Sallie Mae 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Loan Sales and Securitizations

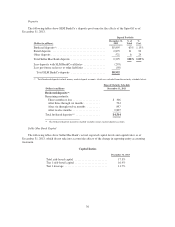

Prior to the Spin-Off, we have operated our Private Education Loan business as an integrated set of

activities and used various subsidiaries to perform the functions necessary to underwrite, originate, fund in the

short-term, fund long-term, service and collect Private Education Loans. These Private Education Loans are

originated by Sallie Mae Bank and initially funded with its deposits. During the year-ended December 31, 2013

and December 31, 2012, Sallie Mae Bank sold loans to our affiliates in the amount of $2.4 billion and $2.6

billion, respectively. During the same periods, Sallie Mae Bank originated $3.8 billion and $3.3 billion of Private

Education Loans.

After the Spin-Off, SLM BankCo may continue to sell Private Education Loans to third parties through an

open auction process as well as through securitization transactions. It may retain servicing of these transferred

Private Education Loans at prevailing market rates for such services. As such, it may incur gains and losses on

sales in future periods. Loan sales and securitization volumes will be determined to prudently manage SLM

BankCo’s asset values, growth rates, and capital and liquidity needs. NewCo may participate in open auction

processes on arm’s length terms. While there may be limited, near-term Private Education Loans sales to NewCo

to facilitate an orderly transition after the Spin-Off, neither SLM BankCo nor NewCo will have any ongoing

obligation to buy or sell Private Education Loans to the other. Following the Spin-Off, it is currently anticipated

that Private Education Loans that are originated by SLM BankCo for individual borrowers who also have Private

Education Loans which are owned by NewCo, will be sold by SLM BankCo to NewCo from time to time.

Competitive Strengths

SLM BankCo will have the following competitive strengths:

Industry Leader with the Most Recognized Brand in Education Loan Industry. SLM BankCo will continue

operating our Private Education Loan origination business under the brand “Sallie Mae.” Once the Spin-Off is

complete, SLM BankCo operations will contain all the capabilities, resources and personnel responsible for

generating our current Private Education Loan originations.

Simple Low-Cost Delivery System. SLM BankCo will leverage an experienced regional-based sales force

and a well-established loan origination network that operates through financial aid offices, direct marketing and

the internet without the need for a physical distribution infrastructure. It will also benefit from the ability of

Sallie Mae Bank to gather deposits and to service accounts online without need of a branch network.

Disciplined Credit Approach. SLM BankCo will continue a disciplined approach to credit. It will use a

proprietary scorecard and deploy experienced credit analysts for selective review. Since the introduction of the

Smart Option loan in 2009, approximately 92 percent of our Smart Option loans have cosigners. As of

December 31, 2013, the average FICO score at origination for our Smart Option loans was 746. To reinforce

responsible borrowing, SLM BankCo will continue to disburse loan proceeds directly to schools, encourage

customers to make payments while in school, and send statements to borrowers and cosigners during

matriculation.

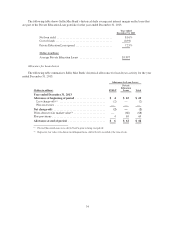

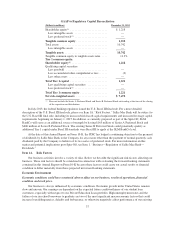

Strong Capital Position and Experienced Funding Capabilities. Sallie Mae Bank is well-capitalized. As of

December 31, 2013, it had a Tier 1 risk-based capital ratio of 16.4 percent.

In addition, on a pro forma basis as of December 31, 2013 and as currently proposed as part of the Spin-Off,

SLM BankCo will serve as an additional source of strength by having $165 million of Series A Preferred Stock and

$400 million of Series B Preferred Stock. The existing Series B Preferred Stock could potentially qualify as

Additional Tier 1 capital under Basel III standards were Basel III to apply at the SLM BankCo level.

SLM BankCo will also retain experienced capital markets professionals currently responsible for

securitizing our current Private Education Loans in the asset-backed market.

28