Sallie Mae 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

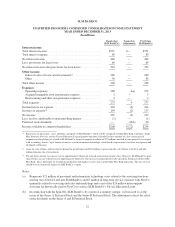

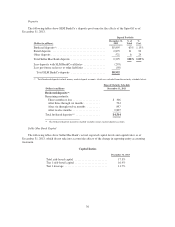

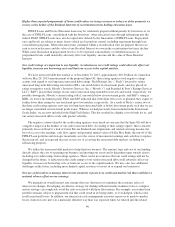

SLM BANKCO

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED INCOME STATEMENT

YEAR ENDED DECEMBER 31, 2013

(In millions)

Stand-alone

SLM BankCo(1)

Separation

Adjustments

Pro Forma

SLM BankCo

Interest income:

Total interest income ...................................... $551 $— $551

Total interest expense ..................................... 89 — 89

Net interest income ....................................... 462 — 462

Less: provisions for loan losses ............................. 69 — 69

Net interest income after provisions for loan losses .............. 393 — 393

Other income:

Gains on sales of loans and investments(2) ................... 260 — 260

Other ................................................ 38 — 38

Total other income ....................................... 298 — 298

Expenses:

Operating expenses ..................................... 268 4(a) 272

Acquired intangible asset amortization expense ............... 3 — 3

Restructuring and other reorganization expenses .............. 2 — 2

Total expenses ........................................... 273 4 277

Income before tax expense ................................. 418 (4) 414

Income tax expense(3) ..................................... 159 (2) 157

Net income ............................................. 259 (2) 257

Less: net loss attributable to noncontrolling interest ............. (1) — (1)

Preferred stock dividends .................................. — 20(b) 20

Income available to common shareholders ..................... $260 $ (22) $238

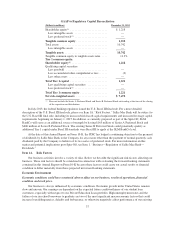

(1) Represents the operations, assets, liabilities and equity of SLM BankCo, which will be comprised of Sallie Mae Bank, Upromise, Sallie

Mae Insurance Services, and the Private Education Loan origination functions. Included in these amounts are also certain general

corporate overhead expenses related to SLM BankCo. General corporate overhead of $77 million consisted of costs primarily associated

with accounting, finance, legal, human resources, certain information technology, stock-based compensation, executive management and

the Board of Directors.

(2) Gains on sales of loans and investments during the period represent $196 million of gains from the sale of loans to NewCo and $64

million from the sale of investments.

(3) The pro forma income tax expense rate of approximately 38 percent is based on historical statutory rates. However, SLM BankCo’s post-

spin effective tax rate will increase to approximately 40 percent. The increase is primarily driven by operations being moved into Sallie

Mae Bank. These operations are located in jurisdictions with higher tax rates than current Sallie Mae Bank operations. The rate increase

should have an immaterial impact on SLM BankCo’s equity.

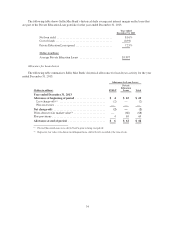

Notes:

(a) Represents $21 million of personnel and information technology costs related to the servicing functions

moving out of NewCo and into SLM BankCo and $7 million in long-term service contracts with NewCo

(primarily related to servicing and sales and marketing) and is net of the $24 million intercompany

servicing fee historically paid to NewCo to service SLM BankCo’s Private Education Loans.

(b) In connection with the Spin-Off, SLM BankCo, by reason of a statutory merger, will succeed us as the

issuer of the Series A Preferred Stock and the Series B Preferred Stock. The adjustment reflects the effect

of the dividends on the Series A and B Preferred Stock.

32