Sallie Mae 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Spin-Off

If we determine to proceed with the Spin-Off, there will first be an internal corporate reorganization

followed by a distribution of the shares of common stock of NewCo, on a 1-to-1 basis, to the holders of shares of

our common stock that will implement the actual separation of the education loan management business. Before

the Spin-Off can be effected, our Board of Directors will need to approve the record date and distribution date for

the distribution of all of the issued and outstanding shares of NewCo.

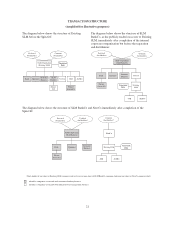

Internal Corporate Reorganization

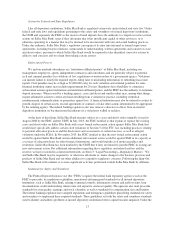

The following diagrams show the progression of the Company, which is referred to below as “Existing

SLM,” through the internal corporate reorganization and the structure of SLM BankCo and NewCo after the

Spin-Off, simplified for illustrative purposes. As used in the three diagrams below:

• “Existing SLM” refers to SLM Corporation as of the date of this Annual Report on Form 10-K. As part of

the internal corporate reorganization, Existing SLM will become a limited liability company and

ultimately be contributed to, and become a wholly owned subsidiary of, NewCo.

• “SLM BankCo” refers to New BLC Corporation, a newly formed Delaware corporation that (a) is

currently a subsidiary of Existing SLM and (b) after the internal corporate reorganization, will replace

Existing SLM as the publicly-traded parent company pursuant to the SLM Merger (as defined herein) and

change its name to “SLM Corporation.” SLM BankCo will own and operate the consumer banking

business and will be the company that distributes all of the issued and outstanding shares of NewCo

common stock in the Spin-Off.

• “NewCo” refers to New Corporation, a newly formed Delaware corporation that (a) is currently a

subsidiary of Existing SLM, (b) as part of the internal corporate reorganization will be transferred by

Existing SLM to, and become a subsidiary of, SLM BankCo and (c) will be distributed to the Existing

SLM stockholders pursuant to the Spin-Off. NewCo was formed to own and operate Existing SLM’s

education loan management business.

• “Bank” refers to Sallie Mae Bank, a Utah industrial bank that (a) is currently a subsidiary of Existing

SLM and (b) as part of the internal corporate reorganization, will be transferred by Existing SLM to, and

become a subsidiary of, SLM BankCo.

• “Upromise” refers to Upromise, Inc., a Delaware corporation that operates the Upromise Rewards

program that (a) is currently a subsidiary of Existing SLM and (b) as part of the internal corporate

reorganization will be transferred by Existing SLM to, and become a subsidiary of, SLM BankCo.

• “Insurance Business” refers to the Existing SLM insurance services business which offers tuition

insurance, renters insurance and student health insurance to college students and higher education

institutions. The Insurance Business (a) is currently operated through one or more subsidiaries of Existing

SLM and (b) as part of the internal corporate reorganization will be transferred by Existing SLM to, and

be operated through one or more subsidiaries of, SLM BankCo.

• “SMI” refers to Sallie Mae, Inc., a Delaware corporation that is currently a subsidiary of Existing SLM

and is responsible for most of its servicing and collection businesses. In connection with the internal

corporate reorganization, SMI will contribute some of the assets and liabilities of its private education

loan servicing business to a new subsidiary, referred to herein as Private ServiceCo. After the internal

corporate reorganization, SMI will remain a subsidiary of Existing SLM and be an indirect subsidiary of

NewCo.

• “Private ServiceCo” refers to SMB Servicing Company, Inc., a Delaware corporation formed to hold the

private education loan services assets to be transferred to it by SMI. Private ServiceCo is currently a

subsidiary of SMI and as part of the internal corporate reorganization will be transferred to, and become a

subsidiary of, SLM BankCo.

• “SLMIC” refers to Sallie Mae Investment Corporation, a Rhode Island corporation that owns the Residual

Interests of the FFELP Loans and Private Education Loans that have been funded through securitization

19