Sallie Mae 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

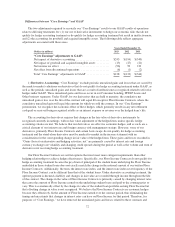

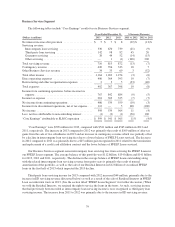

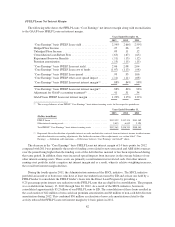

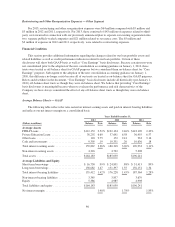

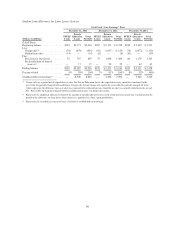

FFELP Loans Net Interest Margin

The following table shows the FFELP Loans “Core Earnings” net interest margin along with reconciliation

to the GAAP-basis FFELP Loans net interest margin.

Years Ended December 31,

2013 2012 2011

“Core Earnings” basis FFELP Loan yield .................. 2.59% 2.66% 2.59%

Hedged Floor Income ................................. .27 .26 .25

Unhedged Floor Income ............................... .09 .11 .12

Consolidation Loan Rebate Fees ......................... (.65) (.67) (.65)

Repayment Borrower Benefits .......................... (.11) (.13) (.12)

Premium amortization ................................. (.13) (.15) (.15)

“Core Earnings” basis FFELP Loan net yield ............... 2.06 2.08 2.04

“Core Earnings” basis FFELP Loan cost of funds ........... (1.07) (1.13) (.98)

“Core Earnings” basis FFELP Loan spread ................ .99 .95 1.06

“Core Earnings” basis FFELP other asset spread impact ...... (.11) (.11) (.08)

“Core Earnings” basis FFELP Loans net interest margin(1) .... .88% .84% .98%

“Core Earnings” basis FFELP Loans net interest margin(1) .... .88% .84% .98%

Adjustment for GAAP accounting treatment(2) .............. .41 .31 .34

GAAP-basis FFELP Loans net interest margin ............. 1.29% 1.15% 1.32%

(1) The average balances of our FFELP “Core Earnings” basis interest-earning assets for the respective periods are:

Years Ended December 31,

2013 2012 2011

(Dollars in millions)

FFELP Loans ................................................. $112,152 $132,124 $143,109

Other interest-earning assets ...................................... 5,013 6,619 5,194

Total FFELP “Core Earnings” basis interest-earning assets ............. $117,165 $138,743 $148,303

(2) Represents the reclassification of periodic interest accruals on derivative contracts from net interest income to other income

and other derivative accounting adjustments. For further discussion of these adjustments, see section titled “‘Core

Earnings’ — Definition and Limitations — Differences between ‘Core Earnings’ and GAAP” above.

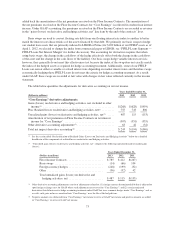

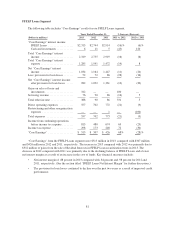

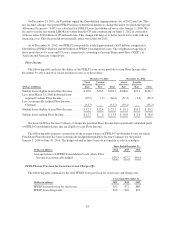

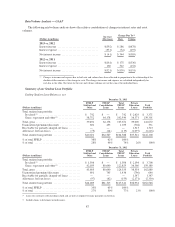

The decrease in the “Core Earnings” basis FFELP Loans net interest margin of 14 basis points for 2012

compared with 2011 was primarily the result of funding costs related to new unsecured and ABS debt issuances

over the period being higher than the funding costs of the debt that has matured or has been repurchased during

that same period. In addition, there were increased spread impacts from increases in the average balance of our

other interest-earning assets. These assets are primarily securitization trust restricted cash. Our other interest-

earning asset portfolio yields a negative net interest margin and as a result, when its relative weighting increases,

the overall net interest margin declines.

During the fourth-quarter 2011, the Administration announced the SDCL initiative. The SDCL initiative

provided an incentive to borrowers who have at least one student loan owned by ED and at least one held by a

FFELP lender to consolidate the FFELP lender’s loans into the Direct Loan Program by providing a

0.25 percentage point interest rate reduction on the FFELP Loans that are eligible for consolidation. The program

was available from January 17, 2012 through June 30, 2012. As a result of the SDCL initiative, borrowers

consolidated approximately $5.2 billion of our FFELP Loans to ED. The consolidation of these loans resulted in

the acceleration of $42 million of non-cash loan premium amortization and $8 million of non-cash debt discount

amortization during 2012. This combined $50 million acceleration of non-cash amortization related to this

activity reduced the FFELP Loans net interest margin by 4 basis points in 2012.

82