Sallie Mae 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

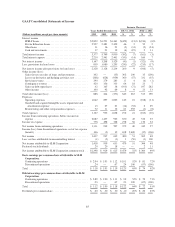

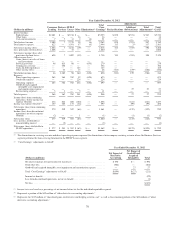

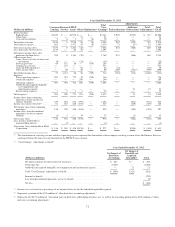

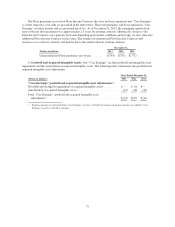

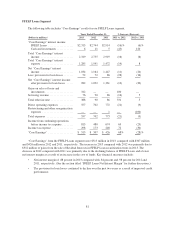

Year Ended December 31, 2011

(Dollars in millions)

Consumer

Lending

Business

Services

FFELP

Loans Other Eliminations(1)

Total

“Core

Earnings”

Adjustments

Total

GAAPReclassifications

Additions/

(Subtractions)

Total

Adjustments(2)

Interest income:

Student loans .................. $2,429 $ — $2,914 $ — $ — $5,343 $ 902 $(355) $ 547 $5,890

Other loans ................... — — — 21 — 21 — — — 21

Cash and investments ........... 9 8 5 5 (8) 19 — — — 19

Total interest income ............. 2,438 8 2,919 26 (8) 5,383 902 (355) 547 5,930

Total interest expense ............. 801 — 1,472 54 (8) 2,319 71 11(4) 82 2,401

Net interest income (loss) .......... 1,637 8 1,447 (28) — 3,064 831 (366) 465 3,529

Less: provisions for loan losses ..... 1,179 — 86 30 — 1,295 — — — 1,295

Net interest income (loss) after

provisions for loan losses ........ 458 8 1,361 (58) — 1,769 831 (366) 465 2,234

Other income (loss):

Gains (losses) on sales of loans and

investments ................. (9) — — (26) — (35) — — — (35)

Servicing revenue .............. 64 872 86 — (739) 283 — — — 283

Contingency revenue ........... — 333 — — — 333 — — — 333

Gains on debt repurchases ....... — — — 64 — 64 (26) — (26) 38

Other income (loss) ............ — 69 — 20 — 89 (805) (174)(5) (979) (890)

Total other income (loss) .......... 55 1,274 86 58 (739) 734 (831) (174) (1,005) (271)

Expenses:

Direct operating expenses ........ 291 393 772 19 (739) 736 — — — 736

Overhead expenses ............. — — — 269 — 269 — — — 269

Operating expenses ............. 291 393 772 288 (739) 1,005 — — — 1,005

Goodwill and acquired intangible

asset impairment and

amortization expense ......... — — — — — — — 21 21 21

Restructuring expenses .......... 3 5 1 3 — 12 — — — 12

Total expenses .................. 294 398 773 291 (739) 1,017 — 21 21 1,038

Income (loss) from continuing

operations, before income tax

expense (benefit) ............... 219 884 674 (291) — 1,486 — (561) (561) 925

Income tax expense (benefit)(3) ...... 81 325 248 (107) — 547 — (219) (219) 328

Net income (loss) from continuing

operations .................... 138 559 426 (184) — 939 — (342) (342) 597

Income (loss) from discontinued

operations, net of tax expense

(benefit) ..................... (2) 5 — 34 — 37 — (2) (2) 35

Net income (loss) ................ 136 564 426 (150) — 976 — (344) (344) 632

Less: net loss attributable to

noncontrolling interest .......... — (1) — — — (1) — — — (1)

Net income (loss) attributable to SLM

Corporation ................... $ 136 $ 565 $ 426 $(150) $ — $ 977 $ — $(344) $ (344) $ 633

(1) The eliminations in servicing revenue and direct operating expense represent the elimination of intercompany servicing revenue where the Business Services

segment performs the loan servicing function for the FFELP Loans segment.

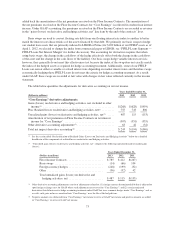

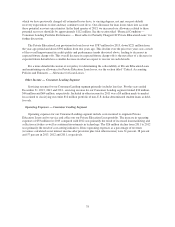

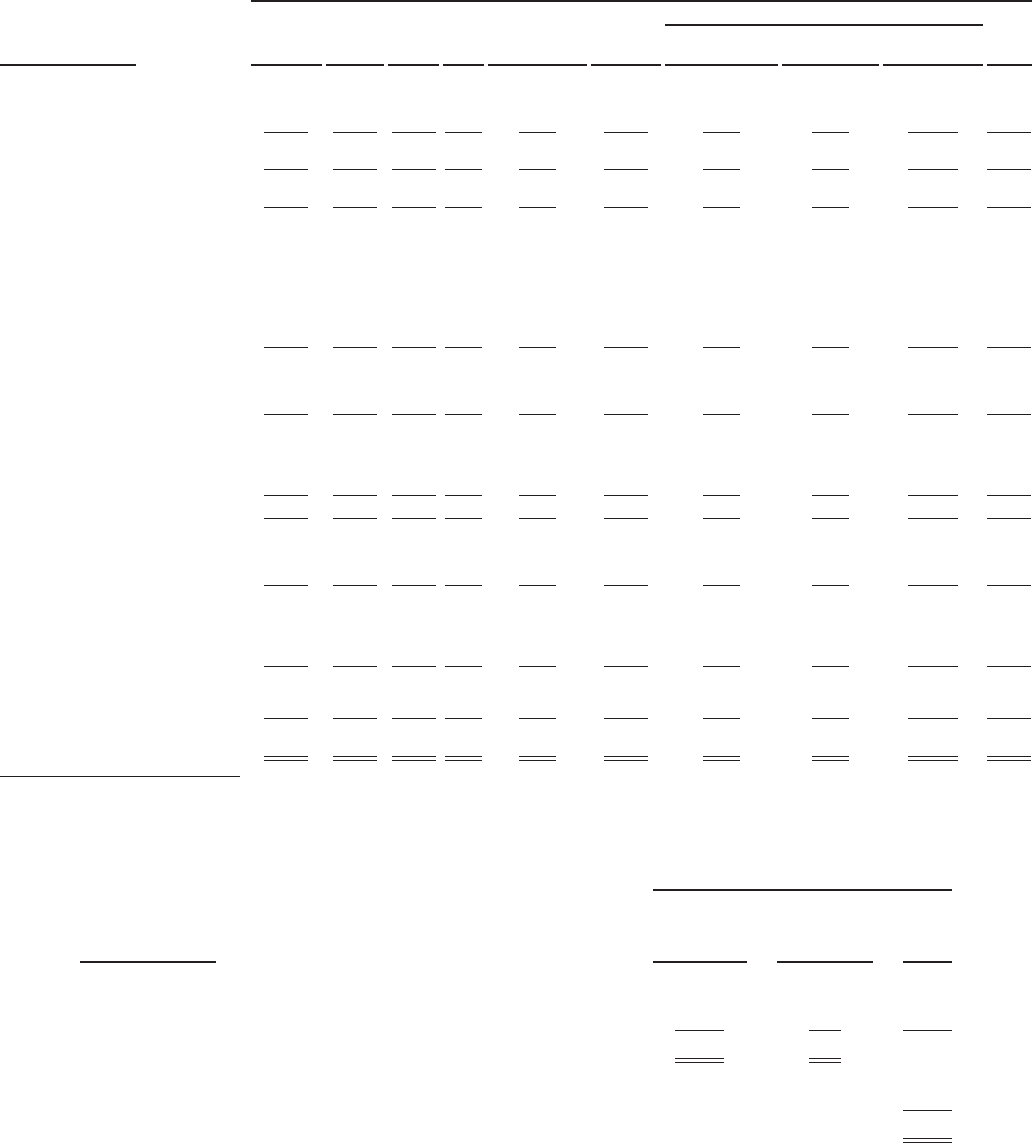

(2) “Core Earnings” adjustments to GAAP:

Year Ended December 31, 2011

(Dollars in millions)

Net Impact of

Derivative

Accounting

Net Impact of

Goodwill and

Acquired

Intangibles Total

Net interest income after provisions for loan losses ........................... $ 465 $— $ 465

Total other loss ....................................................... (1,005) — (1,005)

Goodwill and acquired intangible asset impairment and amortization expense ...... — 21 21

Total “Core Earnings” adjustments to GAAP ............................... $ (540) $ (21) (561)

Income tax benefit .................................................... (219)

Loss from discontinued operations, net of tax benefit ......................... (2)

Net loss ............................................................. $ (344)

(3) Income taxes are based on a percentage of net income before tax for the individual reportable segment.

(4) Represents a portion of the $(32) million of “other derivative accounting adjustments.”

(5) Represents the $(153) million of “unrealized gains on derivative and hedging activities, net” as well as the remaining portion of the $(32) million of “other

derivative accounting adjustments.”

71