Sallie Mae 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

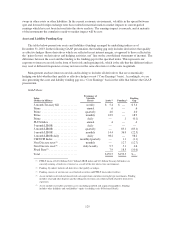

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Interest Rate Sensitivity Analysis

Our interest rate risk management seeks to limit the impact of short-term movements in interest rates on our

results of operations and financial position. The following tables summarize the potential effect on earnings over

the next 12 months and the potential effect on fair values of balance sheet assets and liabilities at December 31,

2013 and 2012, based upon a sensitivity analysis performed by management assuming a hypothetical increase in

market interest rates of 100 basis points and 300 basis points while funding spreads remain constant.

Additionally, as it relates to the effect on earnings, a sensitivity analysis was performed assuming the funding

index increases 25 basis points while holding the asset index constant, if the funding index is different than the

asset index. The earnings sensitivity is applied only to financial assets and liabilities, including hedging

instruments that existed at the balance sheet date and does not take into account new assets, liabilities or hedging

instruments that may arise in 2014.

As of December 31, 2013

Impact on Annual Earnings If:

As of December 31, 2012

Impact on Annual Earnings If:

Interest Rates:

Funding

Indices Interest Rates:

Funding

Indices

(Dollars in millions, except per share amounts)

Increase

100 Basis

Points

Increase

300 Basis

Points

Increase

25 Basis

Points(1)

Increase

100 Basis

Points

Increase

300 Basis

Points

Increase

25 Basis

Points(1)

Effect on Earnings:

Change in pre-tax net income before unrealized

gains (losses) on derivative and hedging

activities ................................ $ 9 $ 93 $(238) $ (20) $ 24 $(307)

Unrealized gains (losses) on derivative and hedging

activities ................................ 256 427 1 463 769 (3)

Increase in net income before taxes ............. $265 $ 520 $(237) $443 $ 793 $(310)

Increase in diluted earnings per common share .... $.59 $1.16 $ (.53) $ .92 $1.64 $ (.64)

(1) If an asset is not funded with the same index/frequency reset of the asset then it is assumed the funding index increases 25 basis points

while holding the asset index constant.

At December 31, 2013

Fair Value

Interest Rates:

Change from

Increase of

100 Basis

Points

Change from

Increase of

300 Basis

Points

(Dollars in millions) $ % $ %

Effect on Fair Values

Assets

FFELP Loans ............................ $104,481 $(566) (1)% $(1,126) (1)%

Private Education Loans .................... 37,485 — — — —

Other earning assets ....................... 9,732 — — (1) —

Other assets ............................. 7,711 (278) (4) (435) (6)

Total assets gain/(loss) ..................... $159,409 $(844) (1)% $(1,562) (1)%

Liabilities

Interest-bearing liabilities ................... $147,385 $(859) (1)% $(2,393) (2)%

Other liabilities ........................... 3,458 58 2 805 23

Total liabilities (gain)/loss .................. $150,843 $(801) (1)% $(1,588) (1)%

123