Sallie Mae 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

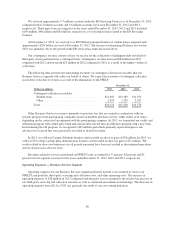

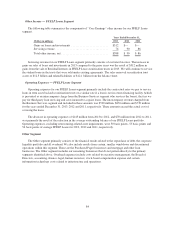

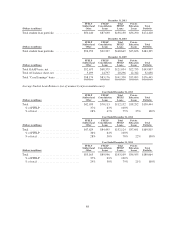

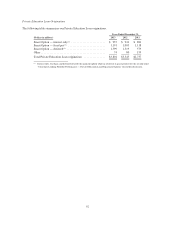

Other Income — FFELP Loans Segment

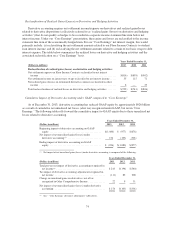

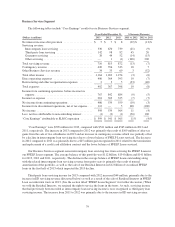

The following table summarizes the components of “Core Earnings” other income for our FFELP Loans

segment.

Years Ended December 31,

(Dollars in millions) 2013 2012 2011

Gains on loans and investments .......................... $312 $— $—

Servicing revenue ..................................... 76 90 86

Total other income, net ................................. $388 $ 90 $ 86

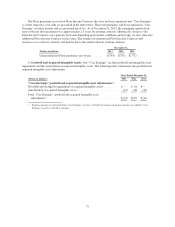

Servicing revenue for our FFELP Loans segment primarily consists of customer late fees. The increase in

gains on sales of loans and investments in 2013 compared to the prior years was the result of $312 million in

gains from the sale of Residual Interests in FFELP Loan securitization trusts in 2013. We will continue to service

the student loans in the trusts that were sold under existing agreements. The sales removed securitization trust

assets of $12.5 billion and related liabilities of $12.1 billion from the balance sheet.

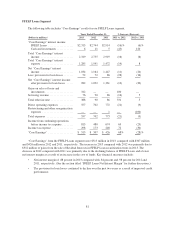

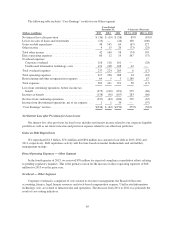

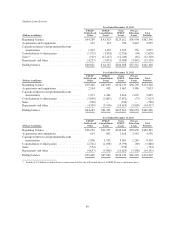

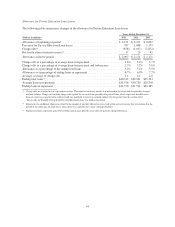

Operating Expenses — FFELP Loans Segment

Operating expenses for our FFELP Loans segment primarily include the contractual rates we pay to service

loans in term asset-backed securitization trusts or a similar rate if a loan is not in a term financing facility (which

is presented as an intercompany charge from the Business Services segment who services the loans), the fees we

pay for third-party loan servicing and costs incurred to acquire loans. The intercompany revenue charged from

the Business Services segment and included in those amounts was $530 million, $670 million and $739 million

for the years ended December 31, 2013, 2012 and 2011, respectively. These amounts exceed the actual cost of

servicing the loans.

The decrease in operating expenses of $145 million from 2013 to 2012, and $70 million from 2012 to 2011,

was primarily the result of the reduction in the average outstanding balance of our FFELP Loans portfolio.

Operating expenses, excluding restructuring-related asset impairments, were 50 basis points, 53 basis points and

54 basis points of average FFELP Loans for 2013, 2012 and 2011, respectively.

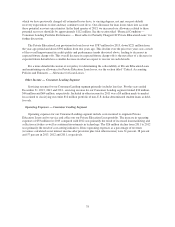

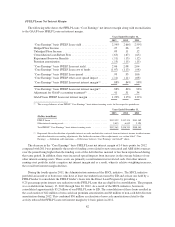

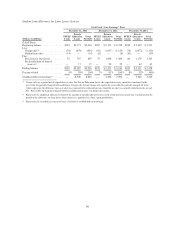

Other Segment

The Other segment primarily consists of the financial results related to the repurchase of debt, the corporate

liquidity portfolio and all overhead. We also include results from certain, smaller wind-down and discontinued

operations within this segment. These are the Purchased Paper businesses and mortgage and other loan

businesses. The Other segment includes our remaining businesses that do not pertain directly to the primary

segments identified above. Overhead expenses include costs related to executive management, the Board of

Directors, accounting, finance, legal, human resources, stock-based compensation expense and certain

information technology costs related to infrastructure and operations.

84