Sallie Mae 2013 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

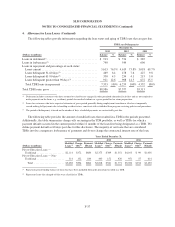

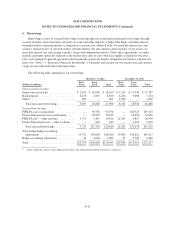

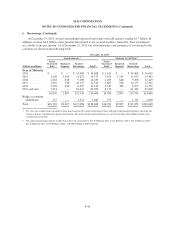

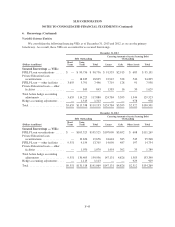

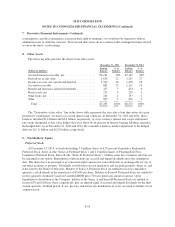

6. Borrowings (Continued)

2013 Sales of FFELP Securitization Trust Residual Interests

On February 13, 2013, we sold the Residual Interest in a FFELP Loan securitization trust to a third party.

We will continue to service the student loans in the trust under existing agreements. The sale removed

securitization trust assets of $3.82 billion and related liabilities of $3.68 billion from our balance sheet.

On April 11, 2013, we sold the Residual Interest in a FFELP Loan securitization trust to a third party. We

will continue to service the student loans in the trust under existing agreements. The sale removed securitization

trust assets of $2.03 billion and related liabilities of $1.99 billion from our balance sheet.

On June 13, 2013, we sold the three Residual Interests in FFELP Loan securitization trusts to a third party.

We will continue to service the student loans in the trusts under existing agreements. The sale removed

securitization trust assets of $6.60 billion and related liabilities of $6.42 billion from our balance sheet.

FFELP Loans — Other Secured Borrowing Facilities

We have various secured borrowing facilities that we use to finance our FFELP loans. Liquidity is available

under these secured credit facilities to the extent we have eligible collateral and available capacity. The

maximum borrowing capacity under these facilities will vary and is subject to each agreement’s borrowing

conditions. These include but are not limited to the facility’s size, current usage and the availability and fair value

of qualifying unencumbered FFELP Loan collateral. Our borrowings under these facilities are non-recourse. The

maturity dates on these facilities range from June 2014 to January 2016. The interest rate on certain facilities can

increase under certain circumstances. The facilities are subject to termination under certain circumstances. As of

December 31, 2013 there was approximately $10.0 billion outstanding under these facilities with approximately

$10.4 billion of assets securing these facilities. As of December 31, 2013, the maximum unused capacity under

these facilities was $10.6 billion. As of December 31, 2013, we had $2.7 billion of unencumbered FFELP Loans.

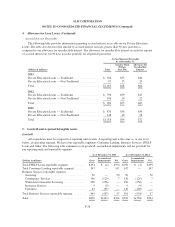

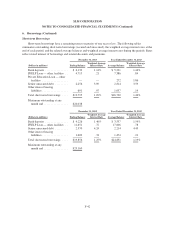

Private Education Loans — Other Secured Borrowing Facilities

We have a facility that was used to fund the call and redemption of our SLM 2009-D Private Education

Loan Trust ABS, which occurred on August 15, 2013. The maturity date of the new facility is August 15, 2015.

Our borrowings under this facility are non-recourse. The interest rate can increase under certain circumstances.

The facility is subject to termination under certain circumstances. As of December 31, 2013, there was $843

million outstanding under the facility. The book basis of the assets securing the facility as of December 31, 2013

was $1.6 billion. Additional borrowings are not available under this facility.

Other Funding Sources

Deposits

Sallie Mae Bank raises deposits through intermediaries in the brokered Certificate of Deposit (“CD”) market

and through direct retail deposit channels. As of December 31, 2013, bank deposits totaled $9.2 billion of which

$4.5 billion were brokered term deposits, $4.4 billion were retail and other deposits and $299 million were

deposits from affiliates that eliminate in our consolidated balance sheet. Cash and liquid investments totaled $2.2

billion as of December 31, 2013.

In addition to its deposit base, Sallie Mae Bank has borrowing capacity with the Federal Reserve Bank

(“FRB”) through a collateralized lending facility. FRB is not obligated to lend; however, in general we can

borrow as long as Sallie Mae Bank is generally in sound financial condition. Borrowing capacity is limited by the

F-47