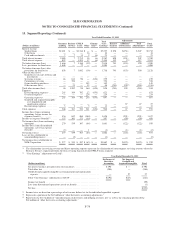

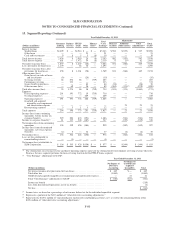

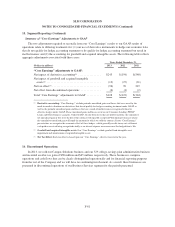

15. Segment Reporting (Continued)

borrower count, defaulted borrower dollar amount, a survey of borrowers, a survey of schools and a survey of ED

personnel. Pursuant to the contract terms related to annual volume allocation of new loans, the maximum any

servicer could be awarded is 40 percent of net new borrowers in that contract year. Our share of new loans

serviced for ED under the contract increased to 18 percent in 2013 from 15 percent in the prior contract year as a

result of our relative standing, as compared to other servicing companies, on the ED Scorecard. We earned $109

million of revenue under the contract for the year ended December 31, 2013.

Other

Upromise generates transaction fees through our Upromise consumer savings network. Since inception

through December 31, 2013, members have earned approximately $800 million in rewards by purchasing

products at hundreds of online retailers, booking travel, purchasing a home, dining out, buying gas and groceries,

using the Upromise World MasterCard, or completing other qualified transactions. We earn a fee for the

marketing and administrative services we provide to companies that participate in the Upromise savings network.

We also compete with other loyalty shopping services and companies.

Previously, we provided program management services for 529 college-savings plans through our 529

college-savings plan administration business and our Campus Solutions business provided processing capabilities

to educational institutions designed to help campus business offices increase their services to students and

families. However, in the second quarter of 2013, we sold our Campus Solutions business and recorded an after-

tax gain of $38 million. Additionally, in the fourth quarter of 2013, we sold our 529 college-savings plan

administration business and recorded an after-tax gain of $65 million. The results of both of these businesses are

reported in discontinued operations for all periods presented.

At December 31, 2013 and 2012, the Business Services segment had total assets of $892 million and $867

million, respectively.

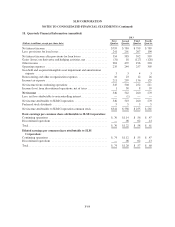

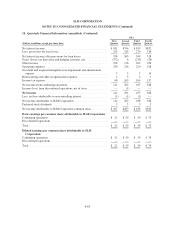

FFELP Loans Segment

Our FFELP Loans segment consists of our FFELP Loan portfolio (approximately $104.6 billion as of

December 31, 2013) and the underlying debt and capital funding the loans. We are currently the largest holder of

FFELP Loans. FFELP Loans are insured or guaranteed by state or not-for-profit agencies and are also protected

by contractual rights to recovery from the United States pursuant to guaranty agreements among ED and these

agencies. These guarantees generally cover at least 97 percent of a FFELP Loan’s principal and accrued interest

for loans disbursed. In the case of death, disability or bankruptcy of the borrower, these guarantees cover

100 percent of the loan’s principal and accrued interest.

As a result of the long-term funding used in the FFELP Loan portfolio and the insurance and guarantees

provided on these loans, the net interest margin recorded in the FFELP Loans segment is relatively stable and the

capital we choose to retain with respect to the segment is modest.

In 2013, we sold Residual Interests in FFELP Loan securitization trusts to third parties. We continue to

service the student loans in the trusts under existing agreements. As a result of the sale of the Residual Interests

in FFELP securitizations, we removed securitization trust assets of $12.5 billion and the related liabilities of

$12.1 billion from our balance sheet and recorded a $312 million gain as part of “gains on sales of loans and

investments” for the year ended December 31, 2013.

F-75