Sallie Mae 2013 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

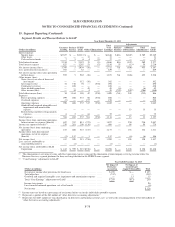

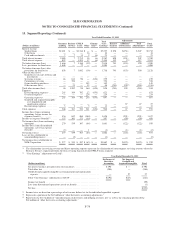

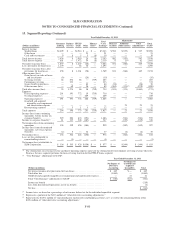

15. Segment Reporting (Continued)

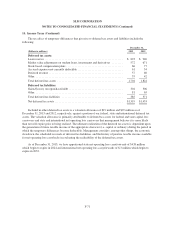

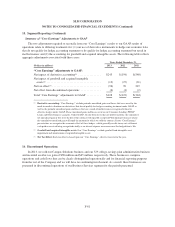

Summary of “Core Earnings” Adjustments to GAAP

The two adjustments required to reconcile from our “Core Earnings” results to our GAAP results of

operations relate to differing treatments for: (1) our use of derivative instruments to hedge our economic risks

that do not qualify for hedge accounting treatment or do qualify for hedge accounting treatment but result in

ineffectiveness and (2) the accounting for goodwill and acquired intangible assets. The following table reflects

aggregate adjustments associated with these areas.

Years Ended December 31,

(Dollars in millions) 2013 2012 2011

“Core Earnings” adjustments to GAAP:

Net impact of derivative accounting(1) ................ $243 $(194) $(540)

Net impact of goodwill and acquired intangible

assets(2) ...................................... (13) (27) (21)

Net tax effect(3) .................................. (96) 99 219

Net effect from discontinued operations .............. (6) (1) (2)

Total “Core Earnings” adjustments to GAAP .......... $128 $(123) $(344)

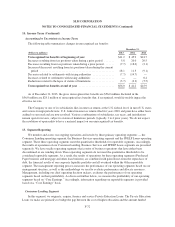

(1) Derivative accounting: “Core Earnings” exclude periodic unrealized gains and losses that are caused by the

mark-to-market valuations on derivatives that do not qualify for hedge accounting treatment under GAAP as

well as the periodic unrealized gains and losses that are a result of ineffectiveness recognized related to

effective hedges under GAAP. These unrealized gains and losses occur in our Consumer Lending, FFELP

Loans and Other business segments. Under GAAP, for our derivatives that are held to maturity, the cumulative

net unrealized gain or loss over the life of the contract will equal $0 except for Floor Income Contracts where

the cumulative unrealized gain will equal the amount for which we sold the contract. In our “Core Earnings”

presentation, we recognize the economic effect of these hedges, which generally results in any net settlement

cash paid or received being recognized ratably as an interest expense or revenue over the hedged item’s life.

(2) Goodwill and acquired intangible assets: Our “Core Earnings” exclude goodwill and intangible asset

impairment and amortization of acquired intangible assets.

(3) Net Tax Effect: Such tax effect is based upon our “Core Earnings” effective tax rate for the year.

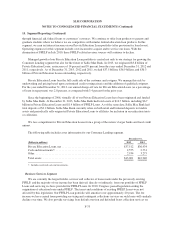

16. Discontinued Operations

In 2013, we sold our Campus Solutions business and our 529 college-savings plan administration business

and recorded an after-tax gain of $38 million and $65 million, respectively. These businesses comprise

operations and cash flows that can be clearly distinguished operationally and for financial reporting purposes

from the rest of the Company and we will have no continuing involvement. As a result, these businesses are

presented in discontinued operations of our Business Services segment for the periods presented.

F-81