Sallie Mae 2013 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

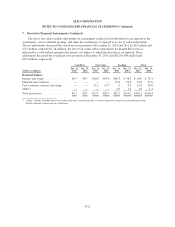

6. Borrowings (Continued)

Long-term Borrowings

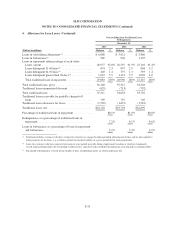

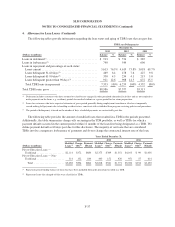

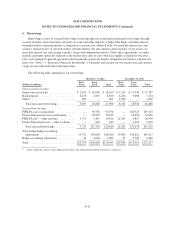

The following tables summarize outstanding long-term borrowings (secured and unsecured), the weighted

average interest rates at the end of the periods, and the related average balances during the periods. Rates reflect

stated interest rate of borrowings and related discounts and premiums.

December 31, 2013 Year Ended

December 31,

2013

Weighted

Average

(Dollars in millions)

Ending

Balance(1)

Interest

Rate(2)

Average

Balance

Floating rate notes:

U.S. dollar-denominated:

Interest bearing, due 2015-2048 ................................ $ 96,724 .99% $102,241

Non-U.S. dollar-denominated:

Interest bearing, due 2021-2041 ................................ 9,249 .62 9,525

Total floating rate notes ........................................... 105,973 .96 111,766

Fixed rate notes:

U.S. dollar-denominated:

Interest bearing, due 2015-2047 ................................ 18,510 5.61 16,149

Non-U.S.-dollar denominated:

Interest bearing, due 2015-2039 ................................ 3,204 2.72 2,420

Total fixed rate notes ............................................. 21,714 5.18 18,569

Brokered deposits — U.S. dollar-denominated, due 2015-2018 ............ 2,807 1.32 2,488

FFELP Loan — other facilities ..................................... 5,311 .76 5,504

Private Education Loan — other facilities ............................. 843 .96 355

Total long-term borrowings ........................................ $136,648 1.63% $138,682

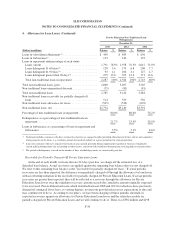

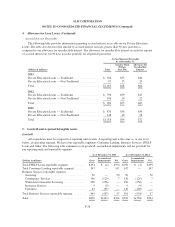

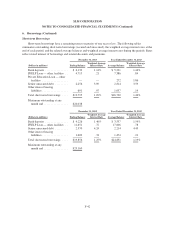

December 31, 2012 Year Ended

December 31,

2012

Weighted

Average

(Dollars in millions)

Ending

Balance(1)

Interest

Rate(2)

Average

Balance

Floating rate notes:

U.S. dollar-denominated:

Interest bearing, due 2014-2048 ................................ $112,408 1.04% $113,236

Non-U.S. dollar-denominated:

Interest bearing, due 2021-2041 ................................ 10,819 .53 11,463

Total floating rate notes ........................................... 123,227 1.00 124,699

Fixed rate notes:

U.S. dollar-denominated:

Interest bearing, due 2014-2046 ................................ 16,096 5.57 14,203

Non-U.S.-dollar denominated:

Interest bearing, due 2014-2039 ................................ 4,061 3.39 2,882

Total fixed rate notes ............................................. 20,157 5.13 17,085

Brokered deposits — U.S. dollar-denominated, due 2014-2017 ............ 3,120 1.77 2,216

FFELP Loan — other facilities ..................................... 4,827 1.29 5,517

Private Education Loan — other facilities ............................. 1,070 1.45 1,880

Total long-term borrowings ........................................ $152,401 1.57% $151,397

(1) Ending balance is expressed in U.S. dollars using the spot currency exchange rate. Includes fair value adjustments under hedge

accounting for notes designated as the hedged item in a fair value hedge.

(2) Weighted average interest rate is stated rate relative to currency denomination of debt.

F-43