Sallie Mae 2013 Annual Report Download - page 24

Download and view the complete annual report

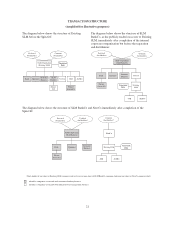

Please find page 24 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In connection with and just prior to the Spin-Off, Existing SLM will undergo an internal corporate

reorganization to facilitate the separation of the education loan management business and the consumer banking

business in a manner intended to be largely tax-free to SLM BankCo.

As part of the internal corporate reorganization, Existing SLM has formed the following three new

companies:

• NewCo, which is initially a wholly owned subsidiary;

• SLM BankCo, which is initially a wholly owned subsidiary; and

• A limited liability company wholly owned by SLM BankCo that is referred to as “Merger Sub.”

Pursuant to Section 251(g) of the Delaware General Corporation Law (“DGCL”), by action of Existing

SLM’s Board of Directors and without the requirement for a stockholder vote, Existing SLM will merge with and

into Merger Sub (the “SLM Merger”). As a result of the SLM Merger:

• All issued and outstanding shares of Existing SLM’s common stock will be converted, through no action

on the part of the holders thereof and by operation of law, into shares of SLM BankCo common stock, on

a 1-to-1 basis;

• Each series of issued and outstanding shares of Existing SLM’s 6.97% cumulative redeemable preferred

stock, Series A, par value $.20 per share (the “Series A Preferred Stock”) and Existing SLM’s floating

rate non-cumulative preferred stock, Series B, par value $.20 per share (the “Series B Preferred Stock”)

will be converted, through no action on the part of the holders thereof and by operation of law, into the

same series of substantially identical shares of SLM BankCo preferred stock, on a 1-to-1 basis;

• Existing SLM will be merged with and into Merger Sub and will become a limited liability company

wholly-owned by SLM BankCo; and

• SLM BankCo will change its name to “SLM Corporation.”

The charter and by-laws of SLM BankCo following the SLM Merger will be substantially identical to

Existing SLM’s charter and by-laws as they exist today.

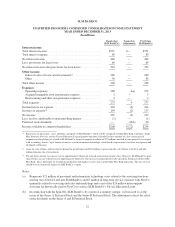

Following the SLM Merger, through a series of internal transactions, all of the assets and liabilities related

to Existing SLM’s consumer banking business, including Sallie Mae Bank, a new private education loan

servicing company, Existing SLM’s Upromise business and Sallie Mae Insurance Services business, will be

distributed by Existing SLM to SLM BankCo. Existing SLM will also distribute the capital stock of NewCo to

SLM BankCo. In addition, on a pro forma basis as of December 31, 2013 and as currently proposed as part of the

Spin-Off, SLM BankCo will retain an additional $578 million of cash primarily to offset the liability represented

by SLM BankCo becoming the issuer of the Series A Preferred Stock and the Series B Preferred Stock as a result

of the SLM Merger. SLM BankCo will then contribute to NewCo, its direct subsidiary, the limited liability

company interests of Existing SLM, which will continue to own substantially all of the assets and liabilities

associated with portfolio of FFELP Loans and Private Education Loans not owned by Sallie Mae Bank, as well

as substantially all of Existing SLM’s existing business of servicing and collecting student education loans.

Existing SLM will continue to hold substantially all of its assets and liabilities related to the education loan

management businesses, which will then be contributed by SLM BankCo to NewCo. Existing SLM’s liabilities

included, as of December 31, 2013, outstanding unsecured public debt of $18.3 billion and derivative contracts

with a net liability of $794 million.

Once the internal corporate reorganization is completed, SLM BankCo (as Existing SLM’s publicly-traded

successor holding company) will distribute all of the issued and outstanding shares of NewCo common stock, on

the basis of one share of NewCo common stock for each share of Existing SLM’s common stock issued and

outstanding as of the close of business on the record date for the distribution. The completion of the internal

corporate reorganization is a condition to the distribution.

22