Sallie Mae 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

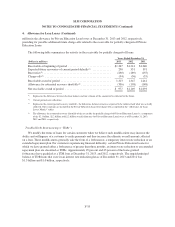

5. Goodwill and Acquired Intangible Assets (Continued)

Goodwill Impairment Testing

We perform our goodwill impairment testing annually in the fourth quarter as of October 1. No goodwill

was deemed impaired in 2013. As part of the 2013 annual impairment testing, we retained a third-party appraisal

firm to assist in the valuations required to perform Step 1 impairment testing. The income approach was the

primary approach used to estimate the fair value of each reporting unit.

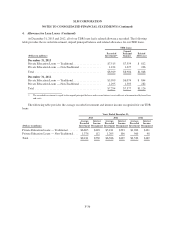

The income approach measures the value of each reporting unit’s future economic benefit determined by its

discounted cash flows derived from our projections plus an assumed terminal growth rate adjusted for what we

believe a market participant would assume in an acquisition. These projections are generally five-year

projections that reflect the anticipated cash flow fluctuations of the respective reporting units. If a component of a

reporting unit is winding down or is assumed to wind down, the projections extend through the anticipated wind-

down period and no residual value is ascribed.

Under our guidance, the third-party appraisal firm developed the discount rate for each reporting unit

incorporating such factors as the risk free rate, a market rate of return, a measure of volatility (Beta) and a

company-specific and capital markets risk premium, as appropriate, to adjust for volatility and uncertainty in the

economy and to capture specific risk related to the respective reporting units. We considered whether an asset

sale or an equity sale would be the most likely sale structure for each reporting unit and valued each reporting

unit based on the more likely hypothetical scenario.

The discount rates reflect market-based estimates of capital costs and are adjusted for our assessment of a

market participant’s view with respect to execution, source concentration and other risks associated with the

projected cash flows of individual reporting units. We reviewed and approved the discount rates provided by the

third-party appraiser including the factors incorporated to develop the discount rates for each reporting unit.

We and the third-party appraisal firm also considered a market approach for each reporting unit. Market-

based multiples for comparable publicly traded companies and similar transactions were evaluated as an indicator

of the value of the reporting units to assess the reasonableness of the estimated fair value derived from the

income approach.

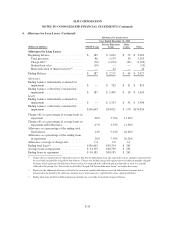

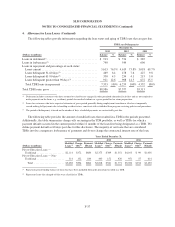

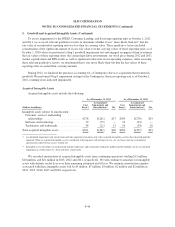

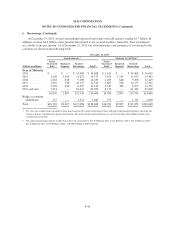

The following table illustrates the carrying value of equity for each reporting unit with remaining goodwill

as of December 31, 2013, and the percentage by which the estimated fair value determined in conjunction with

Step 1 impairment testing in the fourth quarter of 2013 exceeds the carrying value of equity.

(Dollars in millions)

Carrying Value

of Equity

% of Fair Value

in Excess of

Carrying Value

FFELP Loans ............................................ $ 930 202%

Consumer Lending ........................................ 4,335 80%

Servicing ............................................... 137 966%

Contingency Services ..................................... 53 193%

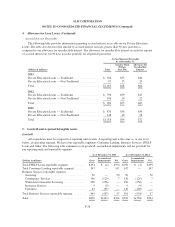

We acknowledge that continued weakness in the economy coupled with changes in legislation and the

regulatory environment could adversely affect the operating results of our reporting units. If the forecasted

performance of our reporting units is not achieved, or if our stock price declines resulting in deterioration in our

total market capitalization, the fair value of one or more of the reporting units could be significantly reduced, and

we may be required to record a charge, which could be material, for an impairment of goodwill.

F-39