Sallie Mae 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

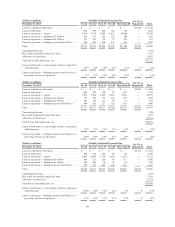

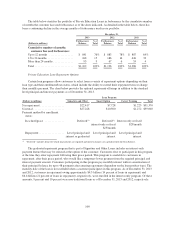

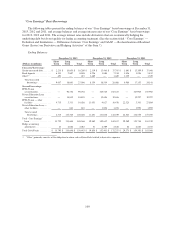

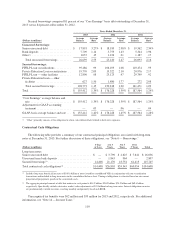

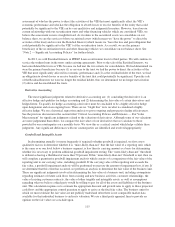

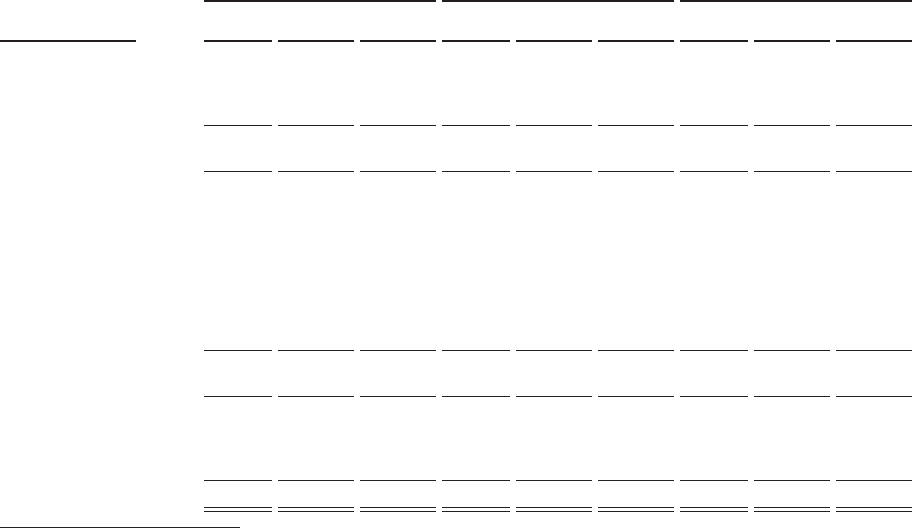

“Core Earnings” Basis Borrowings

The following tables present the ending balances of our “Core Earnings” basis borrowings at December 31,

2013, 2012 and 2011, and average balances and average interest rates of our “Core Earnings” basis borrowings

for 2013, 2012 and 2011. The average interest rates include derivatives that are economically hedging the

underlying debt but do not qualify for hedge accounting treatment. (See the section titled “‘Core Earnings’ —

Definition and Limitations — Differences between ‘Core Earnings’ and GAAP — Reclassification of Realized

Gains (Losses) on Derivative and Hedging Activities” of this Item 7).

Ending Balances

December 31, 2013 December 31, 2012 December 31, 2011

(Dollars in millions)

Short

Term

Long

Term Total

Short

Term

Long

Term Total

Short

Term

Long

Term Total

Unsecured borrowings:

Senior unsecured debt ....... $ 2,213 $ 16,056 $ 18,269 $ 2,319 $ 15,446 $ 17,765 $ 1,801 $ 15,199 $ 17,000

Bank deposits ............. 6,133 2,807 8,940 4,226 3,088 7,314 3,856 1,956 5,812

Other(1) .................. 691 — 691 1,609 — 1,609 1,329 — 1,329

Total unsecured

borrowings ........... 9,037 18,863 27,900 8,154 18,534 26,688 6,986 17,155 24,141

Secured borrowings:

FFELP Loan

securitizations ........... — 90,756 90,756 — 105,525 105,525 — 107,905 107,905

Private Education Loan

securitizations ........... — 18,835 18,835 — 19,656 19,656 — 19,297 19,297

FFELP Loan — other

facilities ............... 4,715 5,311 10,026 11,651 4,827 16,478 22,523 5,361 27,884

Private Education Loan —

other facilities ........... — 843 843 — 1,070 1,070 — 1,992 1,992

Total secured

borrowings ........... 4,715 115,745 120,460 11,651 131,078 142,729 22,523 134,555 157,078

Total “Core Earnings”

basis .................. 13,752 134,608 148,360 19,805 149,612 169,417 29,509 151,710 181,219

Hedge accounting

adjustments ............. 43 2,040 2,083 51 2,789 2,840 64 2,683 2,747

Total GAAP basis .......... $ 13,795 $ 136,648 $ 150,443 $ 19,856 $ 152,401 $ 172,257 $ 29,573 $ 154,393 $ 183,966

(1) “Other” primarily consists of the obligation to return cash collateral held related to derivative exposure.

109