Sallie Mae 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Attractive Customer Base. SLM BankCo’s customer base will be dominated by college students, graduate

students and credit qualified cosigners. SLM BankCo’s customer base also includes more than 12 million

Upromise members who enroll in the college saving service. Customers who are our current customers or will

become customers of SLM BankCo through the Sallie Mae and Upromise brands following the Spin-Off may

also use SLM BankCo’s other products. Approximately 49 percent of Sallie Mae Bank’s depositors have another

product with us.

Experienced Management Team. SLM BankCo’s management team is experienced industry professionals

with extensive expertise in managing rigorous underwriting, marketing, servicing, collection and financing

platforms. Most have at least 25 years of experience in the financial services and consumer banking industries.

The SLM BankCo leadership team have been key players in the development and execution of our Private

Education Loan and consumer banking strategy, including the design of the Smart Option product.

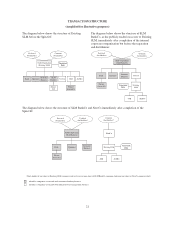

SLM BankCo’s Post-Separation Relationship with NewCo

SLM BankCo will enter into a separation and distribution agreement with the Company and NewCo (the

“Separation and Distribution Agreement”). In connection with the closing of the Spin-Off, SLM BankCo will

enter into various other agreements with NewCo to effect the Spin-Off and provide a framework for its

relationship with NewCo after the Spin-Off, such as a transition services agreement, a tax sharing agreement, an

employee matters agreement, a loan servicing and administration agreement, a joint marketing agreement, a key

services agreement, a data sharing agreement and a master sublease agreement. For additional information

regarding the Separation and Distribution Agreement and the other transaction agreements, see the registration

statement on Form 10 filed by New Corporation, which was initially filed with the SEC on December 6, 2013

and subsequently amended on February 7, 2014, which can be accessed through the SEC’s website at

www.sec.gov/edgar.

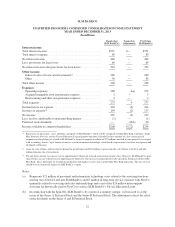

SLM BankCo Pro Forma Financial Information (Unaudited)

Shortly after the completion of the Spin-Off, SLM BankCo will be required to issue audited consolidated

financial statements on a stand-alone basis for SLM BankCo and its subsidiaries for each of the three years ended

December 31, 2013. These carve-out financial statements will be presented on a basis of accounting that reflects

a change in reporting entity. Our historical financial statements prior to the Spin-Off will become the historical

financial statements of NewCo. As a result, the presentation of the financial results of the business and operations

of SLM BankCo, which will be the publicly-traded successor registrant to the Company, for periods arising after

the completion of the Spin-Off will be substantially different from the presentation of our financial results in this

Annual Report on Form 10-K and in our prior filings with the SEC. To provide additional information to our

investors regarding the anticipated impact of the Spin-Off, we have included certain unaudited pro forma

financial information of SLM BankCo, on a carve-out stand-alone basis as of and for the year ended

December 31, 2013, to provide some reference for SLM BankCo’s expected reissued historical financial

statements post Spin-Off and future manner of presentation of its financial condition and results of operations.

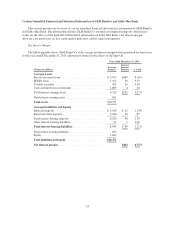

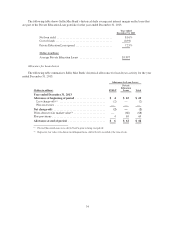

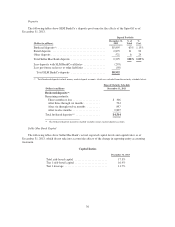

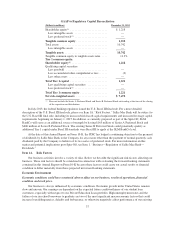

The following unaudited condensed consolidated financial information of SLM BankCo as of and for the

year ended December 31, 2013, which has been adjusted pro forma for the effects of the Spin-Off as currently

proposed, is presented for informational purposes only. These carve-out pro forma financial statements and

selected financial information are unaudited and represent only those operations, assets, liabilities and equity that

will form SLM BankCo on a stand-alone basis. These carve-out pro forma financial statements do not take into

account certain yet to be determined separation adjustments.

The stand-alone SLM BankCo unaudited financial information is comprised of financial information

relating to Sallie Mae Bank, Upromise, Sallie Mae Insurance Services, and the Private Education Loan

origination functions. Also included are certain general corporate overhead expenses allocated to SLM BankCo.

The stand-alone SLM BankCo unaudited financial information has then been adjusted to give effect to the

Spin-Off of NewCo by way of a share distribution. The unaudited balance sheet of SLM BankCo as of

29