Sallie Mae 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

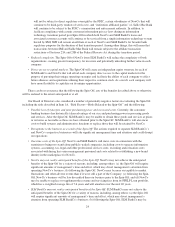

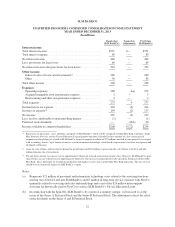

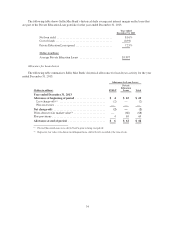

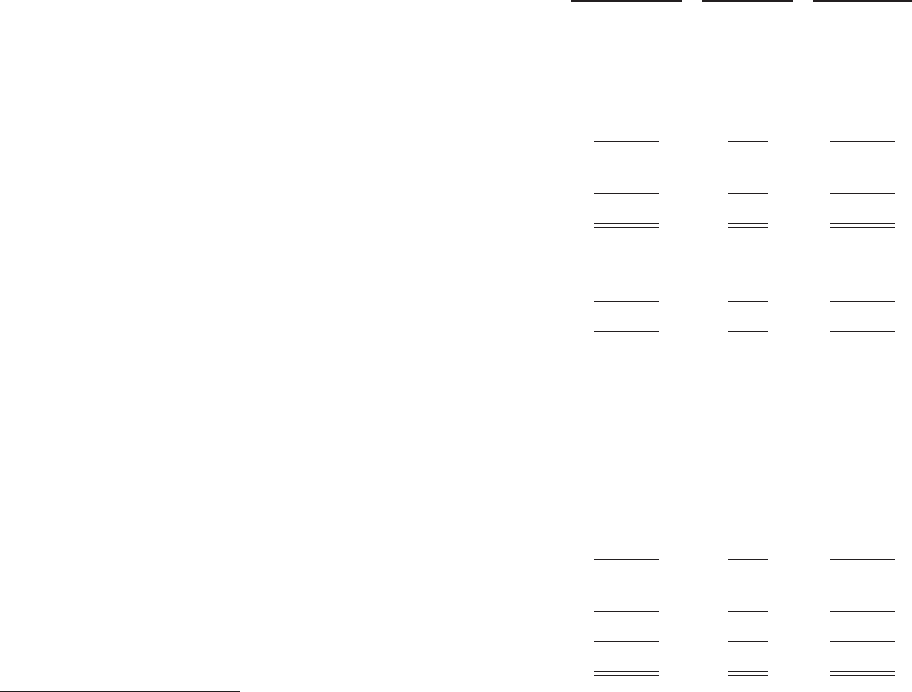

SLM BANKCO

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

AS OF DECEMBER 31, 2013

(In millions)

Stand-alone

SLM BankCo(1)

Separation

Adjustments

Pro Forma

SLM BankCo

Assets

Interest earning assets:

Cash and investments ................................... $ 2,286 $578(a) $ 2,864

Private Education Loans (net of allowance for losses of $62) .... 6,506 — 6,506

FFELP Loans (net of allowance for losses of $6) .............. 1,425 — 1,425

Other interest-earning assets .............................. 4 — 4

Total interest-earning assets .............................. 10,221 578 10,799

Other assets ............................................. 486 — 486

Total assets ............................................. $10,707 $578 $11,285

Liabilities and Equity

Deposits ................................................ $ 8,952 $— $ 8,952

Other liabilities .......................................... 588 — 588

Total liabilities .......................................... 9,540 — 9,540

Preferred stock, par value $.20 per share, 20 million shares

authorized

Series A: 3.3 million shares issued, respectively, at stated value of

$50 per share ........................................ — 165(a) 165

Series B: 4 million shares issued, respectively, at stated value of

$100 per share ....................................... — 400(a) 400

Common stock .......................................... — — —

Additional paid-in capital .................................. 690 13(a) 703

Accumulated other comprehensive loss ....................... (3) — (3)

Retained earnings ........................................ 475 — 475

Total stockholders’ equity .................................. 1,162 578 1,740

Non-controlling interest ................................... 5 — 5

Total equity ............................................ 1,167 578 1,745

Total liabilities and equity ................................ $10,707 $578 $11,285

(1) Represents the operations, assets, liabilities and equity of SLM BankCo, which will be comprised of Sallie Mae Bank, Upromise, Sallie

Mae Insurance Services, and the Private Education Loan origination functions. Included in these amounts are also certain general

corporate overhead payables related to SLM BankCo.

Notes:

(a) In connection with the Spin-Off, SLM BankCo, by reason of a statutory merger, will succeed us as the issuer

of the Series A Preferred Stock and the Series B Preferred Stock. SLM BankCo will retain an additional

$578 million of cash, $565 million of which will offset the obligation attributable to the principal of the Series

A Preferred Stock and the Series B Preferred Stock. The remainder of $13 million will be treated as

additional paid-in capital. The amount of additional cash retained beyond the amount related to offset the

preferred stock obligation was based upon meeting a targeted ending equity balance for SLM BankCo.

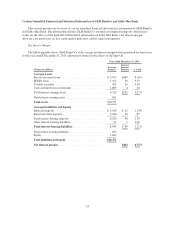

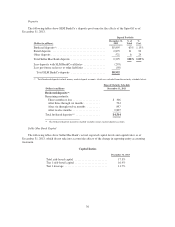

Below is the unaudited pro forma condensed consolidated income statement for SLM BankCo pro forma for

the effects of the Spin-Off for the year ended December 31, 2013. This assumes that the Spin-Off occurred on

January 1, 2013, for purposes of this presentation.

31