Sallie Mae 2013 Annual Report Download - page 32

Download and view the complete annual report

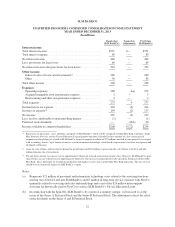

Please find page 32 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 31, 2013 is adjusted pro forma for the effects of the Spin-Off as if it had been completed at

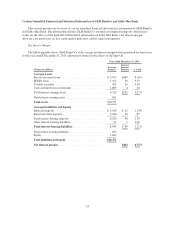

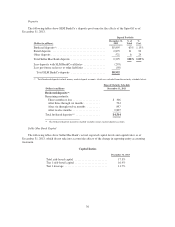

December 31, 2013. The unaudited condensed consolidated income statement of SLM BankCo for the year

ended December 31, 2013 is adjusted pro forma for the effects of the Spin-Off as if it had been completed on

January 1, 2013. The stand-alone SLM BankCo financial information has further been adjusted pro forma for the

effects of the Spin-Off by reflecting that the Spin-Off will be accounted for as a distribution by means of a tax-

free distribution of the shares of common stock of NewCo, on a 1-to-1 basis, to the holders of shares of our

common stock that will implement the actual separation of the education loan management business from SLM

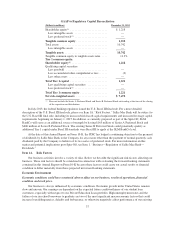

BankCo. The Spin-Off will also account for the transfer of certain assets and liabilities that were historically

operated by NewCo and that will be held by SLM BankCo, SLM BankCo’s anticipated post-separation capital

structure and the impact of, and transactions contemplated by, certain agreements entered into by SLM BankCo

in connection with the Spin-Off.

The unaudited condensed consolidated financial statements of SLM BankCo adjusted pro forma for the

effects of the Spin-Off do not give effect to future estimated annual cost increases after the Spin-Off, attributable

to various factors such as the following:

• personnel required to operate as a stand-alone public company;

• possible changes in compensation with respect to new and existing positions;

• the level of assistance required from professional service providers; and

• the amount of capital expenditures for information technology infrastructure investments associated with

being a stand-alone public company.

In addition, prior to the Spin-Off, Sallie Mae Bank sold loans to affiliates for two reasons: (1) to fund the

loans to term through the issuance of an asset back securitization; and (2) to enable the affiliates to manage loans

that were granted forbearance or were 90 days or more past due. As a result of these past practices, Sallie Mae

Bank’s historical credit results do not reflect charge-offs or recoveries. The following results, pro forma for the

effects of the Spin-Off, have not been adjusted to reflect what the delinquencies, charge-offs and recoveries

would have been, had Sallie Mae Bank not sold these loans to its affiliates. After the Spin-Off, Sallie Mae Bank’s

results will reflect delinquencies and related charge-offs/recoveries as it is contemplated that it will retain loans

throughout the life of the account and will charge off loans at 120 days past due.

The unaudited condensed consolidated financial statements of SLM BankCo adjusted pro forma for the

effects of the Spin-Off have been prepared in accordance with GAAP and related carve-out conventions.

The pro forma adjustments are based on preliminary estimates, accounting judgments and currently

available information and assumptions that our management believes are reasonable. The unaudited financial

information of SLM BankCo adjusted pro forma for the effects of the Spin-Off has been prepared for illustrative

purposes only and is not necessarily indicative of the financial position (had the Spin-Off actually occurred on

December 31, 2013, for purposes of the pro forma balance sheet) or results of operations (had the Spin-Off

actually occurred on January 1, 2013, for purposes of the pro forma income statement), nor is such unaudited pro

forma financial information necessarily indicative of the results to be expected for any future period. A number

of factors may affect the results. See the section titled “Risks Related to the Spin-Off” in Item 1A. “Risk Factors”

for a discussion of the risks and uncertainties related to the Spin-Off.

For additional information on the preparation of the unaudited pro forma condensed consolidated financial

statements of NewCo and the structure and accounting of the Spin-Off, please review the registration statement on

Form 10 of New Corporation, which was initially filed with the SEC on December 6, 2013 and subsequently

amended on February 7, 2014, which can be accessed through the SEC’s website at www.sec.gov/edgar.

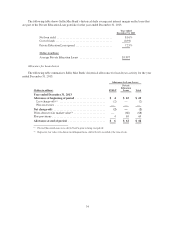

Below is the unaudited condensed consolidated balance sheet for SLM BankCo pro forma for the effects of

the Spin-Off as of December 31, 2013, assuming such Spin-Off occurred on December 31, 2013.

30