Sallie Mae 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

primarily focus on NewCo’s lack of future Private Student Loan originations and related servicing income, the

loss of access to the earnings, cash flow, equity and potential market value of Sallie Mae Bank, the run-off of the

FFELP Loan portfolio and strategic uncertainty as to the source of incremental earnings and cash flow to replace

that in run-off, and an expected increase in our cost of accessing the unsecured debt markets, including for

refinancing purposes.

We expect to fund our ongoing liquidity needs, including the origination of new Private Education Loans

and the repayment of $2.2 billion of senior unsecured notes that mature in the next twelve months, primarily

through our current cash and investment portfolio, the issuance of additional bank deposits and unsecured debt,

the predictable operating cash flows provided by earnings, the repayment of principal on unencumbered student

loan assets and the distributions from our securitization trusts (including servicing fees which are priority

payments within the trusts). We may also draw down on our secured FFELP facilities; we may also issue term

ABS.

Currently, new Private Education Loan originations are initially funded through deposits and subsequently

securitized to term. We have $2.3 billion of cash at Sallie Mae Bank as of December 31, 2013 available to fund

future originations. We no longer originate FFELP Loans and therefore no longer have liquidity requirements for

new FFELP Loan originations, but will continue to opportunistically purchase FFELP Loan portfolios from

others.

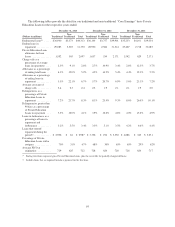

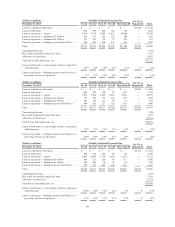

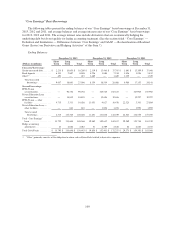

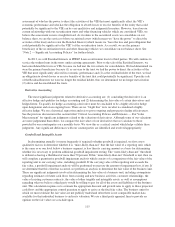

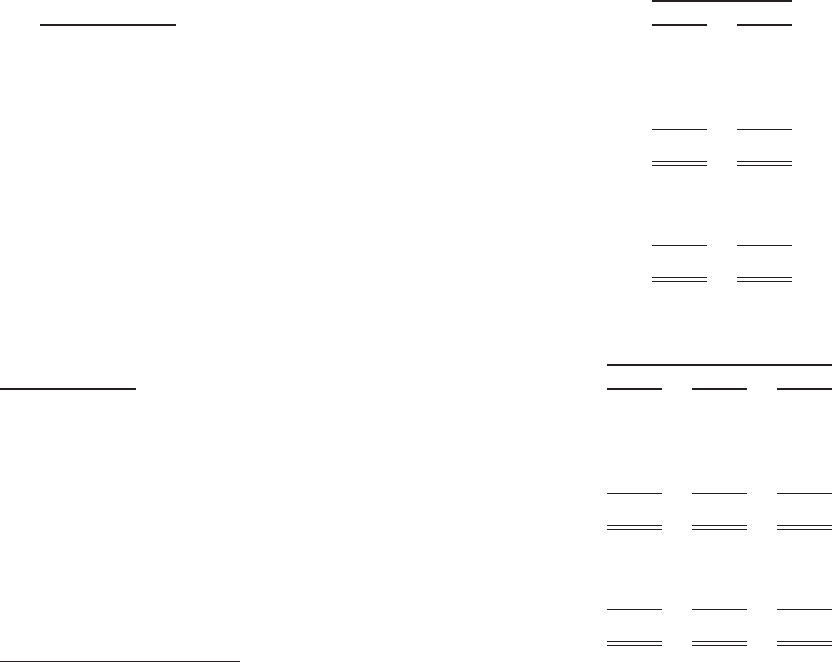

Sources of Liquidity and Available Capacity

Ending Balances

December 31,

(Dollars in millions) 2013 2012

Sources of primary liquidity:

Unrestricted cash and liquid investments:

Holding Company and other non-bank subsidiaries ............. $3,015 $2,376

Sallie Mae Bank(1) ....................................... 2,284 1,598

Total unrestricted cash and liquid investments ................... $5,299 $3,974

Unencumbered FFELP Loans:

Holding Company and other non-bank subsidiaries ............. $1,259 $ 612

Sallie Mae Bank ........................................ 1,425 1,044

Total unencumbered FFELP Loans ............................ $2,684 $1,656

Average Balances

Years Ended December 31,

(Dollars in millions) 2013 2012 2011

Sources of primary liquidity:

Unrestricted cash and liquid investments:

Holding Company and other non-bank subsidiaries ............ $2,475 $2,386 $2,474

Sallie Mae Bank(1) ...................................... 1,582 913 1,244

Total unrestricted cash and liquid investments .................. $4,057 $3,299 $3,718

Unencumbered FFELP Loans:

Holding Company and other non-bank subsidiaries ............ $ 837 $ 691 $1,201

Sallie Mae Bank ........................................ 1,141 527 198

Total unencumbered FFELP Loans ........................... $1,978 $1,218 $1,399

(1) This amount will be used primarily to originate or acquire student loans at Sallie Mae Bank. See discussion below on restrictions on

Sallie Mae Bank to pay dividends.

105