Sallie Mae 2013 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

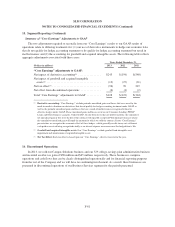

16. Discontinued Operations (Continued)

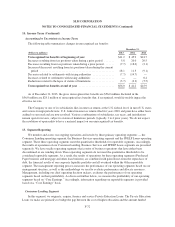

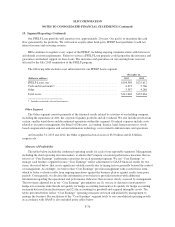

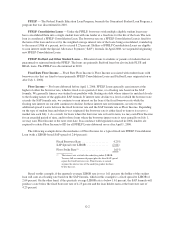

The following table summarizes our discontinued assets and liabilities at December 31, 2013 and 2012.

At December 31,

(Dollars in millions) 2013 2012

Assets:

Cash and equivalents ....................................... $ 5 $ 33

Other assets .............................................. 98 202

Assets of discontinued operations ............................. $103 $235

Liabilities:

Liabilities of discontinued operations .......................... $ 94 $168

At December 31, 2013, other assets of our discontinued operations and the offsetting liability consisted

primarily of funds held in accordance with contractual requirements on behalf of the acquirer of our Campus

Solutions business pending remittance to their school clients.

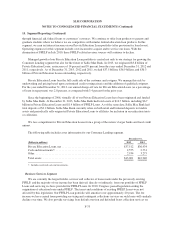

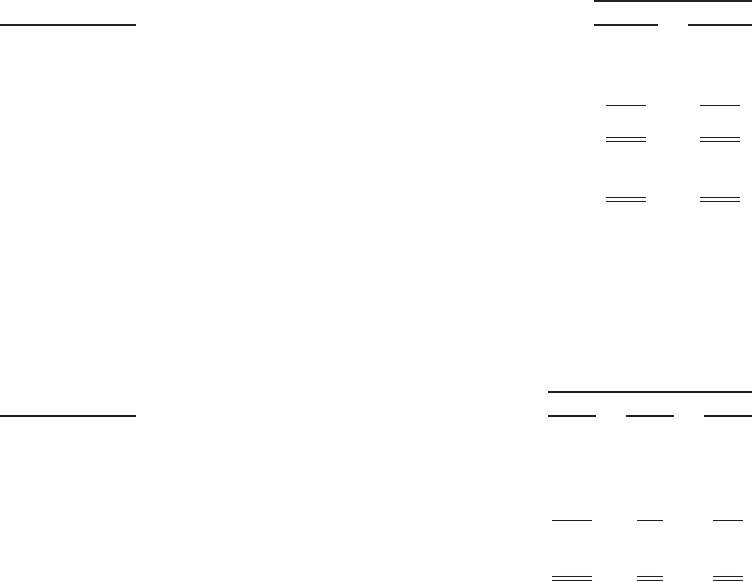

The following table summarizes our discontinued operations.

Years Ended December 31,

(Dollars in millions) 2013 2012 2011

Operations:

Income (loss) from discontinued operations before income tax

expense (benefit) ................................... $126 $(3) $55

Income tax expense (benefit) ............................ 20 (1) 20

Income (loss) from discontinued operations, net of tax expense

(benefit) .......................................... $106 $(2) $35

17. Concentrations of Risk

Our business is primarily focused in providing and/or servicing to help students and their families save, plan

and pay for college. We primarily originate, service and/or collect loans made to students and their families to

finance the cost of their education. We provide funding, delivery and servicing support for education loans in the

United States, through our Private Education Loan programs and as a servicer and collector of loans for ED. In

addition we are the largest holder, servicer and collector of loans under the discontinued FFELP. Because of this

concentration in one industry, we are exposed to credit, legislative, operational, regulatory, and liquidity risks

associated with the student loan industry.

Concentration Risk in the Revenues Associated with Private Education Loans

We compete in the private credit lending business with banks and other consumer lending institutions, some

with strong consumer brand name recognition and greater financial resources. We compete based on our

products, origination capability and customer service. To the extent our competitors compete aggressively or

more effectively, we could lose market share to them or subject our existing loans to refinancing risk. Our

product offerings may not prove to be profitable and may result in higher than expected losses.

We are a leading provider of saving- and paying-for-college products and programs. This concentration

gives us a competitive advantage in the marketplace. This concentration also creates risks in our business,

F-82