Sallie Mae 2013 Annual Report Download - page 29

Download and view the complete annual report

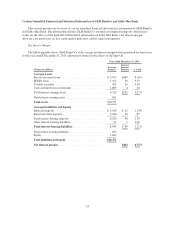

Please find page 29 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• certify and disburse all Private Education Loans through schools.

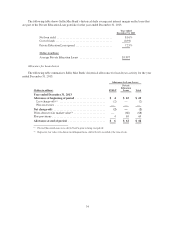

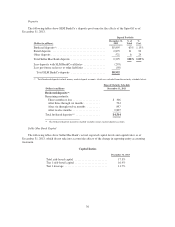

In 2009, we introduced, and SLM BankCo will continue to offer, the Smart Option private education loan

product emphasizing in-school payment features to minimize total finance charges. The product features three

repayment types. The first two, Interest Only and $25 Fixed Pay options, require monthly payments while the

student is in school and they accounted for approximately 56 percent of the Private Education Loans originated

during the fiscal year ended December 31, 2013. The third repayment option is the more traditional deferred

private education loan product where customers do not begin making payments until after graduation.

Private Education Loan Servicing

A subsidiary of SLM BankCo (“Private ServiceCo”) will provide servicing and loan collection for Private

Education Loans originated and held by Sallie Mae Bank, as well as those sold to third parties. As part of the

Spin-Off of the consumer banking business and the education loan management business, SLM BankCo will

obtain ownership, and transition into management and operation of, all assets and personnel needed to operate all

aspects of its Private Education Loan business from asset origination to asset servicing to asset funding. Over

time, SLM BankCo’s business plan contemplates seeking additional funding, liquidity and revenue from the sale

or securitization of loan assets it originates as well as the servicing of the loan assets it sells to third parties. SLM

BankCo’s business plan does not contemplate servicing financial assets originated by other institutions. The

physical and logistical separation of SLM BankCo’s servicing and collection platforms from those of NewCo is

currently expected to be completed within twelve months after completion of the Spin-Off, but could take

significantly longer. During that period, SLM BankCo’s Private Education Loan servicing will be conducted by

NewCo, Sallie Mae Bank and Private ServiceCo employees pursuant to various transition agreements. For

further detail on these agreements, see the section titled “SLM BankCo’s Post-Separation Relationship with

NewCo.”

Upromise

The Upromise save-for-college membership program stands alone as a consumer service committed

exclusively to helping Americans save money for higher education. Membership is free and each year more than

one million customers enroll as members to use the service. Members earn money for college by receiving cash

back when shopping at on-line or brick-and-mortar retailers, booking travel, dining out or buying gas or groceries

at participating merchants or by using their Upromise MasterCard. As of December 31, 2013, more than 1,000

merchants participated by providing discounts on purchases that are returned to the customer. Since inception,

Upromise members have saved approximately $800 million for college, and more than 340,000 members

actively use the Upromise credit card for everyday purchases.

Sallie Mae Insurance Services

Through the existing Sallie Mae Insurance Services venture, SLM BankCo will continue to partner with an

established insurance brokerage to offer America’s college students and young adults insurance programs that

address their unique life-stage needs, including tuition insurance, renters insurance, life insurance and auto

insurance.

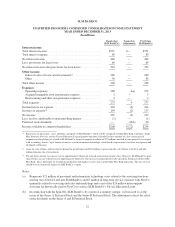

SLM BankCo Funding Sources

Deposits

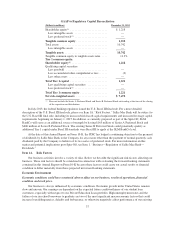

Sallie Mae Bank gathers low-cost retail deposits through its direct banking platform which serves as an

important source of funding. Sallie Mae Bank also utilizes brokered deposits as needed to supplement its funding

needs and enhance its liquidity position. As of December 31, 2013, Sallie Mae Bank had $9.3 billion of customer

deposits, representing 86 percent of interest earning assets, composed of $2.9 billion of retail deposits, $5.9

billion of brokered deposits and $0.5 billion of other deposits on a pro forma basis.

27