Sallie Mae 2013 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

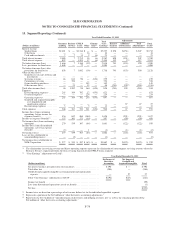

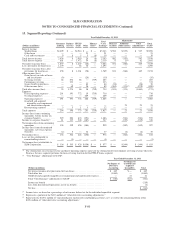

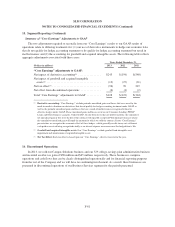

15. Segment Reporting (Continued)

through financial aid, federal loans or customers’ resources. We continue to offer loan products to parents and

graduate students where we believe we are competitive with similar federal education loan products. In this

segment, we earn net interest income on our Private Education Loan portfolio (after provision for loan losses).

Operating expenses for this segment include costs incurred to acquire and to service our loans. With the

elimination of FFELP in July 2010, these FFELP-related revenue sources will continue to decline.

Managed growth of our Private Education Loan portfolio is central not only to our strategy for growing the

Consumer Lending segment but also for the future of Sallie Mae Bank. In 2013, we originated $3.8 billion of

Private Education Loans, an increase of 14 percent and 39 percent from the years ended December 31, 2012 and

2011, respectively. As of December 31, 2013, 2012 and 2011, we had $37.5 billion, $36.9 billion, and $36.3

billion of Private Education Loans outstanding, respectively.

Private Education Loans bear the full credit risk of the customer and cosigner. We manage this risk by

underwriting and pricing based upon customized credit scoring criteria and the addition of qualified cosigners.

For the year ended December 31, 2013, our annual charge-off rate for Private Education Loans (as a percentage

of loans in repayment) was 2.8 percent, as compared with 3.4 percent for the prior year.

Since the beginning of 2006, virtually all of our Private Education Loans have been originated and funded

by Sallie Mae Bank. At December 31, 2013, Sallie Mae Bank had total assets of $10.7 billion, including $6.7

billion in Private Education Loans and $1.4 billion of FFELP Loans. As of the same date, Sallie Mae Bank had

total deposits of $9.2 billion. Sallie Mae Bank currently relies on both retail and brokered deposits to fund its

assets and periodically sells originated Private Education Loans to affiliates for inclusion in securitization trusts

or collection.

We face competition for Private Education Loans from a group of the nation’s larger banks and local credit

unions.

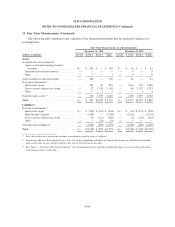

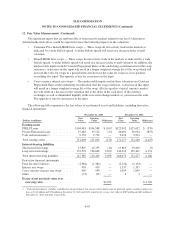

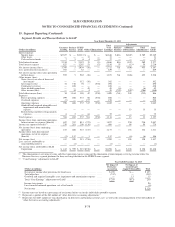

The following table includes asset information for our Consumer Lending segment.

December 31,

(Dollars in millions) 2013 2012

Private Education Loans, net ......................................... $37,512 $36,934

Cash and investments(1) ............................................. 2,555 2,731

Other ........................................................... 2,934 3,275

Total assets ...................................................... $43,001 $42,940

(1) Includes restricted cash and investments.

Business Services Segment

We are currently the largest holder, servicer and collector of loans made under the previously existing

FFELP, and the majority of our income has been derived, directly or indirectly, from our portfolio of FFELP

Loans and servicing we have provided for FFELP Loans. In 2010, Congress passed legislation ending the

origination of education loans under FFELP. The terms and conditions of existing FFELP Loans were not

affected by this legislation. Our FFELP Loan portfolio will amortize over approximately 20 years. The fee

income we have earned from providing servicing and contingent collections services on such loans will similarly

decline over time. We also provide servicing, loan default aversion and defaulted loans collection services on

F-73