Sallie Mae 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

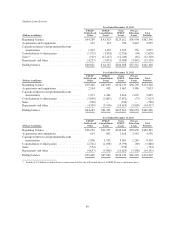

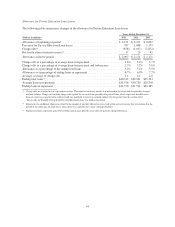

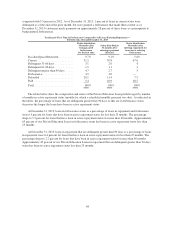

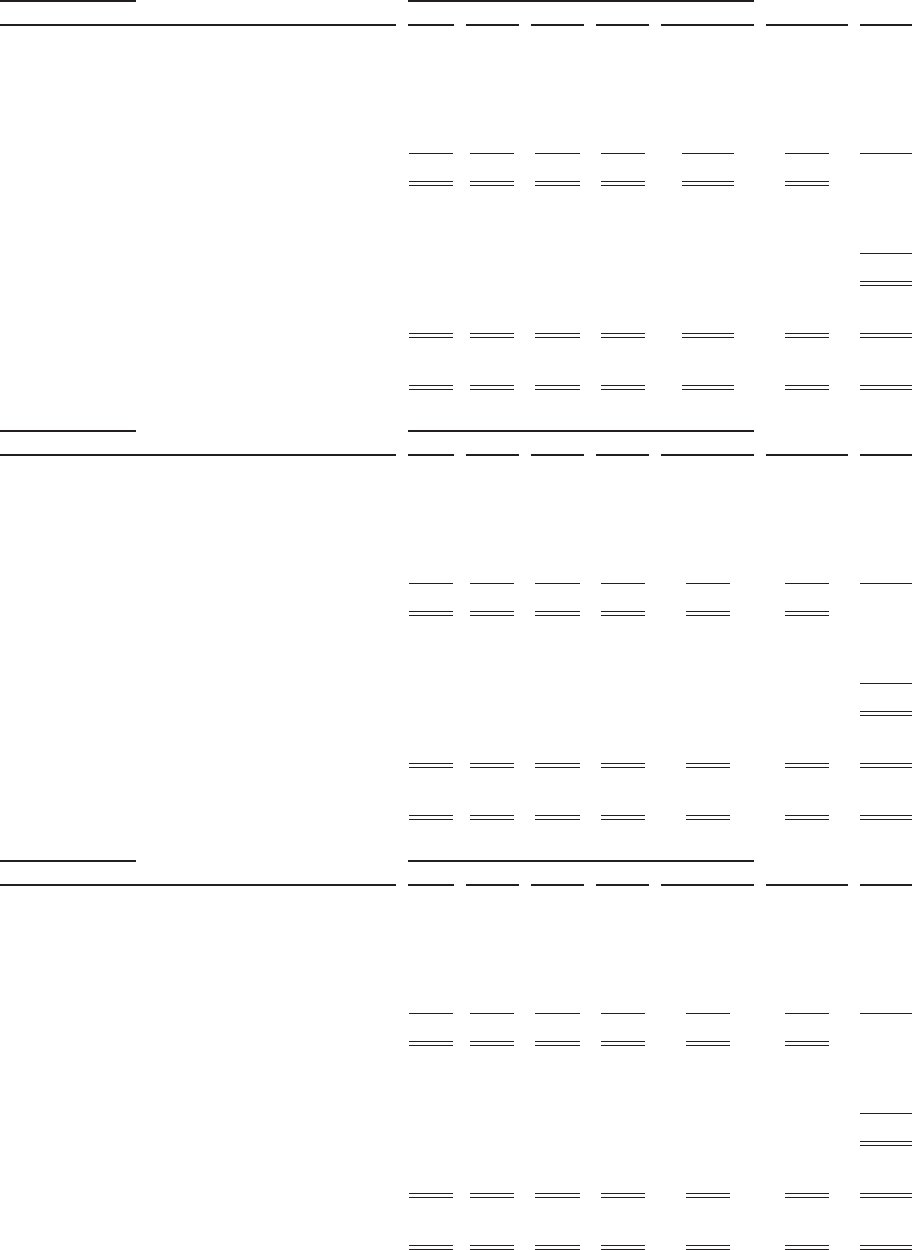

(Dollars in millions) Monthly Scheduled Payments Due Not Yet in

RepaymentDecember 31, 2013 0to12 13 to 24 25 to 36 37 to 48 More than 48 Total

Loans in-school/grace/deferment ....................... $ — $ — $ — $ — $ — $6,528 $ 6,528

Loans in forbearance ................................ 502 189 166 106 139 — 1,102

Loans in repayment — current ......................... 4,056 4,735 4,856 4,633 10,488 — 28,768

Loans in repayment — delinquent 31-60 days ............ 166 167 152 121 196 — 802

Loans in repayment — delinquent 61-90 days ............ 117 115 94 72 115 — 513

Loans in repayment — delinquent greater than 90 days ..... 330 305 238 171 243 — 1,287

Total ............................................. $5,171 $5,511 $5,506 $5,103 $11,181 $6,528 39,000

Unamortized discount ............................... (704)

Receivable for partially charged-off loans ................ 1,313

Allowance for loan losses ............................ (2,097)

Total Private Education Loans, net ..................... $37,512

Loans in forbearance as a percentage of loans in repayment

and forbearance .................................. 9.7% 3.4% 3.0% 2.1% 1.2% — % 3.4%

Loans in repayment — delinquent greater than 90 days as a

percentage of loans in repayment ..................... 7.1% 5.7% 4.5% 3.4% 2.2% — % 4.1%

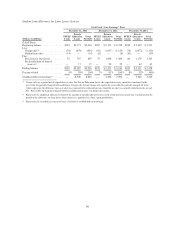

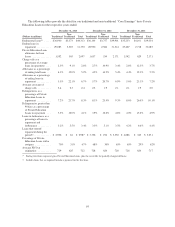

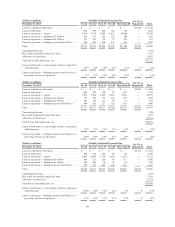

(Dollars in millions) Monthly Scheduled Payments Due Not Yet in

RepaymentDecember 31, 2012 0to12 13 to 24 25 to 36 37 to 48 More than 48 Total

Loans in-school/grace/deferment ....................... $ — $ — $ — $ — $ — $5,904 $ 5,904

Loans in forbearance ................................ 602 195 149 83 107 — 1,136

Loans in repayment — current ......................... 5,591 5,366 5,405 4,403 7,810 — 28,575

Loans in repayment — delinquent 31-60 days ............ 353 189 175 116 179 — 1,012

Loans in repayment — delinquent 61-90 days ............ 185 95 81 49 71 — 481

Loans in repayment — delinquent greater than 90 days ..... 640 292 227 129 158 — 1,446

Total ............................................. $7,371 $6,137 $6,037 $4,780 $8,325 $5,904 38,554

Unamortized discount ............................... (796)

Receivable for partially charged-off loans ................ 1,347

Allowance for loan losses ............................ (2,171)

Total Private Education Loans, net ..................... $36,934

Loans in forbearance as a percentage of loans in repayment

and forbearance .................................. 8.2% 3.2% 2.5% 1.7% 1.3% — % 3.5%

Loans in repayment — delinquent greater than 90 days as a

percentage of loans in repayment ..................... 9.5% 4.9% 3.9% 2.7% 1.9% — % 4.6%

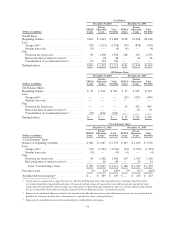

(Dollars in millions) Monthly Scheduled Payments Due Not Yet in

RepaymentDecember 31, 2011 0to12 13 to 24 25 to 36 37 to 48 More than 48 Total

Loans in-school/grace/deferment ....................... $ — $ — $ — $ — $ — $6,522 $ 6,522

Loans in forbearance ................................ 920 194 126 66 80 — 1,386

Loans in repayment — current ......................... 6,866 6,014 5,110 3,486 5,646 — 27,122

Loans in repayment — delinquent 31-60 days ............ 506 212 158 83 117 — 1,076

Loans in repayment — delinquent 61-90 days ............ 245 100 78 41 56 — 520

Loans in repayment — delinquent greater than 90 days ..... 709 317 205 102 134 — 1,467

Total ............................................. $9,246 $6,837 $5,677 $3,778 $6,033 $6,522 38,093

Unamortized discount ............................... (873)

Receivable for partially charged-off loans ................ 1,241

Allowance for loan losses ............................ (2,171)

Total Private Education Loans, net ..................... $36,290

Loans in forbearance as a percentage of loans in repayment

and forbearance .................................. 10.0% 2.8% 2.2% 1.8% 1.3% — % 4.4%

Loans in repayment — delinquent greater than 90 days as a

percentage of loans in repayment ..................... 8.5% 4.8% 3.7% 2.7% 2.3% — % 4.9%

99