Sallie Mae 2013 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

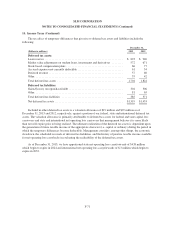

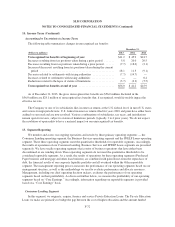

15. Segment Reporting (Continued)

Our FFELP Loan portfolio will amortize over approximately 20 years. Our goal is to maximize the cash

flow generated by the portfolio. We will seek to acquire other third-party FFELP Loan portfolios to add net

interest income and servicing revenue.

HEA continues to regulate every aspect of the FFELP, including ongoing communications with borrowers

and default aversion requirements. Failure to service a FFELP Loan properly could jeopardize the insurance and

guarantees and federal support on these loans. The insurance and guarantees on our existing loans were not

affected by the July 2010 termination of the FFELP program.

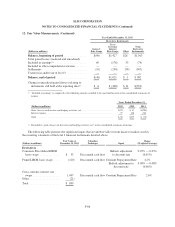

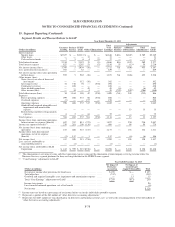

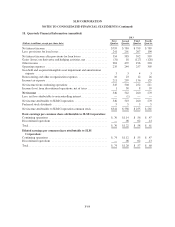

The following table includes asset information for our FFELP Loans segment.

December 31,

(Dollars in millions) 2013 2012

FFELP Loans, net ............................................... $104,588 $125,612

Cash and investments(1) ........................................... 4,473 5,766

Other ......................................................... 3,587 4,286

Total assets .................................................... $112,648 $135,664

(1) Includes restricted cash and investments.

Other Segment

The Other segment consists primarily of the financial results related to activities of our holding company,

including the repurchase of debt, the corporate liquidity portfolio and all overhead. We also include results from

certain, smaller wind-down and discontinued operations within this segment. Overhead expenses include costs

related to executive management, the Board of Directors, accounting, finance, legal, human resources, stock-

based compensation expense and certain information technology costs related to infrastructure and operations.

At December 31, 2013 and 2012, the Other segment had total assets of $3.0 billion and $1.8 billion,

respectively.

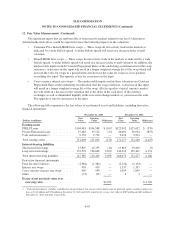

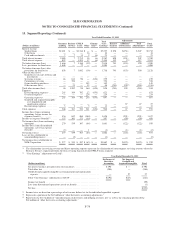

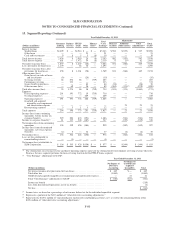

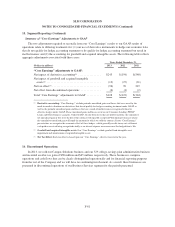

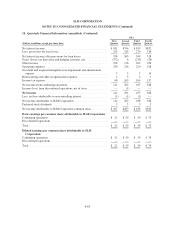

Measure of Profitability

The tables below include the condensed operating results for each of our reportable segments. Management,

including the chief operating decision makers, evaluates the Company on certain performance measures that we

refer to as “Core Earnings” performance measures for each operating segment. We use “Core Earnings” to

manage each business segment because “Core Earnings” reflect adjustments to GAAP financial results for two

items, discussed below, that create significant volatility mostly due to timing factors generally beyond the control

of management. Accordingly, we believe that “Core Earnings” provide management with a useful basis from

which to better evaluate results from ongoing operations against the business plan or against results from prior

periods. Consequently, we disclose this information as we believe it provides investors with additional

information regarding the operational and performance indicators that are most closely assessed by management.

The two items adjusted for in our “Core Earnings” presentations are (1) our use of derivative instruments to

hedge our economic risks that do not qualify for hedge accounting treatment or do qualify for hedge accounting

treatment but result in ineffectiveness and (2) the accounting for goodwill and acquired intangible assets. The

tables presented below reflect “Core Earnings” operating measures reviewed and utilized by management to

manage the business. Reconciliation of the “Core Earnings” segment totals to our consolidated operating results

in accordance with GAAP is also included in the tables below.

F-76