Sallie Mae 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.After the completion of the Spin-Off,

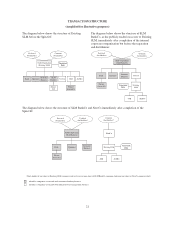

• SLM BankCo, as the publicly-traded successor to Existing SLM, will own the assets, liabilities and

operations of Sallie Mae Bank, including the student loans it holds, a new private education loan

servicing business that will service the Private Education Loans currently held and subsequently

originated by Sallie Mae Bank, Upromise and the Sallie Mae Insurance Services businesses; and

• NewCo will be an independent, publicly-traded company and will own, through its wholly-owned

subsidiary Existing SLM, Existing SLM’s portfolio of student loans not held by Sallie Mae Bank,

together with substantially all of Existing SLM’s student loan servicing and collection businesses.

Reasons for the Spin-Off

Our Board of Directors believes that separating us into two companies—an education loan management

business and a consumer banking business—is in our best interest and the best interests of our stockholders. We

considered a wide variety of factors during our evaluation of the Spin-Off. Among other things, our Board of

Directors considered the following potential benefits of the Spin-Off:

•Distinct identities and strategies. The consumer banking business and the education loan management

business have evolved independently over time. The FFELP loan portfolio and related servicing

businesses generate highly predictable income, but are in wind down as the universe of FFELP loans

amortizes over a period of approximately 20 years. By contrast, the Private Education Loan business is

expected to grow over time as Sallie Mae Bank continues to originate and service more Private Education

Loans. The additional expense of originating these loans, their higher rates of return and growth, their

higher risk profile, the capital support risks associated with ownership of a federally insured financial

institution and increasing demands of regulatory compliance require a different business model than that

of the education loan management business. As a result, the investor bases for these two businesses are

different. The Spin-Off will allow investors to separately value SLM BankCo and NewCo based on their

unique operating identities and strategies, including the merits, performance and future prospects of their

respective businesses. The Spin-Off will also provide investors with two distinct and targeted investment

opportunities.

•Enhanced strategic and management focus. The Spin-Off will allow each of SLM BankCo and NewCo to

more effectively pursue its respective distinct operating priorities and strategies, which have diverged

over time, and will enable the management of each company to focus on pursuing unique opportunities

for long-term growth and profitability. For example, NewCo will seek to acquire additional student loan

portfolios and grow its servicing and collection businesses, while SLM BankCo will initially be focused

on Private Education Loan origination, servicing those loans and other activities related to or associated

with Sallie Mae Bank, including the Upromise Rewards program and the Sallie Mae Insurance services

business.

•Distinct regulatory profiles. SLM BankCo and NewCo will be able to better manage their distinct

regulatory profiles post-Spin-Off:

OSallie Mae Bank, a Utah industrial bank and insured depository institution, will continue to be subject

to prudential bank regulatory oversight and periodic examination by both the UDFI and the FDIC.

Sallie Mae Bank has voluntarily entered into the FDIC’s large bank supervision program. In addition, it

is further expected that by the end of 2014, Sallie Mae Bank and SLM BankCo will be subject to the

requirements established under the Dodd-Frank Act applicable to institutions with total assets greater

than $10 billion, including regulation by the CFPB and the establishment of an independent risk

committee.

ONewCo will continue to be subject to CFPB enforcement, supervisory and examination authority. As a

FFELP loan servicer, NewCo will continue to be subject to the HEA and related regulations, in

addition to regulation, and periodic examinations, by ED. As a third-party service provider to financial

institutions, NewCo will also continue to be subject to examination by the FFIEC. Although NewCo

23