Sallie Mae 2013 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

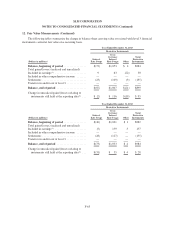

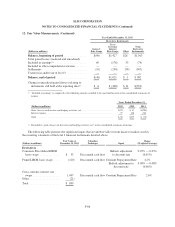

12. Fair Value Measurements (Continued)

The significant inputs that are unobservable or from inactive markets related to our level 3 derivatives

detailed in the table above would be expected to have the following impacts to the valuations:

• Consumer Price Index/LIBOR basis swaps — These swaps do not actively trade in the markets as

indicated by a wide bid/ask spread. A wider bid/ask spread will result in a decrease in the overall

valuation.

• Prime/LIBOR basis swaps — These swaps do not actively trade in the markets as indicated by a wide

bid/ask spread. A wider bid/ask spread will result in a decrease in the overall valuation. In addition, the

unobservable inputs include Constant Prepayment Rates of the underlying securitization trust the swap

references. A decrease in this input will result in a longer weighted average life of the swap which will

increase the value for swaps in a gain position and decrease the value for swaps in a loss position,

everything else equal. The opposite is true for an increase in the input.

• Cross-currency interest rate swaps — The unobservable inputs used in these valuations are Constant

Prepayment Rates of the underlying securitization trust the swap references. A decrease in this input

will result in a longer weighted average life of the swap. All else equal in a typical currency market,

this will result in a decrease to the valuation due to the delay in the cash flows of the currency

exchanges as well as diminished liquidity in the forward exchange markets as you increase the term.

The opposite is true for an increase in the input.

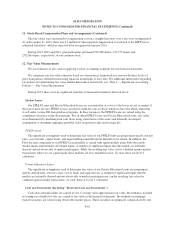

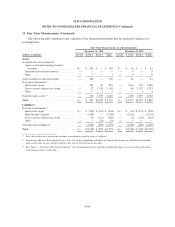

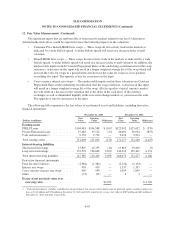

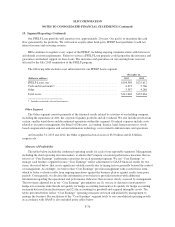

The following table summarizes the fair values of our financial assets and liabilities, including derivative

financial instruments.

December 31, 2013 December 31, 2012

(Dollars in millions)

Fair

Value

Carrying

Value Difference

Fair

Value

Carrying

Value Difference

Earning assets

FFELP Loans ....................... $104,481 $104,588 $ (107) $125,042 $125,612 $ (570)

Private Education Loans ............... 37,485 37,512 (27) 36,081 36,934 (853)

Cash and investments(1) ................ 9,732 9,732 — 9,994 9,994 —

Total earning assets ................... 151,698 151,832 (134) 171,117 172,540 (1,423)

Interest-bearing liabilities

Short-term borrowings ................ 13,807 13,795 (12) 19,861 19,856 (5)

Long-term borrowings ................ 133,578 136,648 3,070 146,210 152,401 6,191

Total interest-bearing liabilities ......... 147,385 150,443 3,058 166,071 172,257 6,186

Derivative financial instruments

Floor Income Contracts ............... (1,384) (1,384) — (2,154) (2,154) —

Interest rate swaps .................... 459 459 — 1,337 1,337 —

Cross-currency interest rate swaps ....... 999 999 — 1,099 1,099 —

Other .............................. (21) (21) — 4 4 —

Excess of net asset fair value over

carrying value .................... $2,924 $ 4,763

(1) “Cash and investments” includes available-for-sale investments that consist of investments that are primarily agency securities whose cost

basis is $113 million and $78 million at December 31, 2013 and 2012, respectively, versus a fair value of $109 million and $81 million at

December 31, 2013 and 2012, respectively.

F-67