Sallie Mae 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.more susceptible to market fluctuations and other adverse events than if it were still a part of the

Company; (c) following the Spin-Off, SLM BankCo’s business will be less diversified than our business

prior to the Spin-Off; and (d) other actions required to separate SLM BankCo’s and NewCo’s respective

businesses could disrupt SLM BankCo’s operations. For additional information, see Item 1A. “Risk

Factors—Risks Related to the Spin-Off.”

•Limitations placed upon NewCo and SLM BankCo as a result of the tax sharing agreement. To preserve

the tax-free treatment to the Company of the Spin-Off, under the tax sharing agreement that NewCo will

enter into with SLM BankCo, both SLM BankCo and NewCo will be restricted from taking any action

that prevents the distribution and related transactions from being tax-free for U.S. federal income tax

purposes. These restrictions could limit both SLM BankCo’s and NewCo’s near–term ability to

repurchase its respective shares or to issue additional shares, pursue strategic transactions or engage in

other transactions that might increase the value of its respective businesses. For additional information,

see Item 1A “Risk Factors—Risks Related to the Spin-Off.”

Our Board of Directors concluded that the potential benefits of the Spin-Off outweighed these negative

factors.

NewCo After the Spin-Off

Following completion of the Spin-Off, NewCo will hold the largest portfolio of education loans insured or

guaranteed under FFELP Loans, as well as the largest portfolio of Private Education Loans. FFELP Loans are

insured or guaranteed by state or not-for-profit agencies and are also protected by contractual rights to recovery

from the United States pursuant to guaranty agreements among ED and these agencies. Private Education Loans

are education loans to students or their families that are non-federal loans and not insured or guaranteed under

FFELP. Private Education Loans bear the full credit risk of the customer and any cosigner and are made

primarily to bridge the gap between the cost of higher education and the amount funded through financial aid,

federal loans or students’ and families’ resources. As of December 31, 2013, approximately 85 percent of the

FFELP Loans and 60 percent of the Private Education Loans held by NewCo were funded to term with non-

recourse, long-term securitization debt through the use of securitization trusts.

NewCo will service and collect on its own portfolio of education loans, as well as on those owned by ED,

financial institutions, banks, credit unions and non-profit education lenders. It will also provide servicing support

for Guarantor agencies, which serve as intermediaries between the U.S. federal government and FFELP lenders

and are responsible for paying claims on defaulted FFELP Loans. These services include account maintenance,

default aversion, post default collections and claim processing. NewCo will also be one of four large servicers to

ED under its DSLP, and will provide collection services to ED. NewCo will also generate revenue through

collection of delinquent debt (consisting of both education loans as well as other asset classes) on behalf of its

clients on a contingent basis. In addition, NewCo will service and collect on SLM BankCo’s portfolio of FFELP

Loans and, during a transition period, SLM BankCo’s portfolio of Private Education Loans. It is currently

anticipated that NewCo will continue to service Private Education Loans owned by SLM BankCo with respect to

individual borrowers who also have Private Education Loans which are owned by NewCo.

In 2010, Congress passed legislation ending the origination of education loans under the FFELP program.

FFELP Loans that remain outstanding will amortize over approximately the next 20 years, and NewCo’s goal is

to maximize the cash flow generated by its FFELP Loan portfolio, including by acquiring additional FFELP

Loans from third parties and expanding its related servicing business.

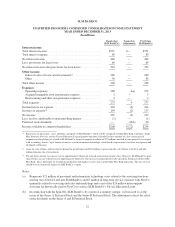

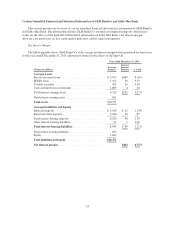

As of December 31, 2013, on a pro forma basis, NewCo’s principal assets consisted of:

• $103.2 billion in FFELP Loans, which yield an average of 2.05 percent annually on a “Core Earnings”

basis and have a weighted average life of 7.6 years;

25