Sallie Mae 2013 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

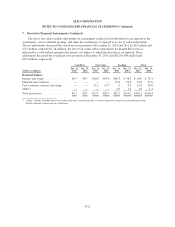

7. Derivative Financial Instruments (Continued)

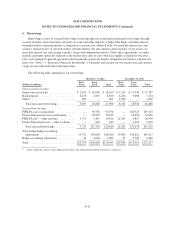

Summary of Derivative Financial Statement Impact

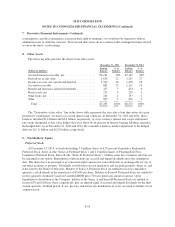

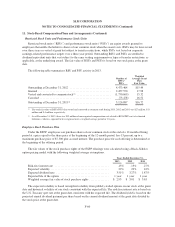

The following tables summarize the fair values and notional amounts or number of contracts of all

derivative instruments at December 31, 2013 and 2012, and their impact on other comprehensive income and

earnings for 2013, 2012 and 2011.

Impact of Derivatives on Consolidated Balance Sheet

Cash Flow Fair Value Trading Total

(Dollars in millions)

Hedged Risk

Exposure

Dec. 31,

2013

Dec. 31,

2012

Dec. 31,

2013

Dec. 31,

2012

Dec. 31,

2013

Dec. 31,

2012

Dec. 31,

2013

Dec. 31,

2012

Fair Values(1)

Derivative Assets:

Interest rate swaps .... Interest rate $24 $ — $ 738 $1,396 $ 61 $ 150 $ 823 $ 1,546

Cross-currency interest

rate swaps ........

Foreign currency and

interest rate — — 1,185 1,165 — 70 1,185 1,235

Other(2) ............. Interest rate — — — —2424

Total derivative

assets(3) ........... 24 — 1,923 2,561 63 224 2,010 2,785

Derivative Liabilities:

Interest rate swaps .... Interest rate — (11) (149) (1) (215) (197) (364) (209)

Floor Income

Contracts ......... Interest rate — — — — (1,384) (2,154) (1,384) (2,154)

Cross-currency interest

rate swaps ........

Foreign currency and

interestrate — — (155) (136) (31) — (186) (136)

Other(2) ............. Interest rate — — — — (23) — (23) —

Total derivative

liabilities(3) ........ — (11) (304) (137) (1,653) (2,351) (1,957) (2,499)

Net total derivatives . . $24 $(11) $1,619 $2,424 $(1,590) $(2,127) $ 53 $ 286

(1) Fair values reported are exclusive of collateral held and pledged and accrued interest. Assets and liabilities are presented without

consideration of master netting agreements. Derivatives are carried on the balance sheet based on net position by counterparty under

master netting agreements, and classified in other assets or other liabilities depending on whether in a net positive or negative position.

(2) “Other” includes embedded derivatives bifurcated from securitization debt as well as derivatives related to our Total Return Swap Facility

and back-to-back private credit floors.

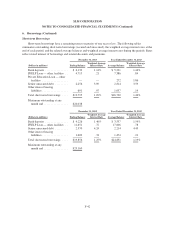

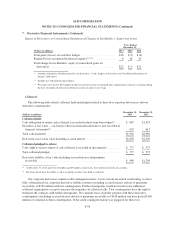

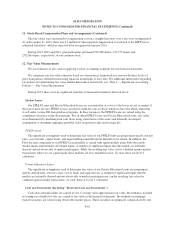

(3) The following table reconciles gross positions with the impact of master netting agreements to the balance sheet classification:

Other Assets Other Liabilities

(Dollar in millions)

December 31,

2013

December 31,

2012

December 31,

2013

December 31,

2012

Gross position .................................. $2,010 $ 2,785 $(1,957) $(2,499)

Impact of master netting agreements ................ (386) (544) 386 544

Derivative values with impact of master netting

agreements (as carried on balance sheet) ........... 1,624 2,241 (1,571) (1,955)

Cash collateral (held) pledged ..................... (687) (1,423) 777 973

Net position .................................... $ 937 $ 818 $ (794) $ (982)

F-51