Sallie Mae 2013 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

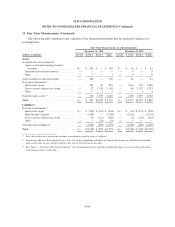

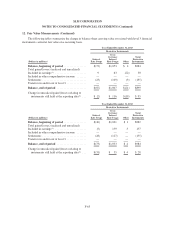

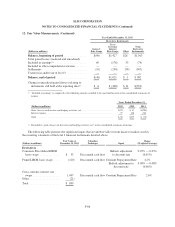

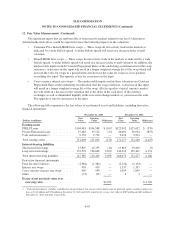

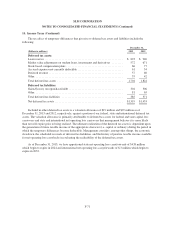

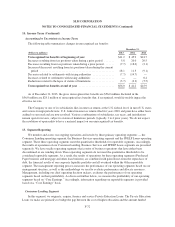

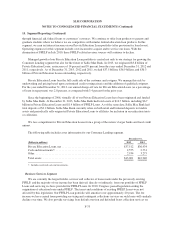

12. Fair Value Measurements (Continued)

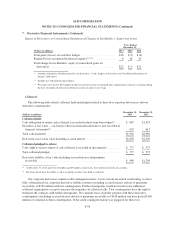

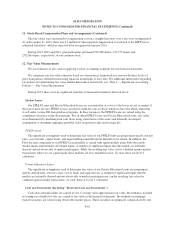

Inputs specific to each class of derivatives disclosed in the table below are as follows:

• Interest rate swaps — Derivatives are valued using standard derivative cash flow models. Derivatives

that swap fixed interest payments for LIBOR interest payments (or vice versa) and derivatives

swapping quarterly reset LIBOR for daily reset LIBOR or one-month LIBOR were valued using the

LIBOR swap yield curve which is an observable input from an active market. These derivatives are

level 2 fair value estimates in the hierarchy. Other derivatives swapping LIBOR interest payments for

another variable interest payment (primarily T-Bill or Prime) or swapping interest payments based on

the Consumer Price Index for LIBOR interest payments are valued using the LIBOR swap yield curve

and observable market spreads for the specified index. The markets for these swaps are generally

illiquid as indicated by a wide bid/ask spread. The adjustment made for liquidity decreased the

valuations by $84 million at December 31, 2013. These derivatives are level 3 fair value estimates.

• Cross-currency interest rate swaps — Derivatives are valued using standard derivative cash flow

models. Derivatives hedging foreign-denominated bonds are valued using the LIBOR swap yield curve

(for both USD and the foreign-denominated currency), cross-currency basis spreads, and forward

foreign currency exchange rates. The derivatives are primarily British Pound Sterling and Euro

denominated. These inputs are observable inputs from active markets. Therefore, the resulting

valuation is a level 2 fair value estimate. Amortizing notional derivatives (derivatives whose notional

amounts change based on changes in the balance of, or pool of, assets or debt) hedging trust debt use

internally derived assumptions for the trust assets’ prepayment speeds and default rates to model the

notional amortization. Management makes assumptions concerning the extension features of

derivatives hedging rate-reset notes denominated in a foreign currency. These inputs are not market

observable; therefore, these derivatives are level 3 fair value estimates.

• Floor Income Contracts — Derivatives are valued using an option pricing model. Inputs to the model

include the LIBOR swap yield curve and LIBOR interest rate volatilities. The inputs are observable

inputs in active markets and these derivatives are level 2 fair value estimates.

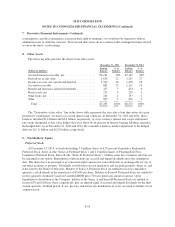

The carrying value of borrowings designated as the hedged item in a fair value hedge is adjusted for changes

in fair value due to benchmark interest rates and foreign-currency exchange rates. These valuations are

determined through standard bond pricing models and option models (when applicable) using the stated terms of

the borrowings, and observable yield curves, foreign currency exchange rates, and volatilities.

F-63