Sallie Mae 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

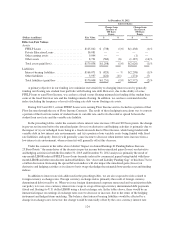

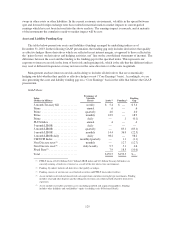

swaps in other assets or other liabilities. In the current economic environment, volatility in the spread between

spot and forward foreign exchange rates has resulted in material mark-to-market impacts to current-period

earnings which have not been factored into the above analysis. The earnings impact is noncash, and at maturity

of the instruments the cumulative mark-to-market impact will be zero.

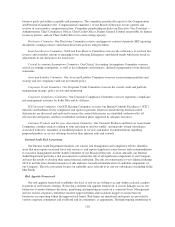

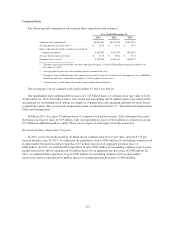

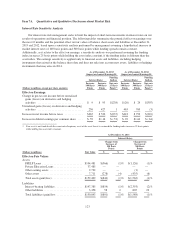

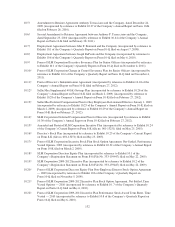

Asset and Liability Funding Gap

The tables below present our assets and liabilities (funding) arranged by underlying indices as of

December 31, 2013. In the following GAAP presentation, the funding gap only includes derivatives that qualify

as effective hedges (those derivatives which are reflected in net interest margin, as opposed to those reflected in

the “gains (losses) on derivatives and hedging activities, net” line on the consolidated statements of income). The

difference between the asset and the funding is the funding gap for the specified index. This represents our

exposure to interest rate risk in the form of basis risk and repricing risk, which is the risk that the different indices

may reset at different frequencies or may not move in the same direction or at the same magnitude.

Management analyzes interest rate risk and in doing so includes all derivatives that are economically

hedging our debt whether they qualify as effective hedges or not (“Core Earnings” basis). Accordingly, we are

also presenting the asset and liability funding gap on a “Core Earnings” basis in the table that follows the GAAP

presentation.

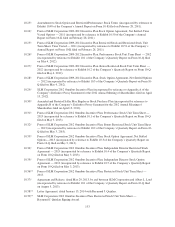

GAAP-Basis

Index

(Dollars in billions)

Frequency of

Variable

Resets Assets(1) Funding(2)

Funding

Gap

3-month Treasury bill ............ weekly $ 5.4 $ — $ 5.4

Prime ......................... annual .6 — .6

Prime ......................... quarterly 4.0 — 4.0

Prime ......................... monthly 18.9 — 18.9

Prime ......................... daily — .1 (0.1)

PLUS Index .................... annual .4 — .4

3-month LIBOR ................. daily — — —

3-month LIBOR ................. quarterly — 85.1 (85.1)

1-month LIBOR ................. monthly 14.4 36.9 (22.5)

1-month LIBOR daily ............ daily 98.2 — 98.2

CMT/CPI Index ................. monthly/quarterly — 1.1 (1.1)

Non-Discrete reset(3) ............. monthly — 12.7 (12.7)

Non-Discrete reset(4) ............. daily/weekly 9.7 5.1 4.6

Fixed Rate(5) .................... 7.9 18.5 (10.6)

Total .......................... $159.5 $159.5 $—

(1) FFELP Loans of $45.0 billion ($41.7 billion LIBOR index and $3.3 billion Treasury bill index) are

currently earning a fixed rate of interest as a result of the low interest rate environment.

(2) Funding (by index) includes all derivatives that qualify as hedges.

(3) Funding consists of auction rate asset-backed securities and FFELP Loan-other facilities.

(4) Assets include restricted and unrestricted cash equivalents and other overnight type instruments. Funding

includes retail and other deposits and the obligation to return cash collateral held related to derivatives

exposures.

(5) Assets include receivables and other assets (including goodwill and acquired intangibles). Funding

includes other liabilities and stockholders’ equity (excluding series B Preferred Stock).

125